How much money did VCs drop in 2020?

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Can a pair of headphones help you focus?

-

A German startup sees the glass half full — and unbroken

-

The Carta debacle, explained

-

Cloudy with a chance of downfalls: The year ahead for startups

-

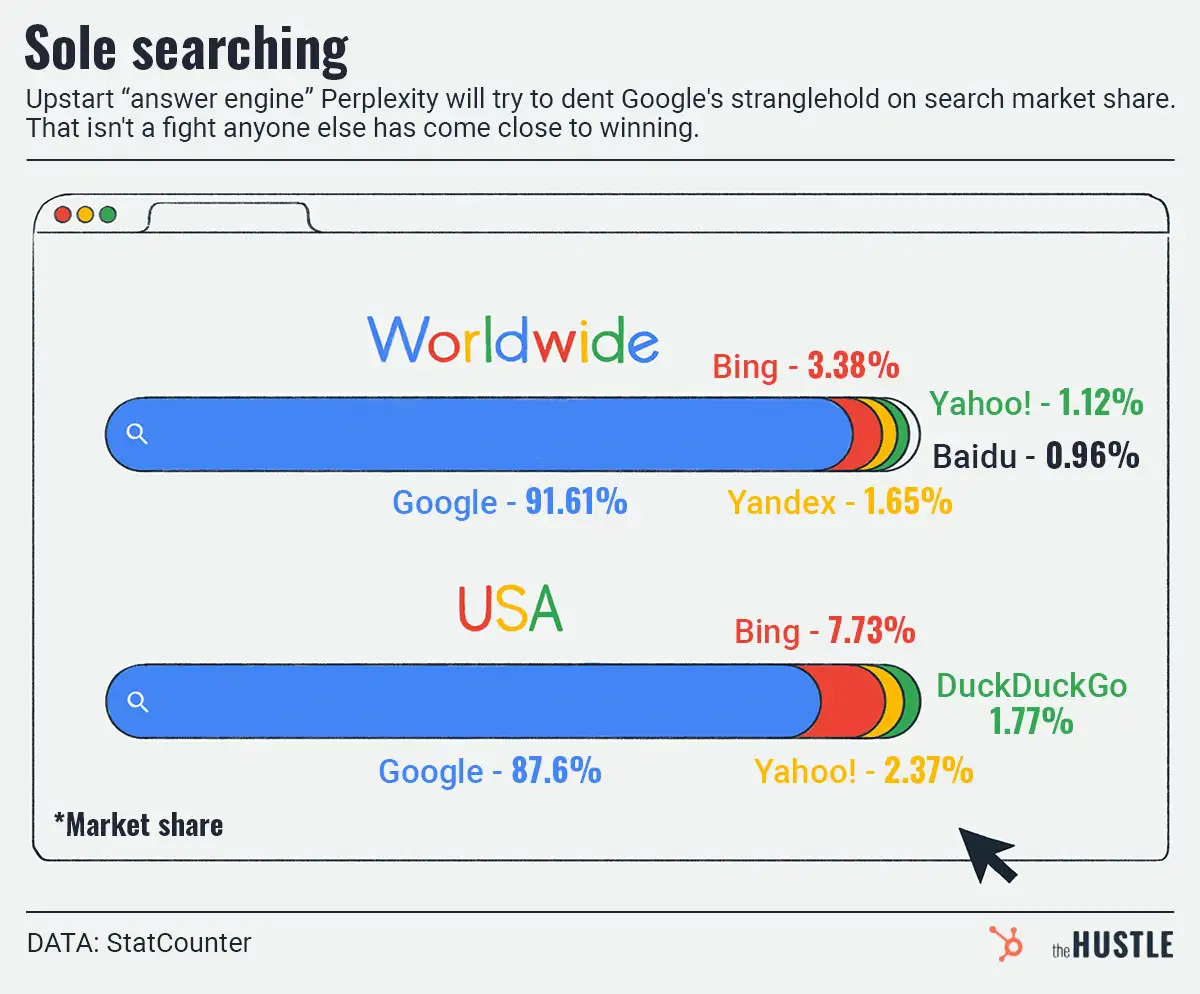

Could a Bezos-backed search startup kick Google’s crown off?

-

Adam Neumann’s apartment startup is here

-

Music you can really feel — no, really

-

After billions of years of the same ol’, same ol’, has water finally been disrupted?

-

Why ‘deaccessioning’ is an art museum controversy