Are airline loyalty programs worth more than the actual airlines?

Some analysis suggests airline loyalty programs are more valuable than the actual airlines. The truth is not that simple.

Published:

Updated:

Related Articles

-

-

Major hotel chains can’t stop inventing new brands

-

Private jets have a pilot problem

-

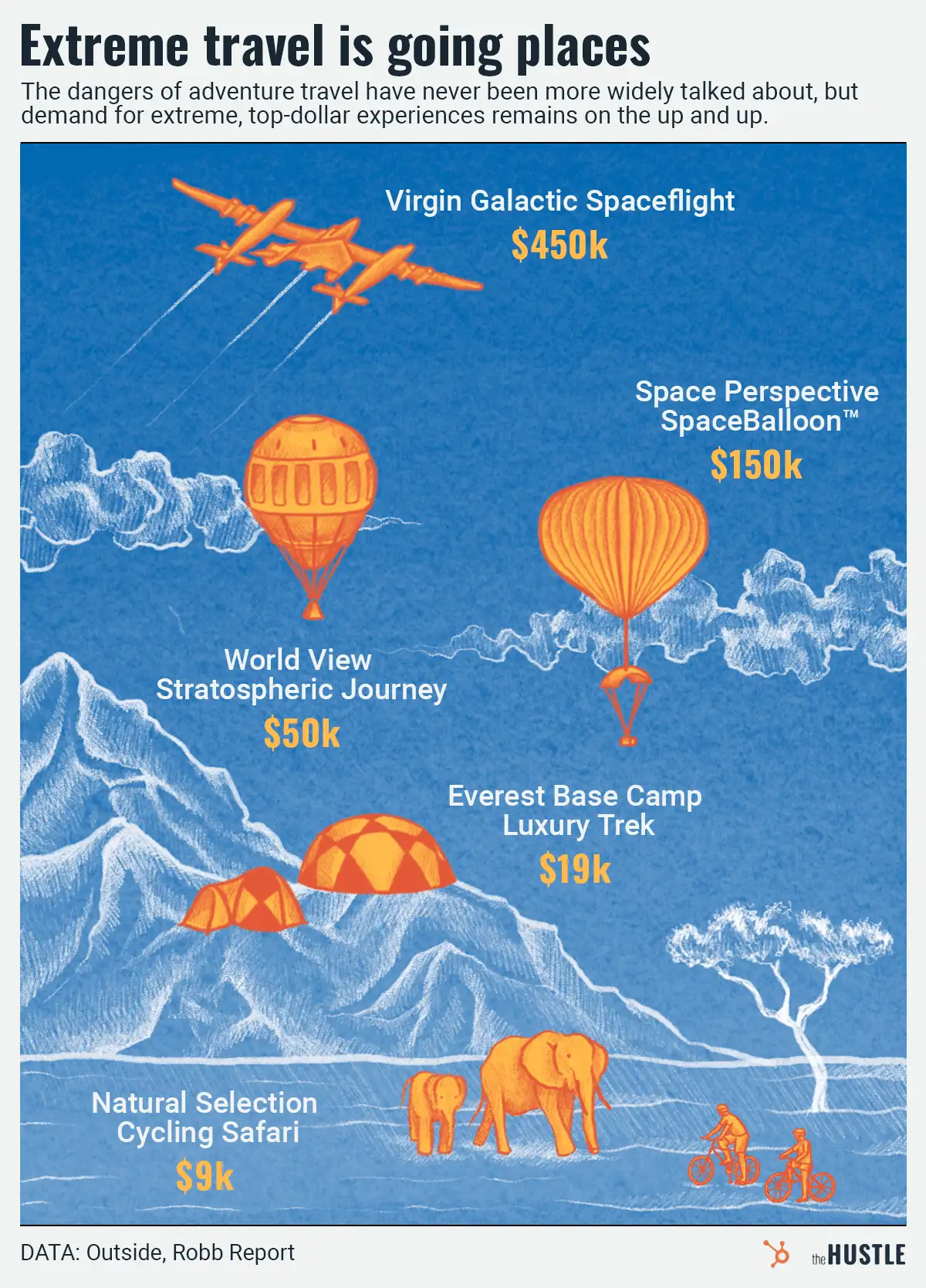

Months after the sub tragedy, extreme tourism is… more popular than ever?

-

The next big travel destination might be the airport itself

-

Ready for a trip? Psychedelic retreats are going mainstream

-

Check into the future: Hotels are getting an upgrade

-

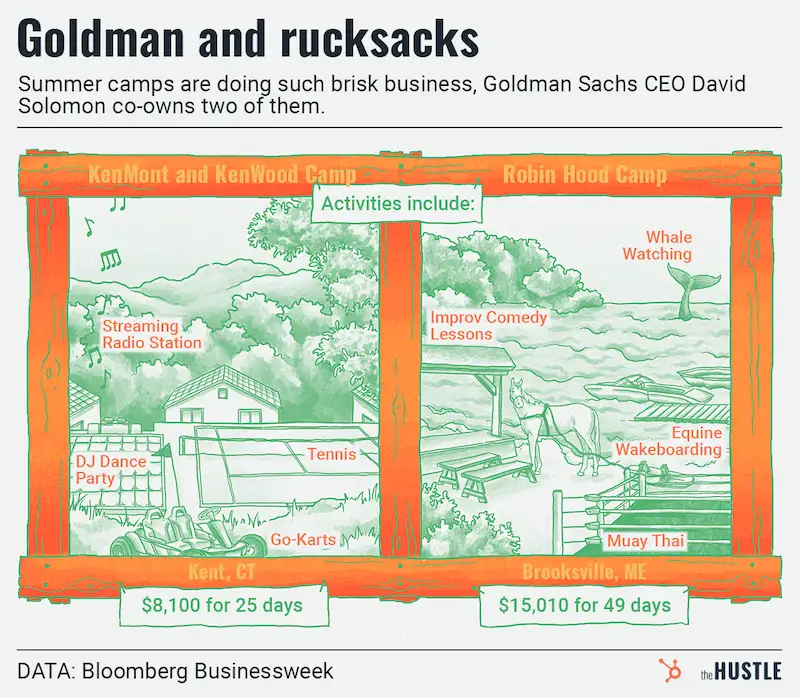

At the elite’s summer camp, the workers allegedly get bunk

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

This summer, at band camp, we got a reverse mortgage