The huge shake-up at oil giant ExxonMobil

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Kinda gross, but kinda cool? A startup that tells synthetic fertilizers to piss off

-

Cooling the planet is as easy as putting an umbrella on an asteroid and blocking out the sun

-

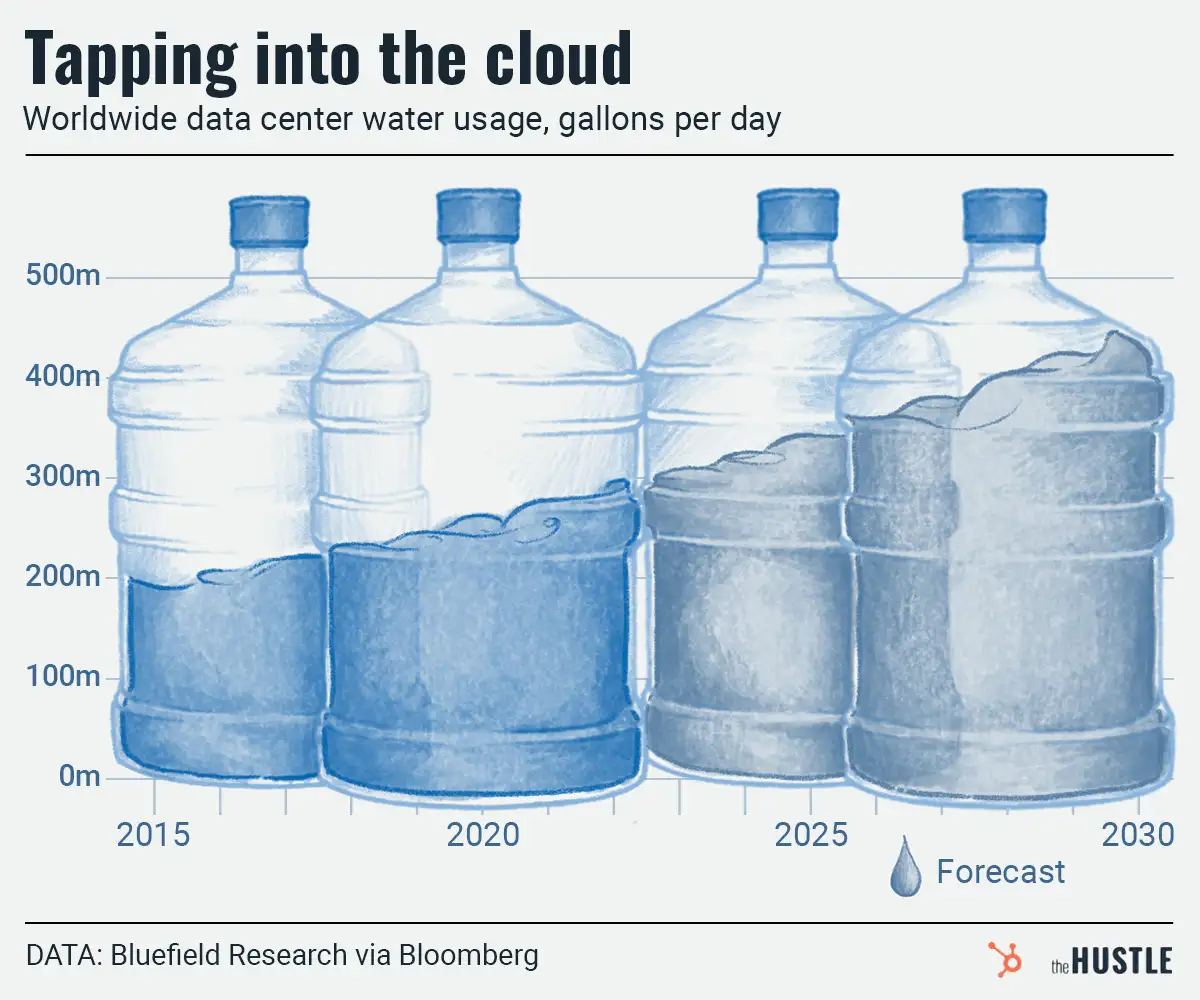

Big Tech’s thirst for AI dominance may bring literal thirst for everyone else

-

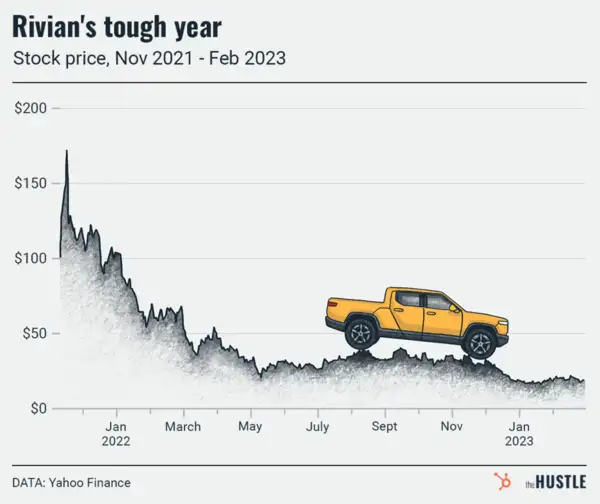

What’s up with Rivian?

