Audrey Peard is searching for an elusive, chocolatey piece of Americana: a package of Hydrox cookies. She’s visited multiple grocery stores near her home in the Bronx, followed a Facebook group, and even talked to a manager at a production facility in El Segundo, California, about supply shortages.

“Almost 30, 40 years I’ve been on the trail for Hydrox,” she says. “And it’s a dirty path, I tell you.”

Hydrox was the original chocolate sandwich cookie, predating Oreo. With a mildly sweet creme and a crunchier cookie that has a darker chocolate taste than its rival, Hydrox developed a reputation as the dessert of the discerning eater. It was, according to legendary food writer Calvin Trillin, the “far superior” cookie.

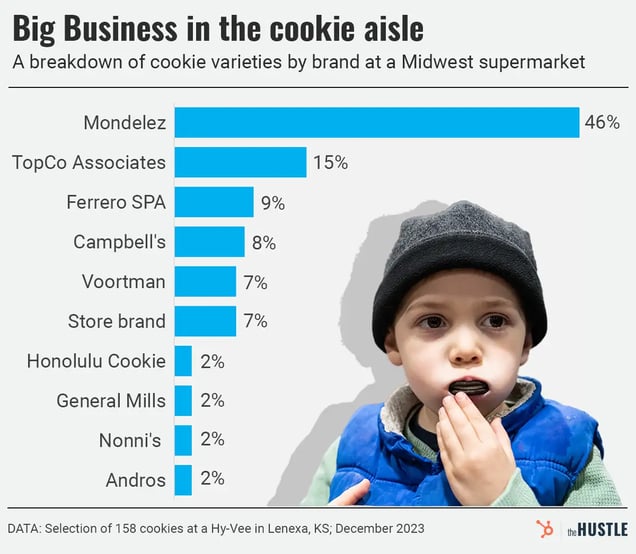

Yet Oreo’s dominance is unparalleled, accounting for roughly 10% of all cookies purchased in the US. Nabisco, the maker of Oreo (and a subsidiary of Mondelez Inc.), commands nearly 40% of the cookie market.

Hydrox, meanwhile, was discontinued in 2003. It came back in 2015 thanks to Leaf Brands, a San Diego-based company that specializes in reheated nostalgia. The company attempted to reintroduce Hydrox to America through deals with the likes of Kroger, Walmart.com, and smaller grocers.

Like almost anything else, you can buy Hydrox on Amazon (in bulk). But a regular package at a grocery store? Peard’s attempts to find them have fallen short, which she regularly vents about with her friends.

“We all blame it on recent MBA graduates,” she says, believing their optimization strategies don’t account for Hydrox’s loyal following.

If you believe the makers of Hydrox, however, the culprit might be their longtime foe: Oreo. The two have been deadlocked in competition for more than a hundred years, and Nabisco has been accused of everything from threatening wholesalers in the early 20th century to buying up grocery store shelves and elbowing out smaller companies today.

The underdog and the trust

In March 1912, the first batch of Oreos produced for sale was shipped from Nabisco’s six-story Romanesque-style headquarters in Manhattan to a grocer in Hoboken, New Jersey. It would’ve been a historic moment of American innovation if not for an inconvenient fact: Nabisco totally copied the cookie.

A smaller rival, Sunshine Biscuits (then known as The Loose-Wiles Biscuit Company), was started by Jacob and Joseph Loose in 1902. A couple decades earlier, the brothers had purchased a modest candy and cracker company in Kansas City, Missouri; renamed it after themselves; and built it into a regional power before merging it with the American Biscuit Company, a coalition of bakeries in the Midwest.

A Nabisco billboard from Los Angeles in the 1950s. (Gary Leonard/Corbis via Getty Images)

But this was the era of consolidation, monopolies, and trusts — corporate outfits created when multiple private firms merged to dominate a market. (Economists and reformers accused trusts of corrupt, anti-competitive behavior and contributing to rampant inequality.)

In 1898, the American Biscuit Company was subsumed into a new trust, the National Biscuit Company (known today as Nabisco), which gained control of ~90% of large US bakeries.

At the time of the Nabisco merger, Jacob Loose was ill and convalescing in Europe. He was cut out of the new trust. To exact revenge, Loose and his brother, along with business associate John Wiles, started Sunshine Biscuits.

Competing against Nabisco was no small feat. Although Nabisco lacked the utter dominance of infamous trusts like Standard Oil (unlike petroleum, families could always make their own desserts), it held massive distribution and advertising advantages and was accused of abusing its power in the grocery industry:

- Starting in the early 20th century, wholesalers claimed Nabisco — the “Octopus of the Cracker World” — would gouge them if they didn’t exclusively offer Nabisco goods to their grocery store clients.

