Carrie Bradshaw’s life on “Sex and The City” wasn’t quite as unrealistic as you might think.

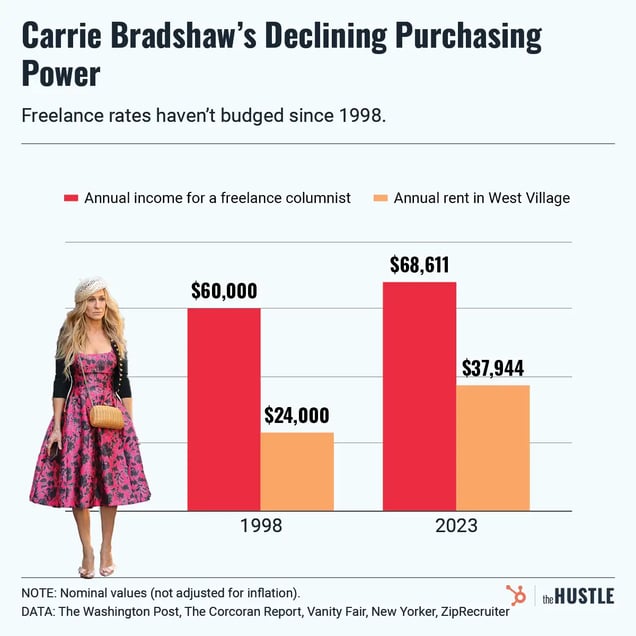

There’s no way she could have afforded routine purchases of Manolo Blahnik shoes and designer dresses on her estimated ~$60k-$70k salary as a freelance New York City magazine columnist. But her ability to afford her apartment, a West Village alcove studio, wasn’t so far-fetched in the late 1990s.

Classified ads from the time showed West Village studios for as low as $1k per month. Even a fancy Lower Manhattan studio with a doorman went for ~$2.2k/month on average.

But as rents have skyrocketed beyond incomes, there’s no way a modern-day Carrie Bradshaw could afford to live alone in the West Village.

- The average rent for a Manhattan studio last month was ~$3.1k, and West Village studios go from ~$3k-$4k+.

- The median freelance journalist in New York City makes ~$69k annually, according to ZipRecruiter, offering less purchasing power than what Bradshaw made more than two decades ago.

Living alone in the West Village as a freelance writer would have been possible for Carrie Bradshaw in the ‘90s. (Getty Images)

As millions of Americans stream “Sex and the City” and other old sitcoms, warm nostalgia has been accompanied by a cold dose of skepticism about the characters’ apartments and houses.

Were they paying far beyond their means, or are we judging with a 2020s perspective?

The Hustle analyzed the salaries and living situations of several famous sitcom characters over the past few decades as a lens on today’s housing market.

What we found is that not every sitcom was a fantasy. But with many young people priced out of cities, and average families unable to buy homes, it just feels that way today.

Income vs. housing costs

When sitcoms began populating the airwaves, housing costs — both for homeownership and rent — tended to rise in tandem with income and wages. From 1960 to 1970, US median household income barely lagged growth in median rent and actually exceeded the increase in median home sales prices.

But the trends began to change after the ’70s.

- In 1970, the median home sales price in the US was ~$23k ($161k in 2021 values), and the median gross rent was $108 ($756). The median household income back then was ~$9k (~$63k).

- By 2021, the median home sales price had increased 18x to ~$424k, the median gross rent 11x to ~$1.2k, and the median household income 7.7x to ~$69k.

Singdhi Sokpo / The Hustle

The increases in recent years have been particularly dramatic. Housing prices climbed steadily in the early 2000s, cooled during the Great Recession, and rose by ~24% in the 2010s, compared to a ~17% rise in income, adjusted for inflation.

And then came the wild pandemic housing market, when the median sales price jumped ~39% from mid-2020 to mid-2022.

The run-up in housing prices has led more people to rent, but rent increases, too, are crushing — outpacing inflation and income growth since 2001. In 2022, cities like Boston and Miami saw rents rise ~20%-40% YoY.

In cities like Miami and elsewhere, demand for apartments and monthly rents shot up to unprecedented levels in 2022. (Getty Images)

The result, according to a report by the Joint Center for Housing Studies of Harvard University, is “record numbers of renters paying excessive amounts of income for housing, with little prospect for meaningful improvement.”

It all means that many living situations depicted on TV just a generation ago would not be possible today.

Rent and the City

When “Living Single” premiered in 1993, it heralded a new era for sitcoms. For years, network TV had mostly focused on suburban families. “Living Single” featured unmarried roommates in their 20s and 30s enjoying the city life and cultivating their careers.

