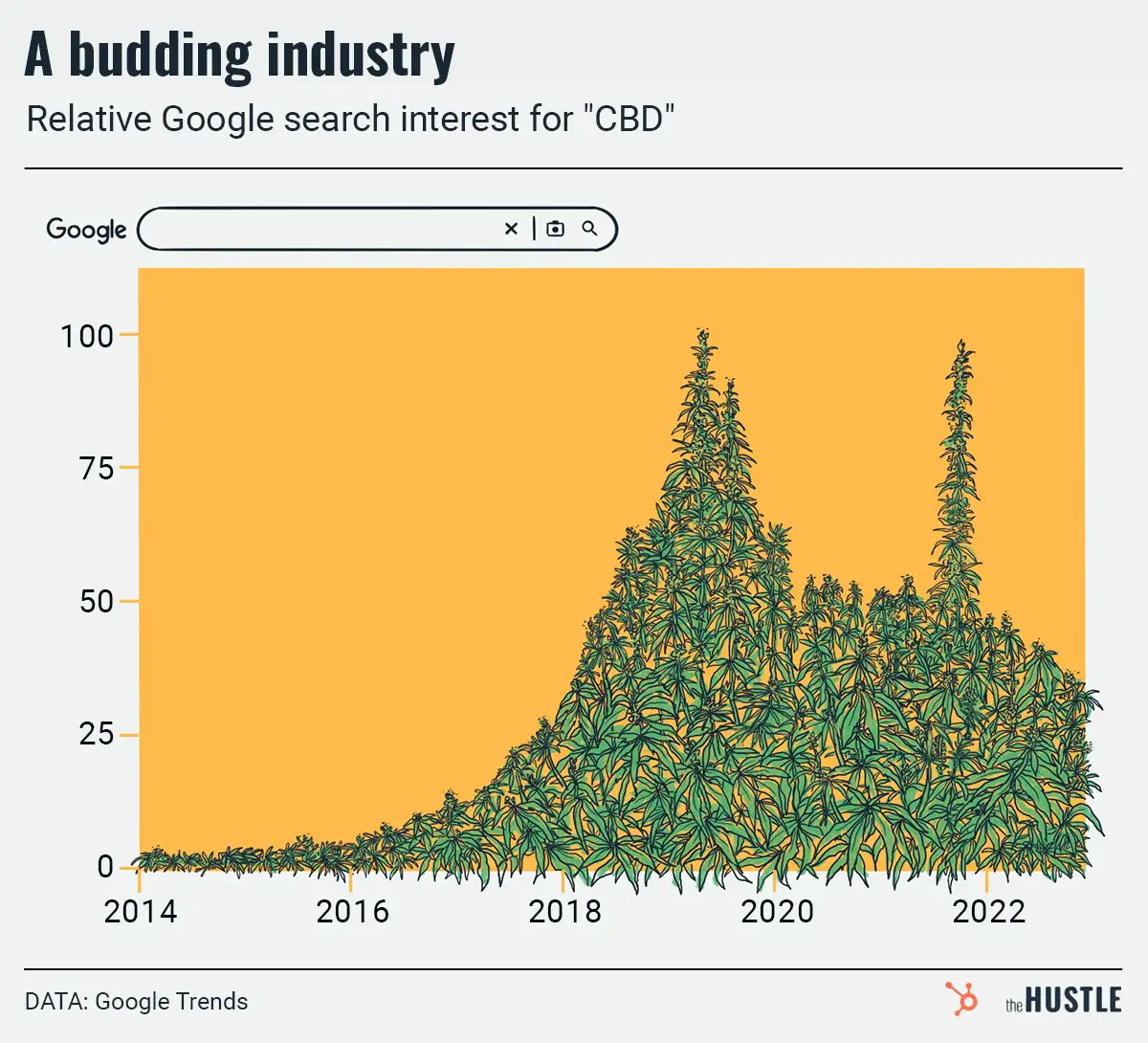

In a nation where 82%+ of retail purchases are made via card, cash-only policies may seem like an odd choice — but for cannabis companies, it’s not a choice at all.

Because cannabis remains federally illegal, related companies can’t access business banking services (e.g., banking accounts, insurance, credit-card processing, loans).

The Secure and Fair Enforcement Regulation (SAFER) Banking Act is a bipartisan bill that could change that.

Why it matters

Cannabis is currently a Schedule I drug, defined as substances with high potential for abuse and no medical usage, per the Controlled Substances Act.

That puts cannabis in the same class as heroin, even though cannabis is legal in 23 states recreationally and 40 states, plus DC, medically.

The Department of Health and Human Services (HHS) wants the Drug Enforcement Administration (DEA) to reclassify cannabis as a Schedule III drug alongside Tylenol with codeine and testosterone.

If that happens — which is likely — cannabis companies will be able to write off expenses on their federal taxes and engage in interstate commerce, but still won’t have access to banking services because, again, cannabis will remain federally illegal, per CNBC.

It’s more convenient for customers…

… to have payment options, but dispensaries face cash-only challenges, too: cash isn’t trackable, and it makes them targets for robberies.

Some workarounds include:

- CanPay, an app that works as a cannabis debit card in some states.

- Third-party payment processors, which tack on fees.

- Accepting debit cards with a PIN.

However, Mastercard recently asked banks to stop allowing cannabis purchases on its debit cards, as it puts them at odds with federal law.

It’s up to Congress

The House has passed SAFER several times since it was introduced in 2013, but not the Senate, where, this time, lawmakers spent months renegotiating provisions, including:

- Guidance for hemp business.

- Protections for cannabis employees applying for federally funded mortgages.

That’s promising for the industry — but now the House may not pass the amended version.

The government — it’s slower than me, couch-locked and watching “X-Files” reruns, after an indica pre-roll.