- In the 1930s and 1940s, the Federal Trade Commission (FTC) investigated the company for discount agreements and price discrimination that encouraged wholesalers to purchase more Nabisco goods, harming its rivals and reducing competition. (The parties reached a settlement.)

Workers struggled, too. In the early years of Nabisco, the socialist newspaper the Coming Nation reported lockouts of unionized staff at several Nabisco plants. Union membership in the US bakery industry, according to the paper, declined from ~5k to a few hundred.

“Exploitation and trust crackers,” wrote the Coming Nation in 1913, “go hand in hand.”

Jacob Loose, co-founder of Sunshine Biscuits. (Wikimedia Commons)

Although Sunshine also had a spotty record for workers’ rights, the company became a check on Nabisco’s power — and a counter to the prevailing sentiment among business moguls that trusts benefited the country while competition was “ruinous.” In 1912, the Wall Street Journal described Sunshine, “an independent,” as an example of successful competition against “an alleged trust.”

In 1908, Sunshine created one of its most popular products, Hydrox.

- According to company lore, the name stemmed from the elements of water — hydrogen and oxygen — chosen to symbolize the cookie’s cleanliness at a time when materials like chalk and plaster of Paris routinely appeared in baked goods.

- Sunshine bragged that chemists tested Hydrox for purity and that workers made them at “thousand window” factories with natural light.

When Nabisco flexed its trust muscles by developing the Oreo, Sunshine doubled down: In 1912, the year Nabisco first sold its copycat creme cookie, Sunshine announced the construction of a $2m Queens factory to challenge Nabisco’s home base of New York City.

Hydrox also stood out against Oreo by promoting its more adult taste and kosher ingredients — in advertisements that bordered on erotic.

“Hydrox will delight any appetite at any time,” boasted one ad from 1925. Another, in 1929, seemed clipped from a romance novel. “Imprisoned between the two chocolate cookies of Sunshine, Hydrox is the purest, snow-white velvety cream in all the cookie world.”

It’s unclear how Hydrox and Oreo compared in sales for most of the 20th century. Newspapers shared the financials of Nabisco and Sunshine every year, but, sadly, they didn’t have cookie reporters to offer deeper analysis.

But I do have an insider’s account: My family helped make Hydrox.

Boom and bust for Sunshine Biscuits

Sometime around 1950, a Sunshine Biscuits factory opened in Kansas City, Kansas. My great-aunt Mildred Podry started working there. She clocked in from 3pm to midnight and eventually rose to supervisor.

Mildred handled quality control. She observed and guided other women who sorted Hydrox cookies coming off a conveyor belt. Cookies with physical defects were discarded — and often taken home by Mildred to share for desserts.

Later, my dad, uncle, and aunt spent summers working at the factory, too. My dad recalled Hydrox being “every bit as big or bigger than Oreo. You’d see Hydrox at the store on the shelves. There would be Oreos, but Hydrox would stand out.”

A Hydrox advertisement reminding consumers who created the original cookie, from the Charlotte Observer in 1955.

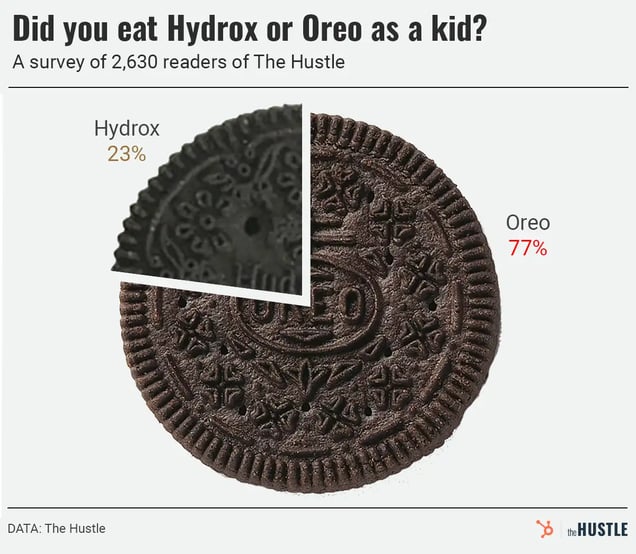

I heard the same from other Hydrox fans I interviewed — that in the ’50s, ’60s, and ’70s Hydrox and Oreo were more like Pepsi and Coke than Bing and Google. The market share wasn’t necessarily equal, but each cookie had a sizable fan base and presence.

“[Hydrox] were the cookies we had when I was a little kid,” says Jeannette Cooperman, a St. Louis resident. “Oreos came later, and they were weird.”

At the Key Food where Francine Hamilton shopped growing up in New York City, the store had a huge section of Hydrox.

“I don’t even remember an Oreo when I was a kid,” she says.

