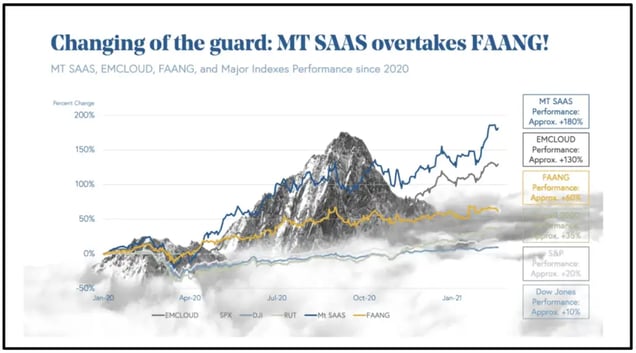

After a pandemic boom, cloud companies are now collectively worth $2T

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Would you pay to get your Instagram account back?

-

Is it finally time for smart glasses?

-

What if your TV knew you were sad?

-

Can VR make you care about nature?

-

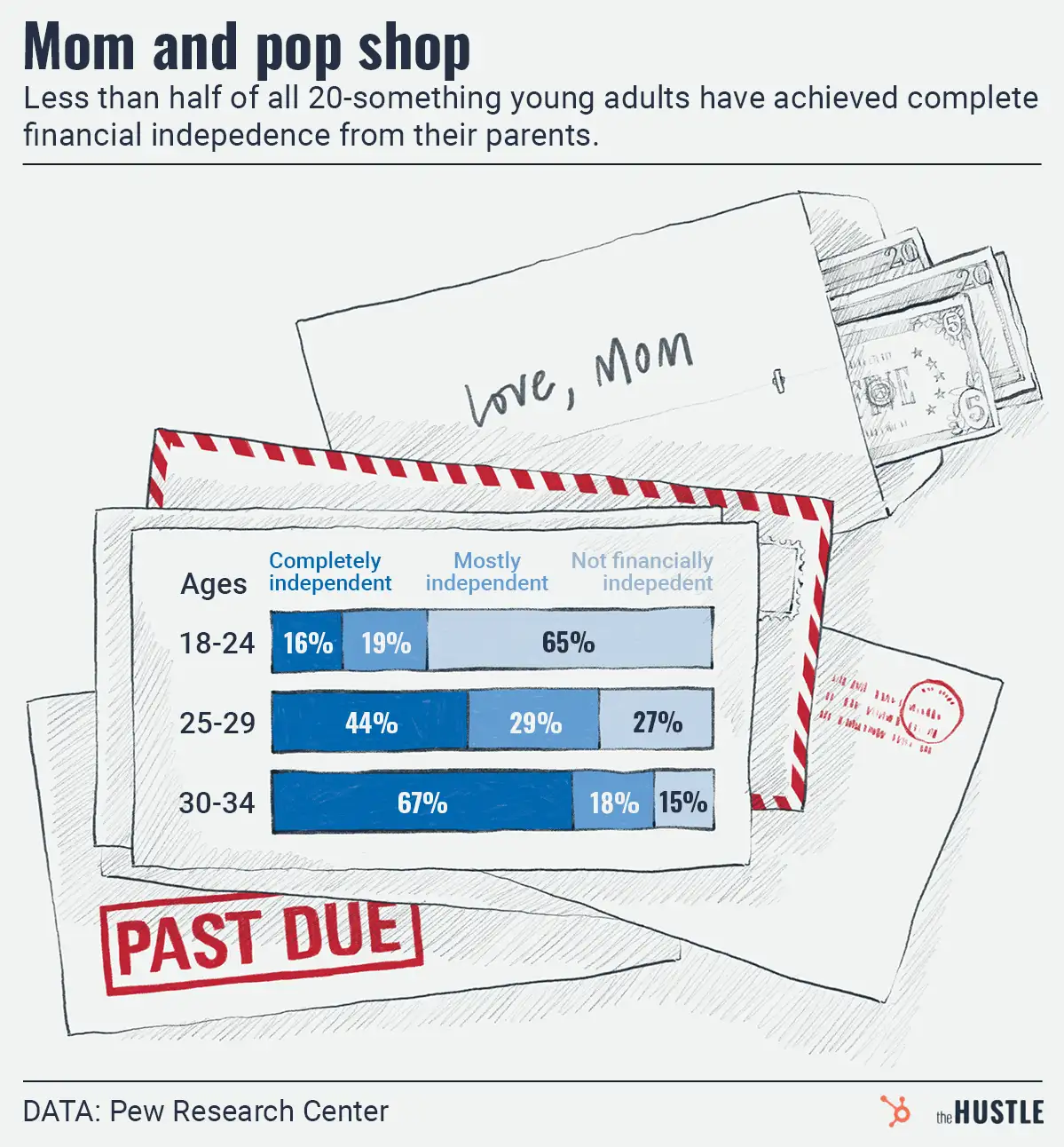

A bunch of young Americans are living on their parents’ tab

-

Alphabet’s innovation lab will solve humanity’s biggest problems, if others help foot the bill

-

Big Tech power rankings: Where the 5 giants stand to start 2024

-

The government can read your push notifications

-

Brrring back the deals: Will the IPO and M&A markets warm up again?