Why are tobacco stocks performing so well?

Philip Morris and Altria are performing well as investors look for dividends in an inflationary environment.

Published:

Updated:

Related Articles

-

-

Budweiser’s dry World Cup saga

-

The Dow index got a makeover. What does it mean?

-

Canada’s drug experiment

-

A tense situation at the happiest place on earth

-

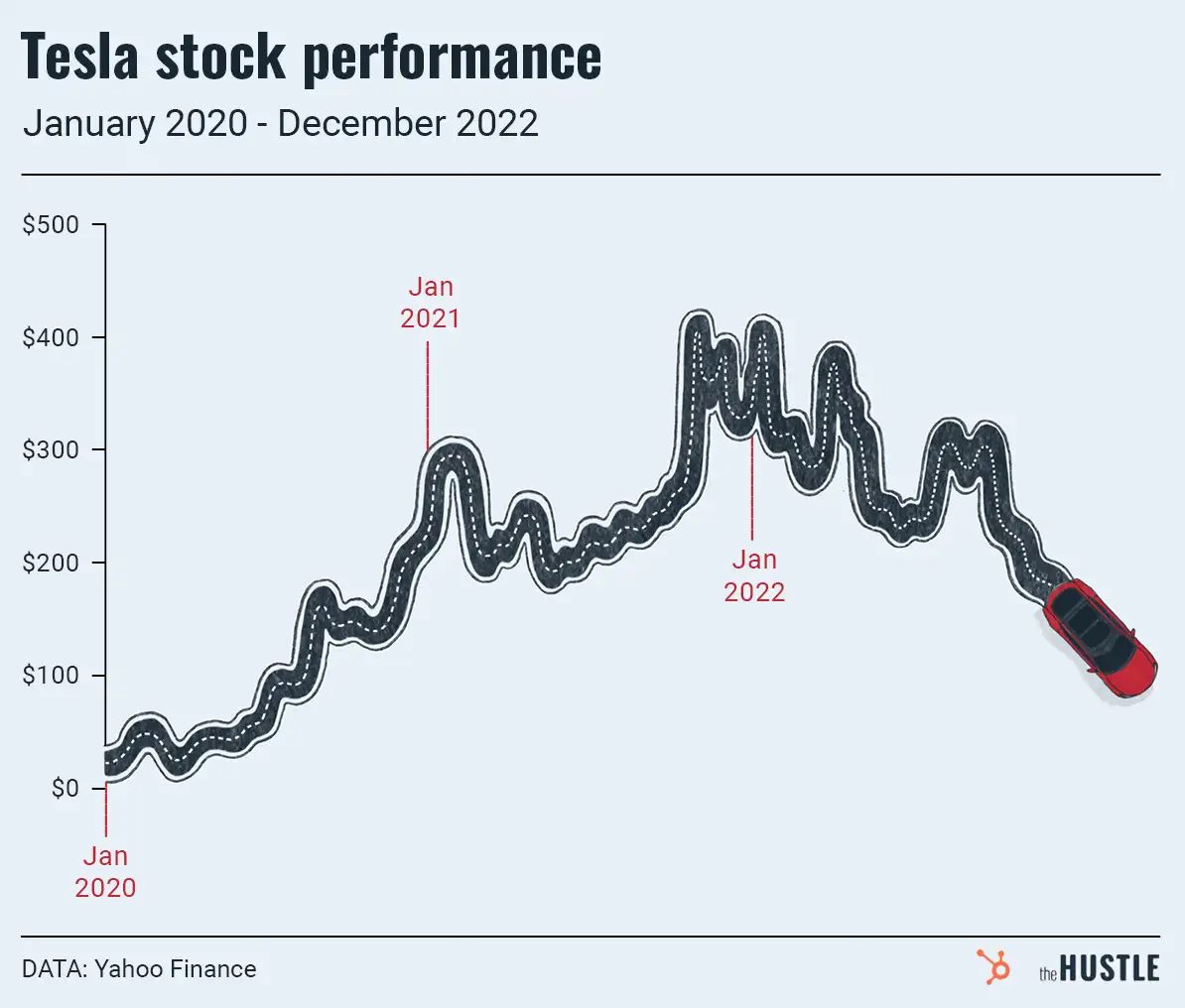

Tesla’s not-as-epic-as-expected end to the year

-

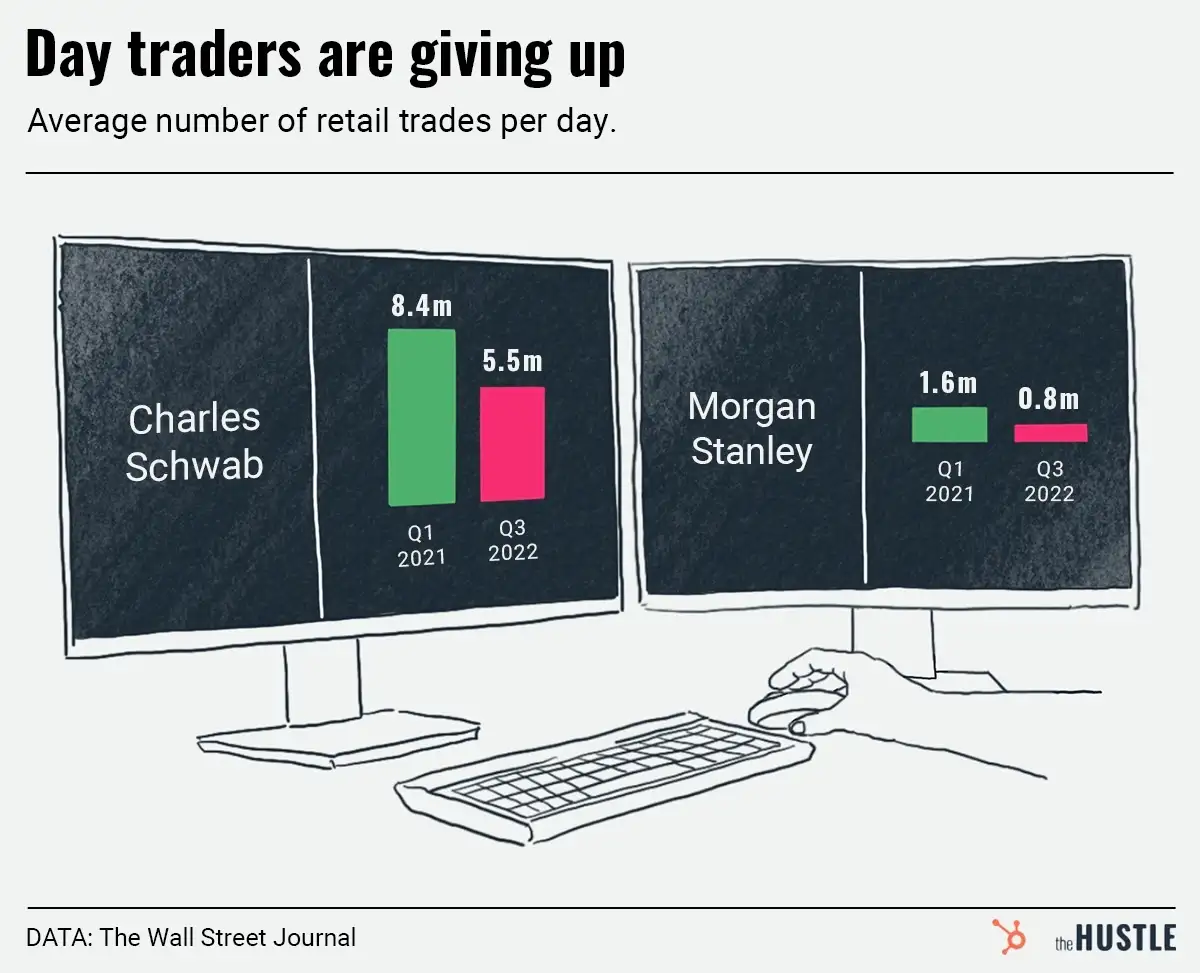

