The whole thing started because Robin H. Swanson wanted to send flowers.

She was a Southern Californian who worked at an aerospace firm. Swanson was a wife, a mother to four kids in a blended family, and a secretary who enjoyed her job. She was living what most people would consider an ordinary life.

When her boss’s spouse got surgery in January 1986, that began to change.

Swanson ordered a standard bouquet from the closest florist she could find, a business called Floral Fantasies. The flowers plus delivery cost $23.95. Swanson used her Visa card. The boss’s wife was thankful for the gift. That was that.

Or so Swanson thought.

She realized a few weeks later she had been charged $601.11 for the order — the equivalent of ~$1.6k today.

“The bottom line is I got pissed,” Swanson told The Hustle. “I turned into an investigator.”

Robin Swanson in the 1980s. (Courtesy of Robin Swanson)

The coming months would take Swanson and her husband down a path that was anything but ordinary: phone calls with a charismatic young entrepreneur, a clandestine visit to a lavish gated community, a dust-up with hired goons.

Swanson was just trying to get her money, but she ended up doing far more. She helped set a foundation for the downfall of one of the biggest — and most bizarre — Ponzi schemes of the 1980s.

The making of an entrepreneur

When Barry Minkow was in high school, all he wanted was to be noticed.

The odds were decidedly against him. Grover Cleveland Charter High School in Reseda, California, he later recalled, featured a classic adolescent pecking order — jocks, cheerleaders, and rich kids occupied the cool tables at lunch and threw the best parties on weekends.

Minkow, a shrimpy nonathlete who drove an old Buick nicknamed “The Bomb,” checked exactly zero of those boxes.

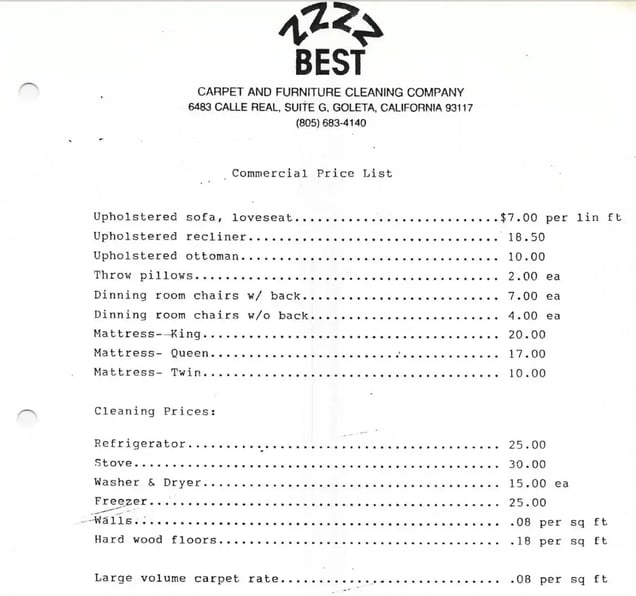

Motivated by his teenage angst, 15-year-old Minkow decided to get bigger and richer. For the first goal, he took steroids and lifted weights. For the second, he started a carpet cleaning business in 1982, naming it ZZZZ Best (the four Z’s representing the number of future children he desired).

The name didn’t make a ton of sense, but the choice to enter the carpet cleaning industry did:

- His mother managed a carpet cleaning business, where Minkow had spent summers working.

- The carpet cleaning industry was on the rise, especially in sprawling Southern California. Most suburban homes were carpeted, yet one insider estimated that ~80% of owners had never paid for carpet cleaning.

Minkow got the business off the ground with a loan from an acquaintance at his gym and hired other gym contacts for key positions at the company. He managed cleaners and salespeople (including his father) while balancing his high school studies.

Compared to competitors known for unsavory sales tactics, ZZZZ Best stood out for consistency. The company cleaned carpets for the prices they advertised at the times their customers requested, sometimes late at night.

A price list of services performed by ZZZZ Best carpet cleaners. (Courtesy of Robin Swanson)

It also helped that Minkow engineered free publicity, calling a local TV station and posing as a customer enthralled by a teenage business owner. The station fell for the ruse and interviewed Minkow.

Soon, several local media outlets wanted to tell the story of ZZZZ Best, and investors listened. Although ZZZZ Best was an average company, the narrative of a prodigious high school entrepreneur pursuing the American dream resonated widely.

By the time Minkow graduated, in 1984, he had 80 employees at three offices and reported $1.3m in revenue on a ~20% profit margin that year. The investments allowed ZZZZ Best to expand and gave Minkow plenty of cash, which he used to enjoy a glitzy lifestyle:

- In 1985, he bought a $698k Mediterranean-influenced mansion in a gated community in Woodland Hills (on the same street as actress Heather Locklear), adorning the bottom of a backyard pool with a massive “Z.”

