Why Instacart and DoorDash are launching credit cards

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Domino’s ups its delivery game

-

The Dow index got a makeover. What does it mean?

-

DoorDash wants to deliver everything

-

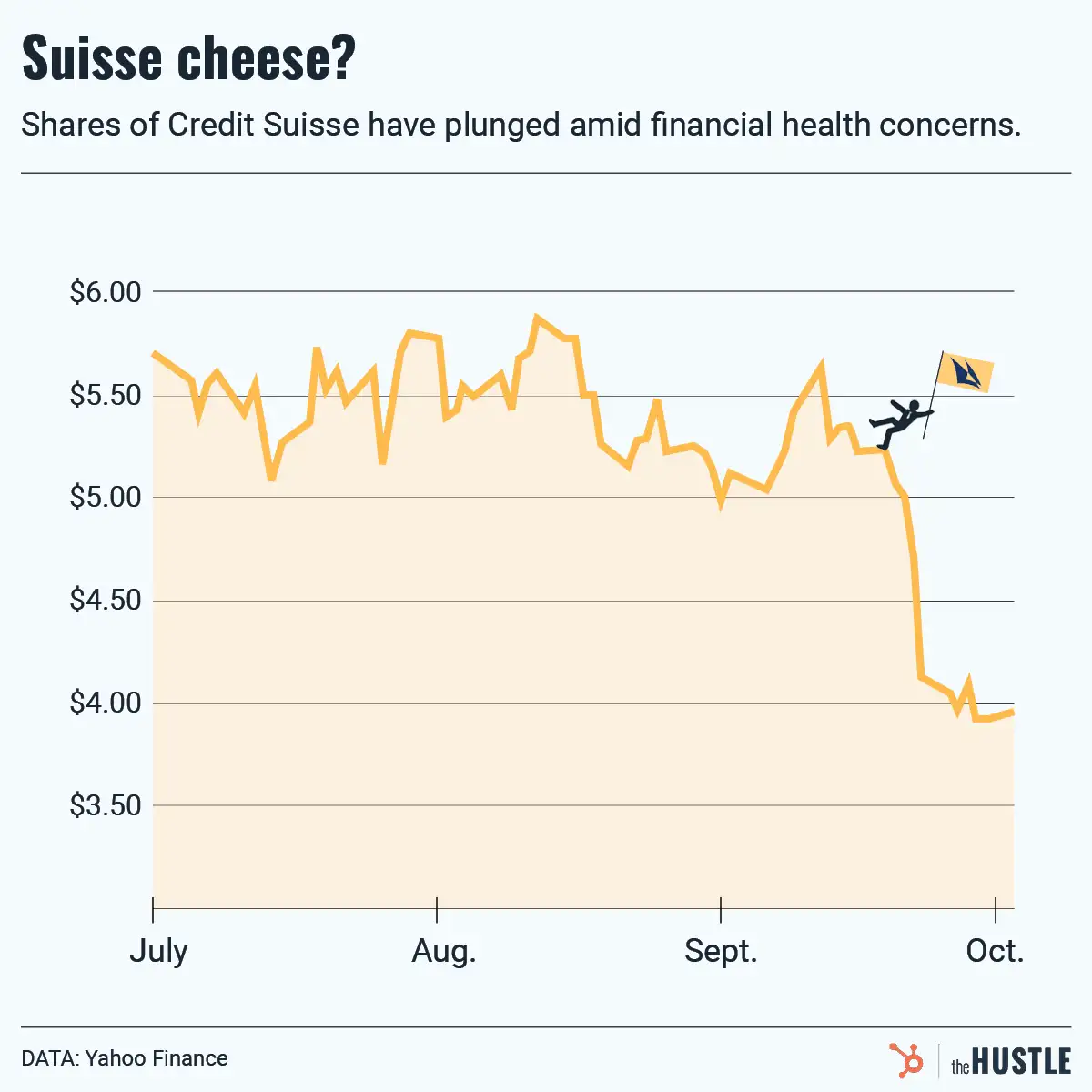

Not those credit default swaps again…

-

Are we caught in a ‘bear market trap’?