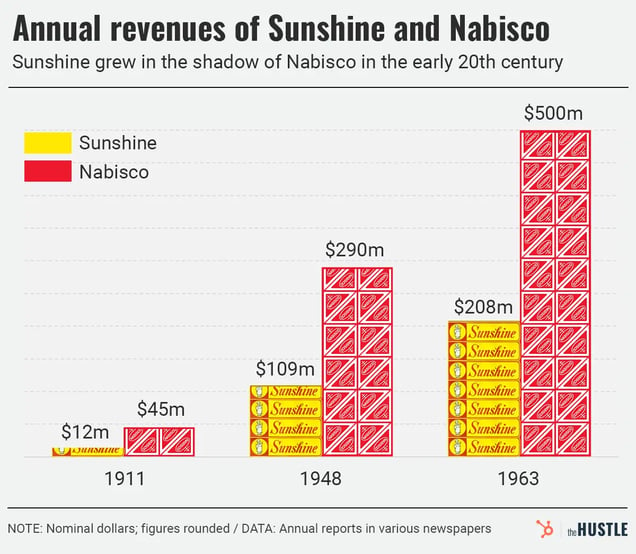

There are some numbers to back up Hydrox’s popularity: As Sunshine ascended through the first half of the 20th century, its sales grew from ~25% of Nabisco’s in the early 1900s ($11.7m vs. $45m) to ~40% by the early 1960s ($207.9m vs. ~$500m).

The Hustle

But that was as close as Sunshine would get. Nabisco’s power, and deep coffers, lifted the company as television ushered in a golden age for advertising.

Messages geared to children gave Oreo a youthful edge, while Hydrox, when it advertised at all, continued to tout its superior (and kosher) taste to adults, failing to capture the younger audience driving more consumer decisions.

There were other missteps: Sunshine’s sale to American Tobacco Company in 1966; its fumbled attempt to create a cartoon baker mascot that led Pillsbury to claim copyright infringement of its famed doughboy; and a Hydrox recipe adjustment and rebrand in the ’90s.

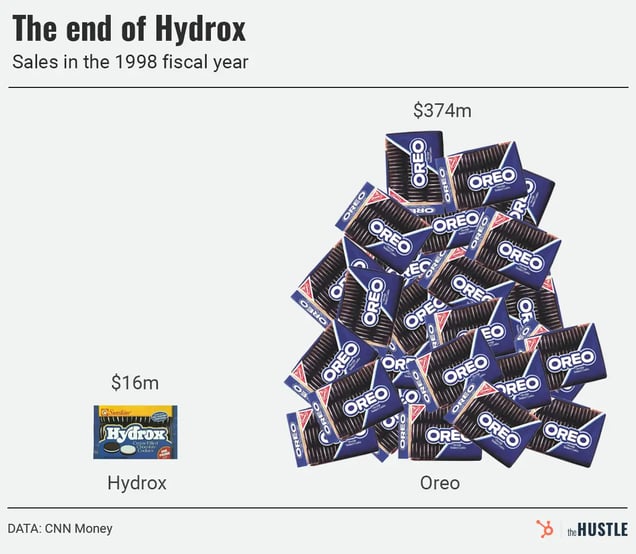

Scant available sales reports showed a 4-to-1 sales advantage for Oreo in the 1980s, when it celebrated its 75th anniversary with a $1m sweepstakes and a bash at the Waldorf Astoria hotel — as potent a symbol for Gilded Age, trust-era excess as any. (When Hydrox turned 75, in 1983, all Sunshine did was ask fans to mail them a proof of purchase; in return, the company sent back 75 cents.)

By the ’90s, Hydrox was an afterthought, losing out to Oreo by a 20x margin. Its adherents were limited to:

- The thrifty (Hydrox was now consistently the cheaper option)

- The kosher (until Oreo removed animal fat from its recipe)

- The obsessively loyal (like my family)

The Hustle

Keebler purchased Sunshine in 1996 before getting acquired by Kellogg, which discontinued the brand in 2003.

In its final years, Hydrox couldn’t even talk up its status as the original.

“According to our research,” a Keebler spokeswoman explained at the time, “not only is that claim [of Hydrox predating Oreos] not meaningful to consumers, it’s not even credible. People don’t believe it — they think Hydrox are the knockoff of Oreos, not the other way around.”

The Hustle

With Hydrox gone, loyal fans scoured shelves for their favorite cookie, sharing stories online. One person claimed they spotted a crushed Hydrox in a scoop of Edy’s ice cream. Another believed Delta had a stash it served on flights.