- He owned a white BMW and a red Ferrari, and bought his girlfriend a black Porsche.

- He spent $2k on a customized kennel for his dog.

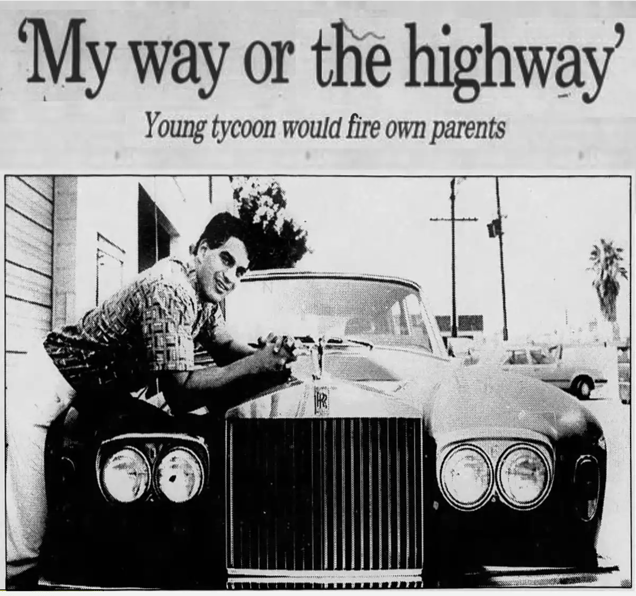

When The Los Angeles Times gave Minkow his biggest platform yet, in a 1985 feature story, he came off as brash and unforgiving, saying he resented his parents and the bankers who denied him loans when he started his business.

His goal, he proclaimed, was to build “the General Motors of carpet cleaning.”

The obsession

Robin Swanson’s life in the mid-80s was steeped in routine.

She dropped off her youngest kids at an extended daycare, drove to work, picked the kids up, made dinner, and helped with homework. There wasn’t time for much else — but she wouldn’t let a $601 charge for flowers slide.

Swanson called Floral Fantasies to notify them of the error, and the person who answered forwarded her to a person she referred to as the owner of the company.

His name was Barry Minkow.

Minkow poses with a Rolls Royce (The Los Angeles Times, 1987)

Minkow had bought the flower shop in the fall of 1985 as a side business for his associates Charles “Chip” Arrington. Arrington technically ran Floral Fantasies, but Minkow still had influence.

Swanson didn’t know anything about him, except that he sounded young and charming and promised to fix the erroneous charge. But weeks went by and the company never did. In fact, Minkow and Arrington sold Floral Fantasies in the spring of 1986.

Meanwhile, Swanson’s credit card company declined to reimburse the overcharge because 60 days had passed since the error. Swanson had delayed contacting the company because Minkow said he’d repay her.

At this point, Swanson became “a little obsessed.”

She looked up Minkow’s address in Woodland Hills and scaled a barrier to sneak into his gated community — “It wasn’t a very tall fence,” she recalls. She didn’t plan to confront him; she just wanted a closer glimpse of the person who took her $601.

Swanson, nor hardly anyone else, knew what was really going on.

The real ZZZZ Best

In reality, Minkow’s opulent home — and the gauche swimming pool in his backyard — were the fruits of a fraudulent empire.

Although ZZZZ Best cleaned carpets, most of its reported capital was phony:

- In the early days of his company, Minkow faked burglaries at his headquarters to collect insurance and used an illegal strategy called “check kiting” to cover expenses. Some of his early financing came from reputed mobsters.

- Minkow’s scheming grew more complex with the creation of the company Interstate Appraisal Services, which sent ZZZZ Best fictitious restoration projects worth millions of dollars that artificially padded ZZZZ Best’s ledgers.

- While ZZZZ Best’s carpet cleaning business was legitimate (and successful), the restoration projects made the company appear far larger, drawing investors whose funds could be used to pay off earlier investors, expand the company, and subsidize Minkow’s ostentatious spending.

Basically, ZZZZ Best was a Ponzi scheme. Newer investors paid off existing loans, which Minkow and his colleagues referred to as “hooks.”

Most customers knew ZZZZ Best as a quality carpet cleaning outfit. (Courtesy of Robin Swanson)

Another way Minkow cashed in was by overcharging customers’ credit cards. The scheme was small-time compared to the fake restoration projects — a few hundred dollars here and there — but he ended up collecting tens of thousands of dollars. If customers found out, he’d blame an unsavory employee and pay them back. The scrutiny typically ended there.

