For many businesses, the coronavirus pandemic threatened cash flows almost immediately.

The Trump administration wants to fix that by letting people defer tax payments and sending them $$$ directly, but it’s clear that some industries still need the power brokers to throw them a rope — and quickly.

Here’s a look at 3 of them.

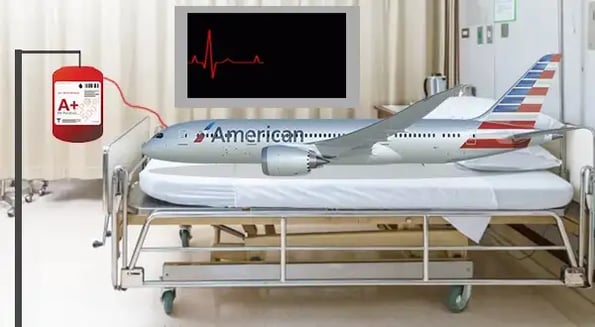

Airlines

What’s happened so far: Governments are telling residents to stop traveling (and, in some cases, to shelter in place). Major carriers are slashing flights. The slowdown could have huge consequences:

- Most carriers worldwide could go bankrupt by the end of May.

- US airlines alone employed ~747k people as of January.

What they’re asking for: A lifeline of $50B+ from the federal government.

- That’s more than 3x what the industry received after 9/11.

- The ~$850B in stimulus money that President Trump wants includes that support for airlines.

What might happen next: The airlines need support, but some people are skeptical.

- That’s because the biggest US ones spent their free cash flow on stock buybacks (more on those below).

- An example of the side-eye: “As the government considers what we, the public, should do for the airlines,” wrote Tim Wu of The New York Times, “We should ask, Just what have they done for us?”

Restaurants

What’s happened so far: Dining destinations are being forced to shift to takeout and delivery only — or to shut down entirely.

What they’re asking for: They’re urging patrons to buy gift cards, reschedule reservations, and get that grub delivered.

- But the industry’s 15m+ workers are losing out on shifts and tips right now, and owners still have bills to pay.

What might happen next: Governments might have to step in to prevent widespread industry collapse. As Eater put it: “Restaurants Are F*cked — Unless They Get a Bailout.”

Casinos

What’s happened so far: The pandemic created a bizarre scene on the Las Vegas Strip and at other gambling hotspots: Lights out at the slot machines and craps tables.

What they’re asking for: Casino kingpins are doubling down on the idea that the government should help their $260B industry, too.

- In 2017, US casinos employed 360k+ people.

- In 2018, casinos generated ~$9.7B in tax revenue.

What might happen next: So far, there’s no sign that the government will put more chips on the table. Any movement would cause controversy due to President Trump’s deep industry connections.

Elsewhere in virus news:

- Facebook is giving employees $1k bonuses.

- Amazon is prioritizing shipments of household goods and medical supplies.

- Uber and Lyft suspended pool rides.

- People are toasting at virtual happy hours with a drink known as the “quarantini.”

- Think WFH is drivin’ you nuts? At least you didn’t try to wash your hands with a block of cheese.