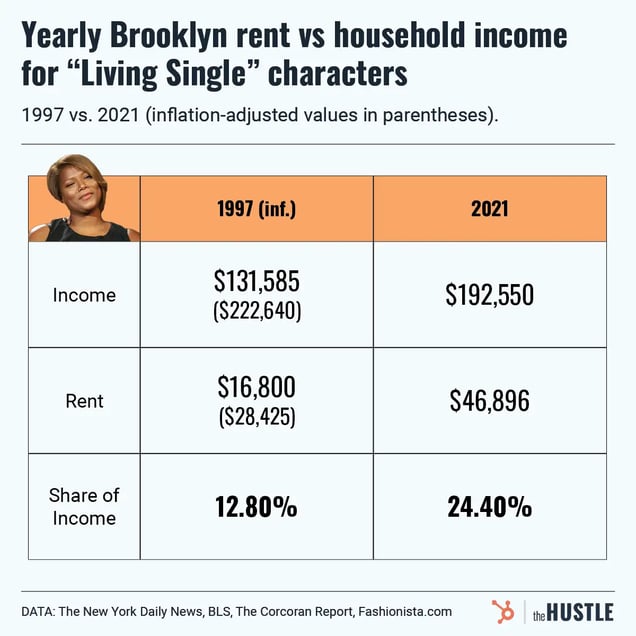

Khadijah was a magazine editor, Regine was an apparel buyer (and later an event planner), and Synclaire was an administrative assistant at Khadijah’s magazine and an aspiring actress. They lived in Brooklyn, in a neighborhood many consider to be Prospect Heights.

- Using estimates from the Bureau of Labor and Statistics and the magazine trade publication Folio, the average income for a secretary, a retail buyer, and a New York-based editor would’ve been a combined ~$131k in 1997.

- Three bedroom apartments in Prospect Heights went for ~$900-$1.4k per month that year, according to classified ads. At $1.4k per month, Khadijah, Synclaire, and Regine would’ve spent ~13% of their income on rent.

Alice Leppert, an associate professor of media and communication studies at Ursinus University who has studied sitcoms, described the inclusion of roommates on shows like “Living Single” as a differentiator from typical sitcoms that often portray what people “wish their life could be like.”

“It’s a setup about friendship and friends… but it’s a nod toward economic reality,” Leppert said.

“Living Single,” created by Yvette Lee Bowser and starring Queen Latifah, aired from 1993 to 1998. (Getty Images)

Mid-’90s Brooklyn was affordable enough that the “Living Single” trio’s less career-oriented counterparts in “Friends,” which came out in 1994, could have paid the rent if they moved to the outer borough.

- The average combined salary for two waitresses like Monica and Rachel would have been ~$24.2k, according to BLS data (and potentially above $30k, given what the BLS has referred to as a New York City “premium”).

- That was not enough for where they lived: The average two-bedroom in Lower Manhattan rented for ~$2.9k per month in the mid-’90s. But they could have scraped by in a “good” two-bedroom in Fort Greene ($1k-$1.8k) or renovated two-bedrooms in Williamsburg ($710-$800 per month, according to classified ads).

What would be the economic reality now?

Monica and Rachel could no longer afford two-bedroom apartments in Brooklyn, and the “Living Single” roommates would have tough choices to make.

- In 2021, the combined average salaries for Khadijah, Regine, and Synclaire would have been ~$193k.

- The average monthly rent for a Brooklyn three-bedroom in May 2021 was ~$3.9k, per the Corcoran Group real estate firm, which would take up ~24% of their income.

Singdhi Sokpo / The Hustle

Because the most recent BLS info for wage estimates is from May 2021, it’s hard to predict their 2023 incomes. But rents ballooned in 2021 and 2022.

The average Brooklyn three-bedroom rented for ~$5.4k last month, and the scant number of three-bedrooms available in Prospect Heights were priced for between $4k-$10k+ per month.

Barring significant raises, the 2023 version of the “Living Single” roommates would be rent-burdened, a designation that would make them plenty relatable. Rent-burdened households, which have doubled since 1950, spend more than 30% of their income on rent and utilities.

Earlier this year, a Moody’s report revealed that the average American renter household was rent-burdened, a first in 20+ years of crunching data. In 1999, Moody’s found the average renter household spent 22.5% of its income on rent.

With steady employment and no children, the “Living Single” characters would be better off than many rent-burdened Americans. But they’d also be saving less, making it harder to move beyond the hallmarks of young adulthood — renting apartments, being single — as they ascended in age and career.

Which brings us to homeownership and families.

The end of the American sitcom dream

In the 1980s into the 1990s, TV sitcoms showcased a wide spectrum of incomes and living situations:

- The working-class Bundys of “Married With Children”

- The upper-middle-class, college degree-holding Keatons of “Family Ties”

- And the nouveau riche entrepreneurial power couple Jeffersons of “The Jeffersons”

“[It] was the American Dream ideology of you work hard and you get a middle class home and environment,” said Adrien Sebro, an assistant professor of media studies at The University of Texas and author of the forthcoming book, Scratchin’ and Survivin’: Hustle Economics and the Black Sitcoms of Tandem Productions.

The Jeffersons moved to the Upper East Side when three-bedroom condos cost ~$150k (~$866k adjusted for inflation). Condos at the building where the show’s credits were filmed now cost ~$1.3m. (Getty Images)

And at the time, attaining the dream of middle-class homeownership was more realistic.

In 1989, the show “Family Matters” gave audiences a portrayal of life somewhere between the Keatons and Bundys: a solidly middle-class family living in the middle of the country.