But after numerous frustrated phone calls, Minkow never repaid Swanson. That was ultimately a big mistake.

“I just don’t like getting taken like that,” she said.

In September 1986, Swanson filed a lawsuit in small claims court. Her husband, Bill, went to serve the papers at one of Minkow’s offices, where he was greeted by Minkow’s father. Moments later, two large men appeared, and then Minkow arrived at the office, joined by yet another goon.

According to Swanson’s notes of the event, Minkow threw the papers in the trash and said, “This is what you can do with your fucking lawsuit.” Swanson said one of the goons jumped Bill, and that Minkow smashed his eyeglasses.

The Swansons considered pressing charges, but instead went ahead with the small claims case. Minkow didn’t show, and the judge pro tem ruled in Swanson’s favor.

But it was a Pyrrhic victory. The judge declined to award payments for the interest on the stolen money and the damage to Bill’s glasses, chiding Swanson for not disputing the charge with her credit card company quickly enough.

“And I said, ‘so basically you’re punishing me for being naive, rather than punishing him for being a crook?’” Swanson recalls saying. “The judge got a little bit ticked off about that.”

Swanson didn’t feel vindicated. Worse, she saw Minkow being celebrated: for giving advice on the television show “Teen Talk,” for donating $10k to a drug rehabilitation program, for hosting a Los Angeles Chamber of Commerce event about the “American free enterprise system” that featured the actor James Caan.

After the small claims case, Swanson alerted a Los Angeles journalist about Minkow. (Courtesy of Robin Swanson)

As a last-ditch effort in the fall of 1986, she contacted LA Times reporter Daniel Akst, who had written a complimentary profile of Minkow in 1985, explaining how she had been cheated.

Swanson sent him a bunch of documents and didn’t hear anything back.

Going public

As Swanson continued to fight, ZZZZ Best continued to ascend.

- In late 1986, the company, which had grown to 1.3k+ employees, got listed on the Nasdaq through a ~$13m public offering.

- The company’s offering documents stated that 86% of revenue came from insurance restoration jobs, its fictitious revenue sources.

- To hoodwink skeptical auditors before the IPO, the company leased an old building in San Diego and filled it with cleaning equipment to resemble a restoration site. In Sacramento, ZZZZ Best paid off a security guard at a random building undergoing construction so they could fill it with company signs for a walk-through.

The stock began trading at $4 and soared to $18+ within months, giving ZZZZ Best a market cap of $211m+. Minkow’s worth, on paper, was ~$100m, and the company reported $33.4m in sales for the nine months ended Jan. 31, 1987.

The Hustle

Best yet, the company was turning a corner, announcing on April 16 it would acquire KeyServ Group in a $25m deal that would bring in cash to pay off loans and investors.

KeyServ was Sears’ authorized carpet cleaner, netting $80m in annual revenues. According to what one of Minkow’s associates, Mark Morze, later told The Los Angeles Times, it would be a “cure,” allowing ZZZZ Best to shut down its fraudulent restoration work.

Minkow was even more ambitious. He bragged about ZZZZ Best’s sales in an April 27 appearance on “The Oprah Winfrey Show” and spoke of buying the Seattle Mariners baseball team with the incoming fortune.

“I saw acquiring KeyServ as a way to instantly fulfill my dream of becoming the General Motors of the carpet cleaning industry,” he later wrote in his book Cleaning Up.

But no amount of bluster could save Minkow. Akst, the LA Times reporter, called Swanson out of the blue that spring. He was preparing to leave for a job at The Wall Street Journal and came across her information while cleaning his desk.

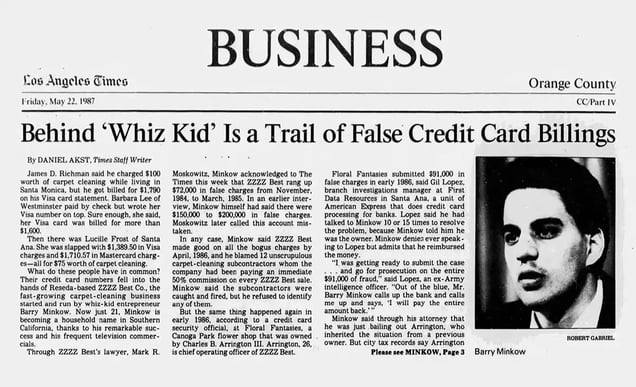

This time, Akst dug in. The result was an expose published May 22 on the front page of the Times’s business section. Minkow saw the headline when he picked up the newspaper from his front porch: “Behind ‘Whiz Kid’ Is a Trail of False Credit Card Billings.”

