Coinbase’s venture arm has invested in 100+ startups

Coinbase Ventures has invested in 100+ startups (most in the crypto space).

Published:

Updated:

Related Articles

-

-

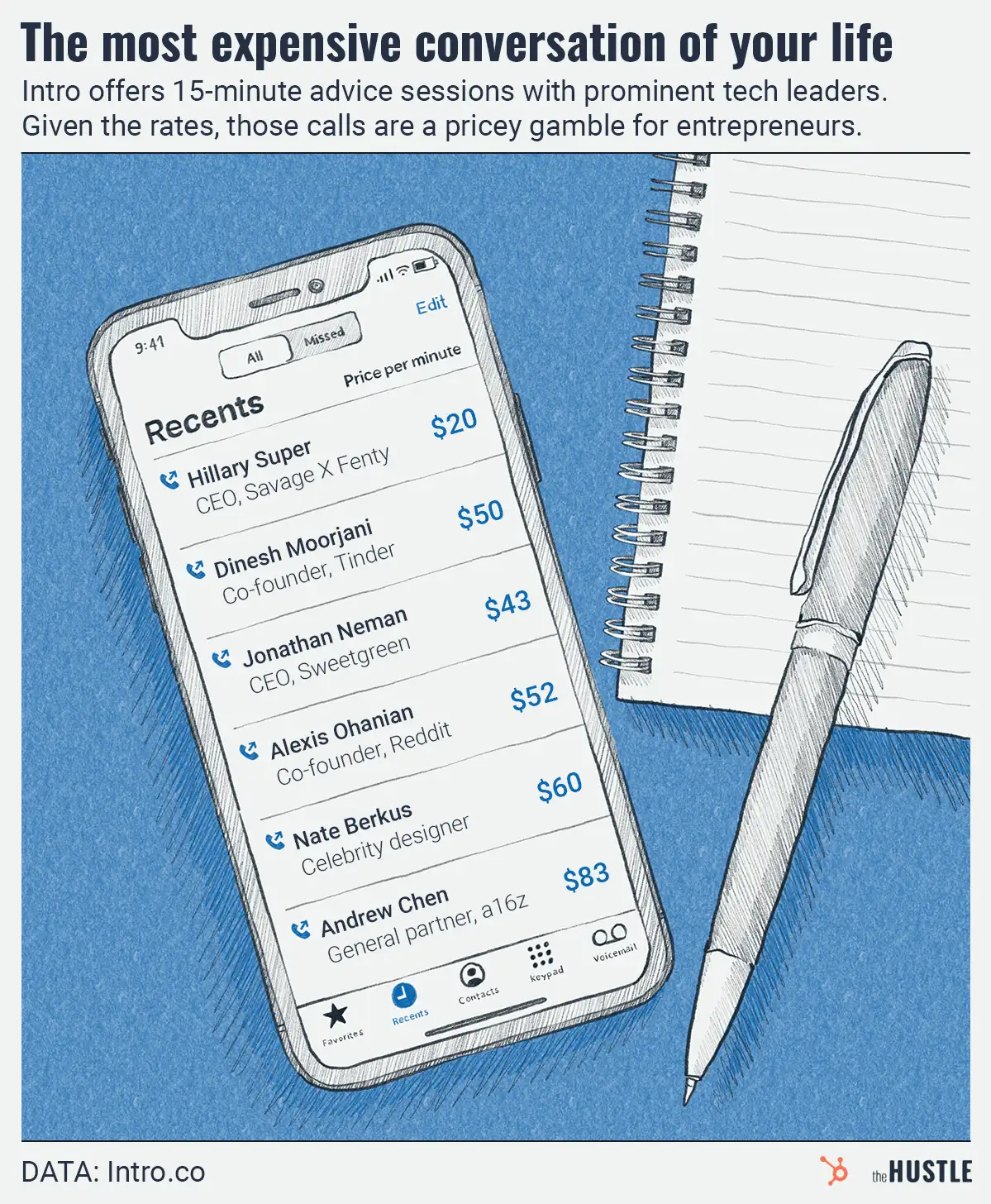

Would you pay $1k for 15 minutes with your business idol?