-

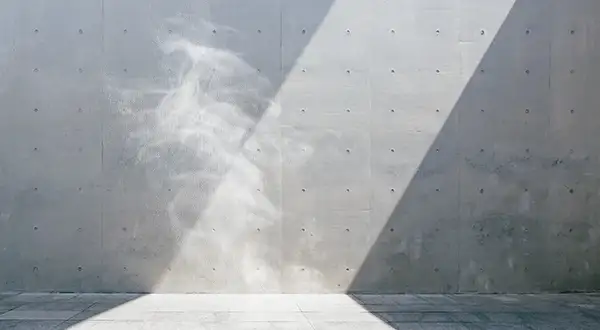

Rock-solid news in the concrete industry

-

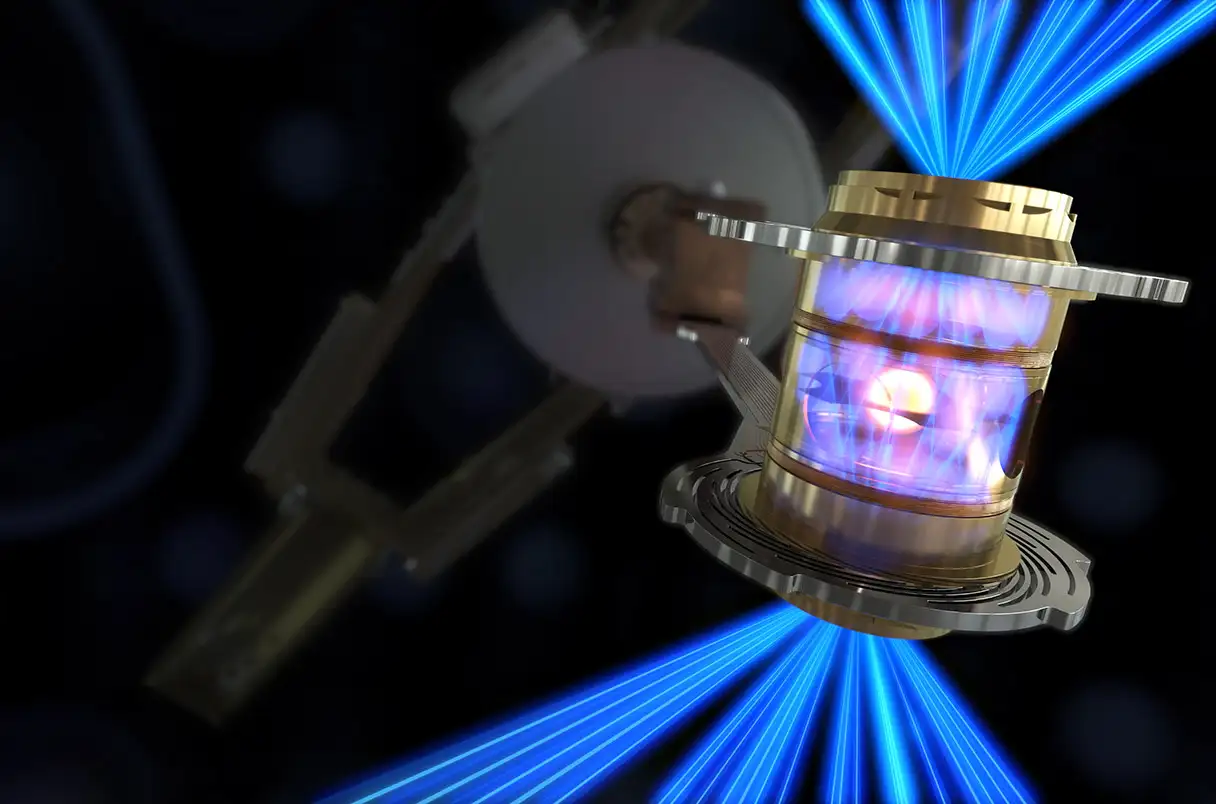

Why the nuclear fusion breakthrough matters

-

Can compostable undies prevent waste?

-

Zoomtowns are drying up, literally

-

Sponge cities are sopping up climate change