Amateur investors are bowing out

-

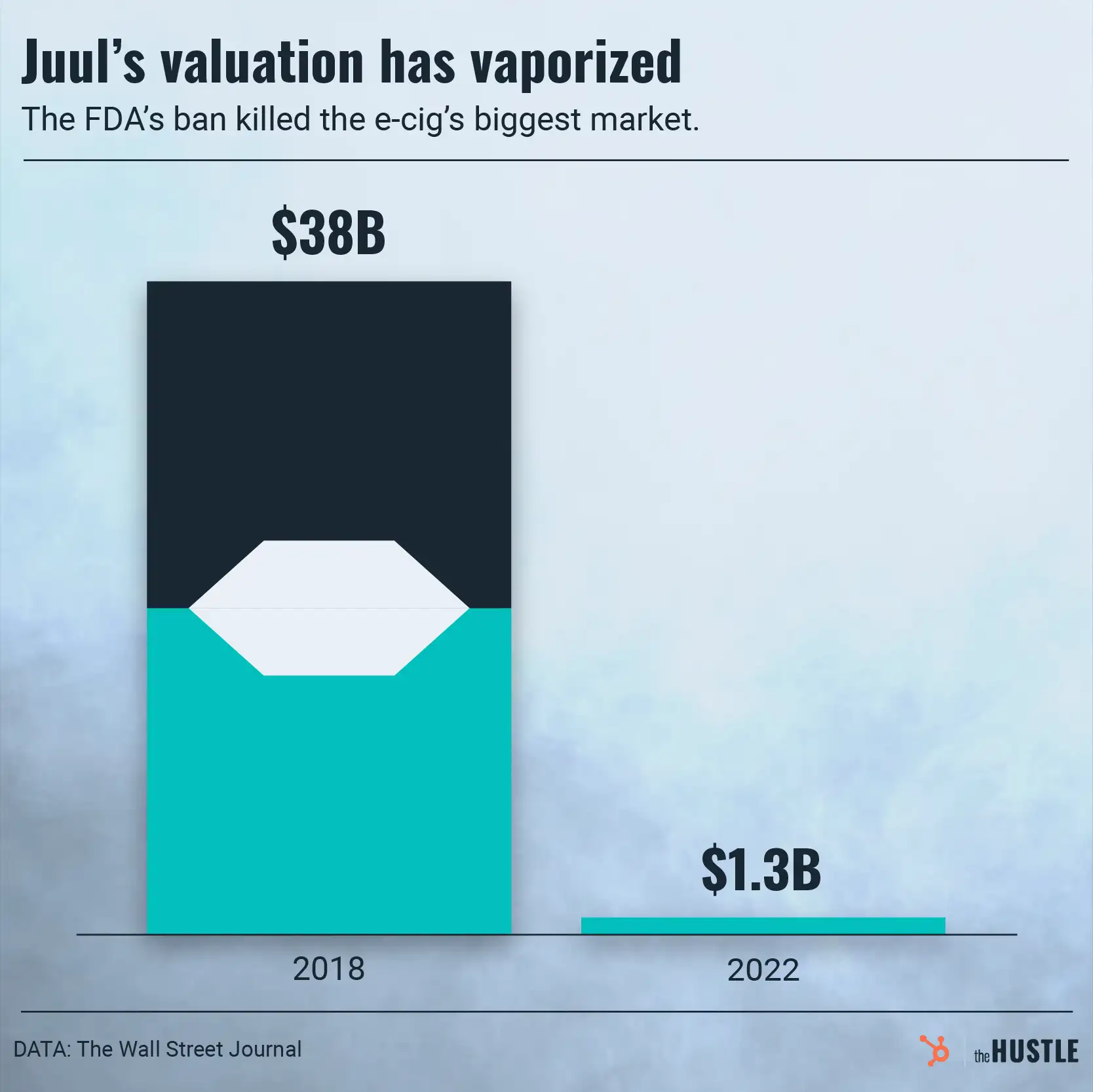

The rise and fall of Juul

-

Tequila and mezcal are taking over the bar

-

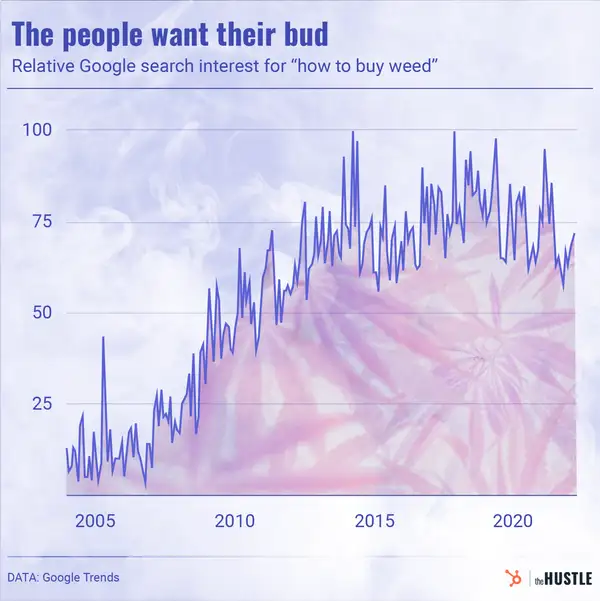

Weed rolls into the metaverse