-

All of the drama, none of the attention span: Bite-sized soap operas are getting big

-

A bunch of young Americans are living on their parents’ tab

-

Some users are swiping left on traditional dating apps

-

Privacy, who? Gen Z is sharing its location

-

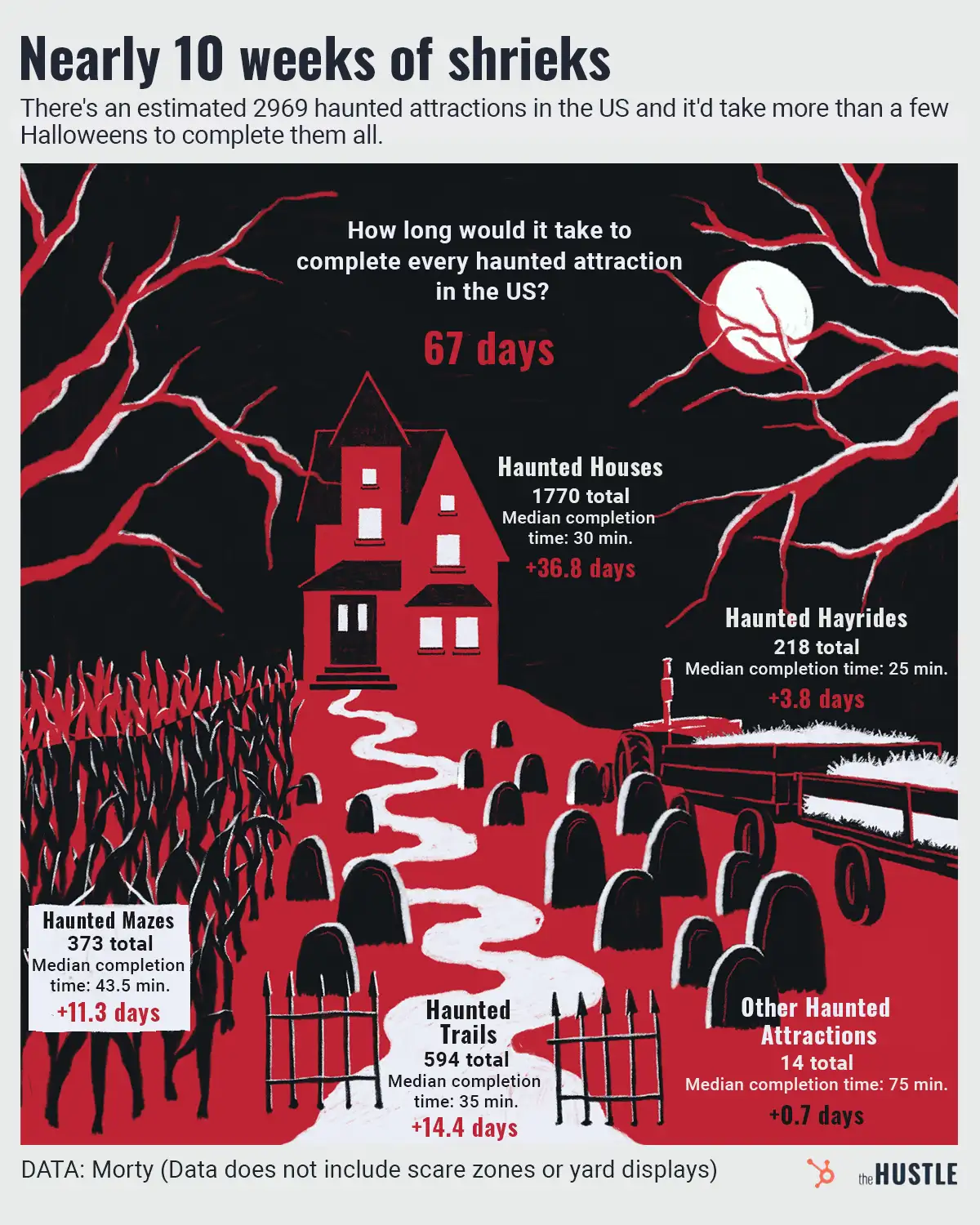

How to find the best haunt this Halloween

-

Screen time slowing you down? Try ‘monk mode’

-

Yelp vs. fake reviews

-

Do dating apps decide who we get to date?