A tense situation at the happiest place on earth

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Nylon’s new idea: An invite-only influencers’ club

-

Another publication accused of serving up AI-generated crap

-

Disney Parks focuses overseas, on seas, and on ceasing

-

Disney will buy Comcast out of Hulu as streaming looks more like regular old TV

-

Disney will lose $250m on its ‘Star Wars’ hotel… but it was really cool

-

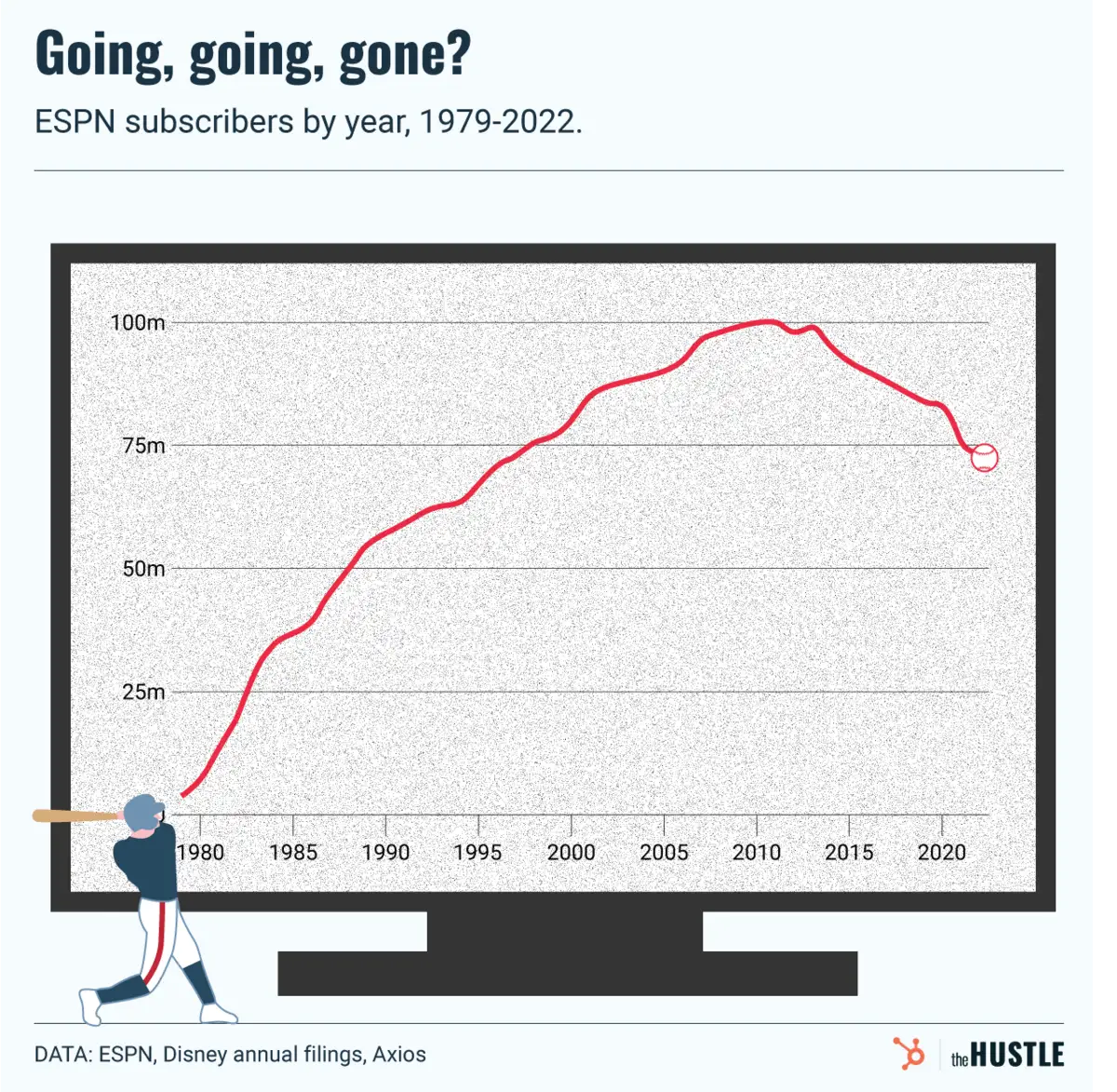

On Bob Iger’s to-do list: Fix ESPN, TV, Pixar, and more

-

Is this exactly what Elon Musk wanted?

-

The Dow index got a makeover. What does it mean?

-

Price increase? Disney fans are nonplussed