Set in an undisclosed part of the Chicago area, the show’s income earners were Carl Winslow, a police sergeant, and wife Harriette Winslow, who applied to become a security guard in the show’s second episode, “Two Income Family.” Carl’s sergeant salary would’ve been ~$50k and Harriette’s security guard salary ~$14.3k, based on BLS averages and Chicago classified ads seeking security guards.

Bungalows line the streets of a neighborhood on the Southwest Side of Chicago. (Getty Images)

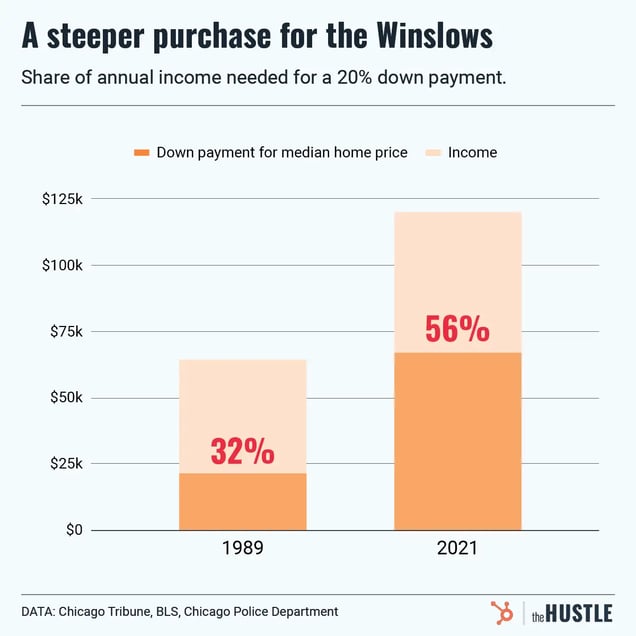

Buying a typical house would have been no problem for the Winslows, who had two kids (a third was written out midway through the show) and extended family.

- In 1989, the average price for a Chicago area home was ~$105k ($236k in 2021 dollars), which was 1.6x the Winslows’ annual income. Houses with four bedrooms in new suburban developments could easily be found for less than $200k and as low as $111k. Interest rates were at ~10%.

- For the average $105k home, the Winslows would’ve put down ~$21k (for a 20% down payment) and owed $756 per month, ~14% of their income.

These days, the Winslows would be making ~$120k, according to 2021 wage averages, slightly less than their inflation-adjusted income from 1989. The median home price in 2021, however, was ~$335k, ~2.8x the Winslows’ annual income.

Because of basement interest rates (~3% in Illinois in 2021), the Winslows’ monthly payment on a median home (~$1.1k) would have taken up just ~11% of their income. The problem would be the down payment.

- A 20% down payment of $21k in 1989 was equal to ~32% of their annual income. The same 20% down payment would be equal to ~56% of their 2021 income.

- If the Winslows saved 8% of their annual income, it would have taken them about four years to afford the down payment in 1989. The 2021 down payment would take seven years.

Singdhi Sokpo / The Hustle

In real life, saving for down payments can be particularly difficult for middle-class Black families like the Winslows, who are far less likely than white families to receive family financial support.

Cash buyers are another complication. They accounted for ~33% of total buyers last year (23% in Chicago), up from 8%-12% in the early ’90s, according to National Association of Realtors estimates.

Between those wealthy buyers, housing shortages, and higher prices, the situation in Chicago has become increasingly difficult for people with Carl Winslow’s job. Last year, a city council member floated a plan to offer new police officers up to $10k apiece for housing.

The sitcom’s new reality

A different family from the Chicago area returned to television in 2018 when the cast of “Roseanne” was resurrected in “The Conners.”

Dan Conner was in the same house in a fictional Illinois city, a home that would have been affordable in the late ’80s on the income from his work as a drywall installer and Roseanne’s job at a plastics factory.

The Conners have the same house and same couch in the “Roseanne” spinoff. (Getty Images)

But things had changed: Reliable blue-collar jobs declined in the area, Roseanne died from an opioid overdose, and Dan faced turmoil, including with housing.

His daughter, Darlene, had to seek help from her on-and-off boyfriend, Ben, to be considered for home loans. Ben’s mom asked Dan to sell his house so the couple could afford to buy their own.

It fits with an era in which viewers want realism and drama along with comedy, according to Sebro, the University of Texas professor.

“The reality now is folks are so much more critical at looking at TV as not just escapist anymore,” he said. “They’re looking at TV as another reality for them and…how race and housing and economics play out on TV.”

That reality with apartments and houses is far different from what it might have been in the ’80s or ’90s.

One of this generation’s most popular sitcoms, “Abbott Elementary,” stars Quinta Brunson as Janine, a young teacher in Philadelphia. In 2023, someone with her job couldn’t afford to split a Brooklyn brownstone with roommates.

In fact, at the end of the first season, Janine broke up with her longtime boyfriend, Tariq, when he decided to move to New York City. The main reasons were her love for her job and Philadelphia, but she also listened to him discuss Brooklyn’s unappealing housing options.

Tariq saw that apartments were way too expensive and decided the only thing he could afford were “some really roomy closets in Bushwick.”