-

Digits: Crypto ads, Kilimanjaro, and more

-

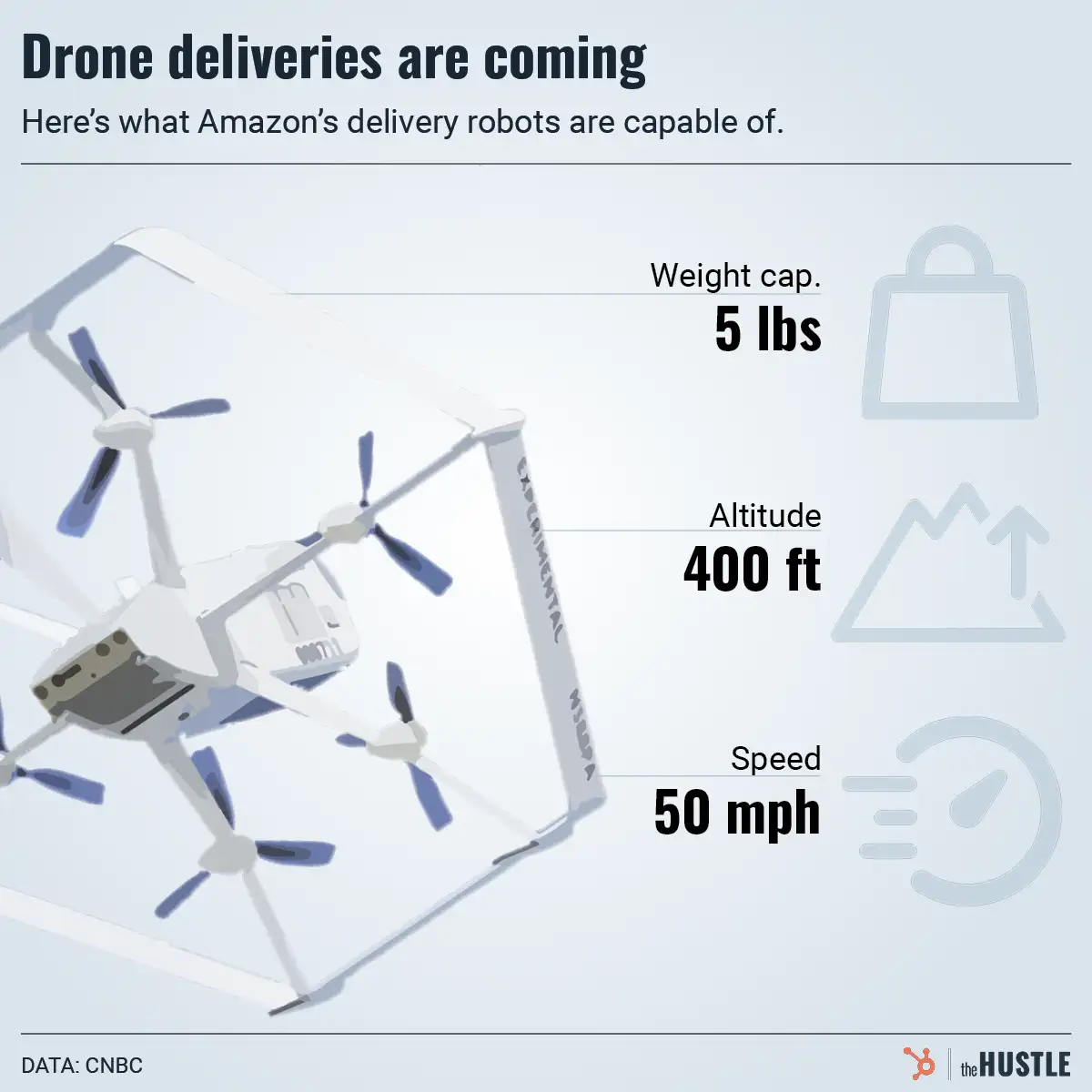

Amazon is rolling out the delivery drones

-

Where the heck is all our change?