In the story, Minkow claimed bogus charges at ZZZZ Best had been repaid. But his explanation for Floral Fantasies — that the problem was inherited when he and his associate bought the business — didn’t match the timeline of Swanson and others who’d been overcharged.

The Los Angeles Times alleged financial wrongdoing by Minkow when he was on the verge of acquiring a major cleaning business. (The Los Angeles Times via Newspapers.com)

Others began to question Minkow, too.

- Norman Rothberg, who was hired as a part-time accountant for Interstate Appraisal Services, expressed concerns to ZZZZ Best auditor Ernst & Whinney around the same time the article came out.

- Gil Lopez, an investigator for a credit card payment processing company, after hearing reports of credit card fraud attached to ZZZZ Best and Floral Fantasies, discovered hundreds of incorrect charges. He started compiling evidence from Floral Fantasies customers for a police report before Minkow paid back most of the false charges, according to Akst’s reporting.

But Swanson was never paid back, and it was her tip that brought everything into the open.

Years later, when Akst published a book about the fraud, he described Swanson as the person “who did as much as anyone to destroy (Minkow).”

The empire crumbles

In early May, Minkow flew hundreds of KeyServ employees to California for an introductory conference. The sale would go through as soon as the financing was finalized.

It all began to unravel:

- The stock sank ~25% the day the story was published.

- Drexel Burnham Lambert, underwriters for ZZZZ Best in its deal with KeyServ, withdrew on June 1. Auditor Ernst & Whinney pulled out a day later, effectively quashing the deal.

- Minkow resigned on July 2. By July 6, the stock had plummeted to $0.75 per share, from ~$15 in mid May. Two days later, ZZZZ Best filed for bankruptcy, and Minkow did the same for himself in August.

Later, in a 1989 interview with The Los Angeles Times, Morze, the Minkow associate, reflected on how the newspaper article, prompted by Swanson, ruined the KeyServ acquisition an estimated four days before it was going to close.

“If everything had worked out, everyone makes out like a bandit,” he said. “The stockholders make money, the income tax people collect taxes, three or four thousand people get jobs, America gets its carpets cleaned.”

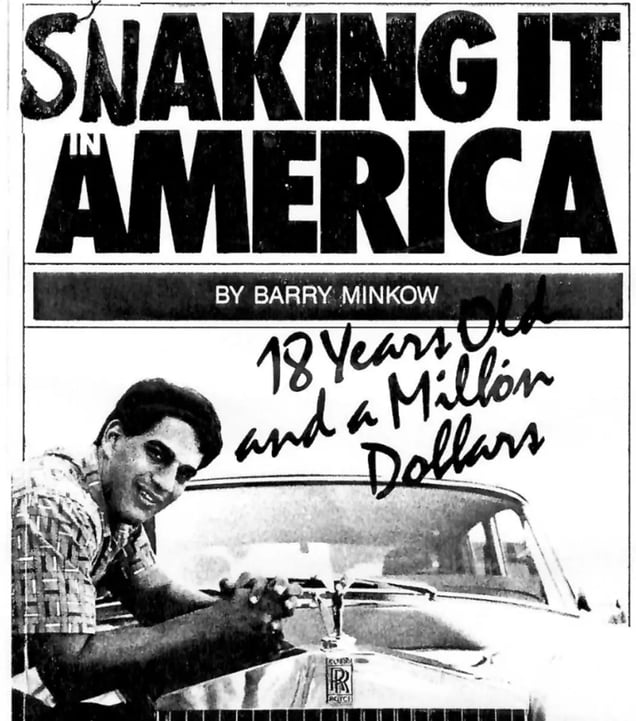

Instead, Minkow was convicted on fraud charges, sentenced to 25 years in prison, and forced to pay back defrauded investors $26m in restitution. The prosecutors used Swanson’s notes as evidence during the trial.

Swanson Xeroxed an altered title on the cover of Minkow’s self-published book, Making It in America, eliciting laughter when it was shown during Minkow’s trial. (Courtesy of Robin Swanson)

After serving six years in federal prison, Minkow became a pastor and fraud investigator — only to be convicted of financial crimes, including the defrauding of his church congregation in San Diego, and sentenced to federal prison again in 2014.

As for Swanson, her story as a primary instigator of ZZZZ Best’s downfall has largely been forgotten. She doesn’t hold any grudges against Minkow — she eventually got her money back — and believes his empire was ripe for failure.

“It was going to come crashing down eventually,” she said. “Hopefully by my weird obsession fewer people lost their life savings.”

Fraud And Scams