Ellia Kassoff, a longtime kosher fan of Hydrox, figured out a way to bring the cookie back. His company, Leaf Brands, petitioned the federal government to secure the unused Hydrox trademark from Kellogg and resurrected Hydrox in 2015, swapping high fructose corn syrup for natural sugar and otherwise mostly sticking to the original recipe.

But the feel-good story didn’t last long. According to Leaf Brands, a buyer for a major grocery chain gave them a warning in 2018: “Mondelez is going to hide your cookies all over our stores to make sure you don’t get any sales.”

Category captains

The grocery store is not the meritocracy you might imagine. Many shelves are governed not by supply and demand but rather, says Matthew Simon, by “big manufacturers making backroom deals with retailers to purchase shelf space.”

As deputy litigation director for the Center for Science in the Public Interest, Simon has researched anti-competitive practices in retail. One way these manufacturers score top positions, he says, is through category captain arrangements, which gained popularity in the ’90s.

Basically, retailers get paid to have a major manufacturer in a food or drink category advise them how to stock, place, and price the various products within that company’s category.

Supporters for the arrangements believe the dominant manufacturer has the best insights into the category, leading to efficient usage of shelf space that benefits grocery stores and other manufacturers. In a 2000 Food Marketing Institute survey of retailers and wholesalers, 76% of respondents described category captain arrangements as essential.

But the potential downside is obvious: A category captain has an opportunity to stifle its competitors.

When former commissioner of the FTC Thomas B. Leary first learned about category captains, he wrote that the concept set off “every antitrust alarm.” A 2021 study by Xinrong Zhu revealed that category captains benefited significantly while competitors dealt with increased competition for shelf space and revenue losses.

But the pervasiveness of category captain arrangements and how they work is a closely guarded industry secret. Few academic studies have been devoted to the subject, and the FTC and Congress haven’t held hearings on them since the late ’90s and early 2000s. (At one congressional hearing, two witnesses testifying against category captains demanded anonymity and had their voices scrambled out of fear of retaliation.)

Leaf Brands has been a rare outspoken manufacturer against the practice.

- It asked the FTC in 2018 and in 2021 to examine whether Mondelez used its role as a category captain to “quell nascent competition from Hydrox by implementing its bag of dirty tricks.” (Mondelez did not respond to a request for comment from The Hustle.)

- Citing testimony from anonymous grocery store wholesalers and customers, Leaf Brands said Mondelez influenced employees and contractors to hide Hydrox packages on retailers’ shelves and gave incorrect sales data on Hydrox to convince retailers to stop selling the product.

Hydrox, pictured between the Ginger Snaps and Cookies ‘n Creme. (Leaf Brands via Facebook)

Where the FTC stands on this is unclear. The group did not respond to an interview request. And when I filed a Freedom of Information Act request for a copy of the 2021 complaint, the FTC said it didn’t have any records regarding a complaint from Leaf Brands about Mondelez.

Simon still sees potential change on the horizon, just not because of Hydrox. In late 2021, the FTC announced an inquiry into supply chain disruptions at major retailers. Although empty shelves and rising prices led to the investigation, the stores may also have to answer questions about their category captain arrangements.

The search continues

For now, Hydrox remains a tough cookie to find — whether it’s because of the influence of Mondelez; the limitations on Leaf Brands to promote, produce, and sell Hydrox; or the fact that most people under the age of 30 have likely never tasted a Hydrox cookie.

- In 2018, Kroger dropped Hydrox from its stores, according to Leaf Brands.

- Last year, customers complained of delays and shortages for bulk Hydrox packages on Amazon, one of the few reliable places to find Hydrox.

- Hydrox fans have posted that they can’t find Hydrox at regional and local stores where Leaf Brands have claimed the cookies are available. (Leaf Brands did not respond to interview requests.)

The Hustle

According to Hydrox fans, Cracker Barrel, which has nearly 700 US locations, is one of the most reliable places to find the cookies at a physical store.

Oreo, meanwhile, remains ubiquitous. Last month at one of my local supermarkets, the cookie aisle featured eight shelves filled with Oreo variations. There wasn’t a Hydrox in sight.

For Peard, the New Yorker, her quest to find a package of Hydrox continues.

This month she said she had a dental appointment in the far south of Brooklyn and made a note in her calendar to shop at the neighborhood kosher grocery stores. She wants to find Hydrox — as well as the answer to a larger question she believes lies at the heart of Hydrox’s long, hopeless battle with Oreo.

“Where is the market,” Peard says, “for us people who like good things?”

Update, January 6: In a statement, Mondelez said “As we have stated numerous times in the past and in numerous forums when Hydrox raises these allegations, our shelf placement in stores stems from the fact that Oreo is the #1 cookie in the US, loved by consumers, and retailers typically align their placement decisions to serve that consumer demand. We always operate with integrity, and we are proud to be America’s favorite cookie.”