Why is the SEC shaking up its investing rules?

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

The future of Hollywood: Make fans do it

-

A bunch of young Americans are living on their parents’ tab

-

Move over, stocks — alternative investing apps are here

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

We’ve gotta talk debt ceiling — and you’re already asleep

-

The Dow index got a makeover. What does it mean?

-

Fractional investing is making everyone a landlord… kinda

-

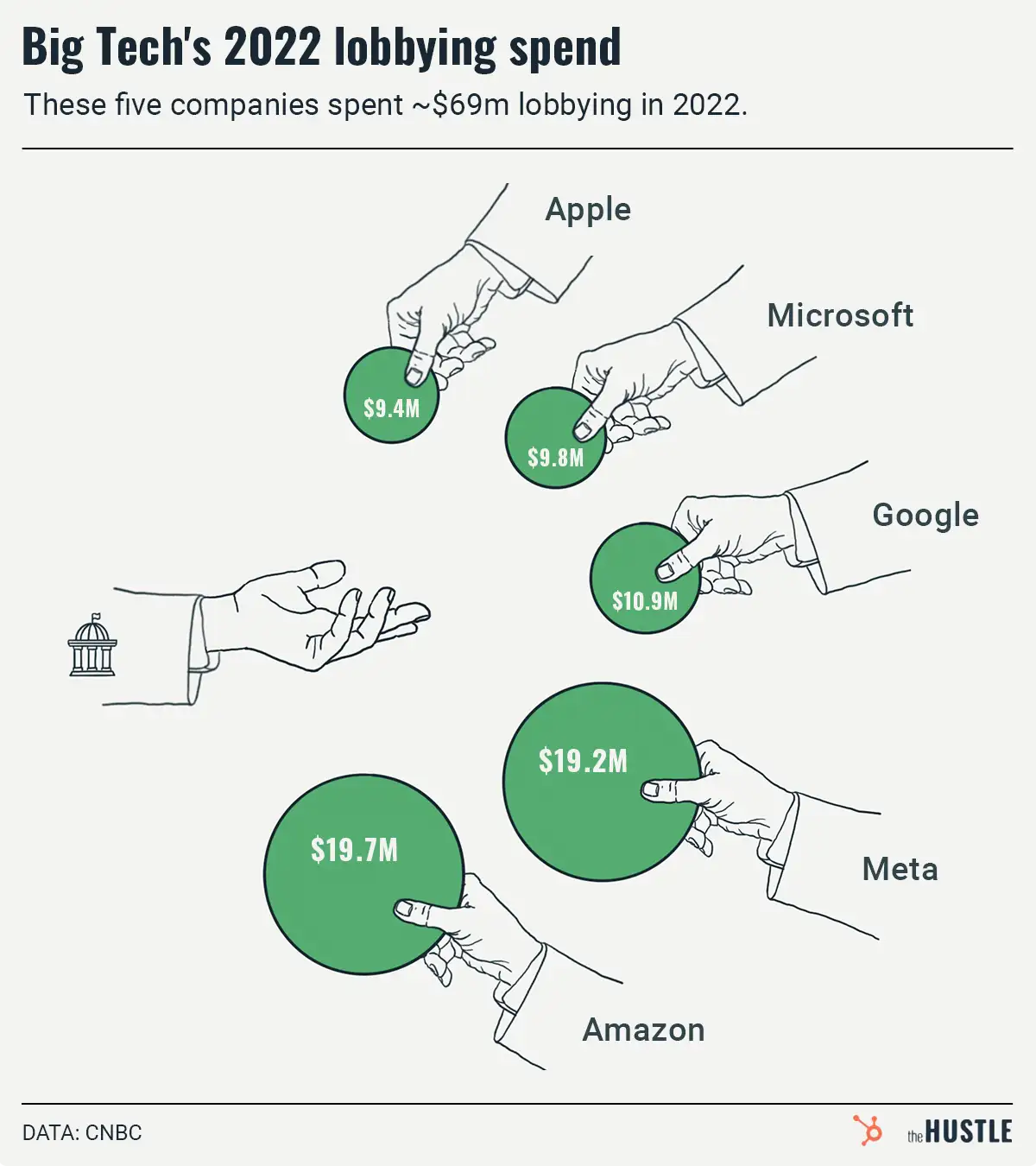

What the past year of tech lobbying looked like

-

The $1.4B prison phone call industry gets an overhaul