How Rivian customers score on its IPO

Rivian has spiked 50%+ on its first 2 trading days and -- at $120B+ -- is now worth more than Ford or GM.

Published:

Updated:

Related Articles

-

-

Federal traffic control updates are getting the green light

-

Electrified roads could be the tipping point for EV adoption

-

It’s not a great time to be GM’s Cruise

-

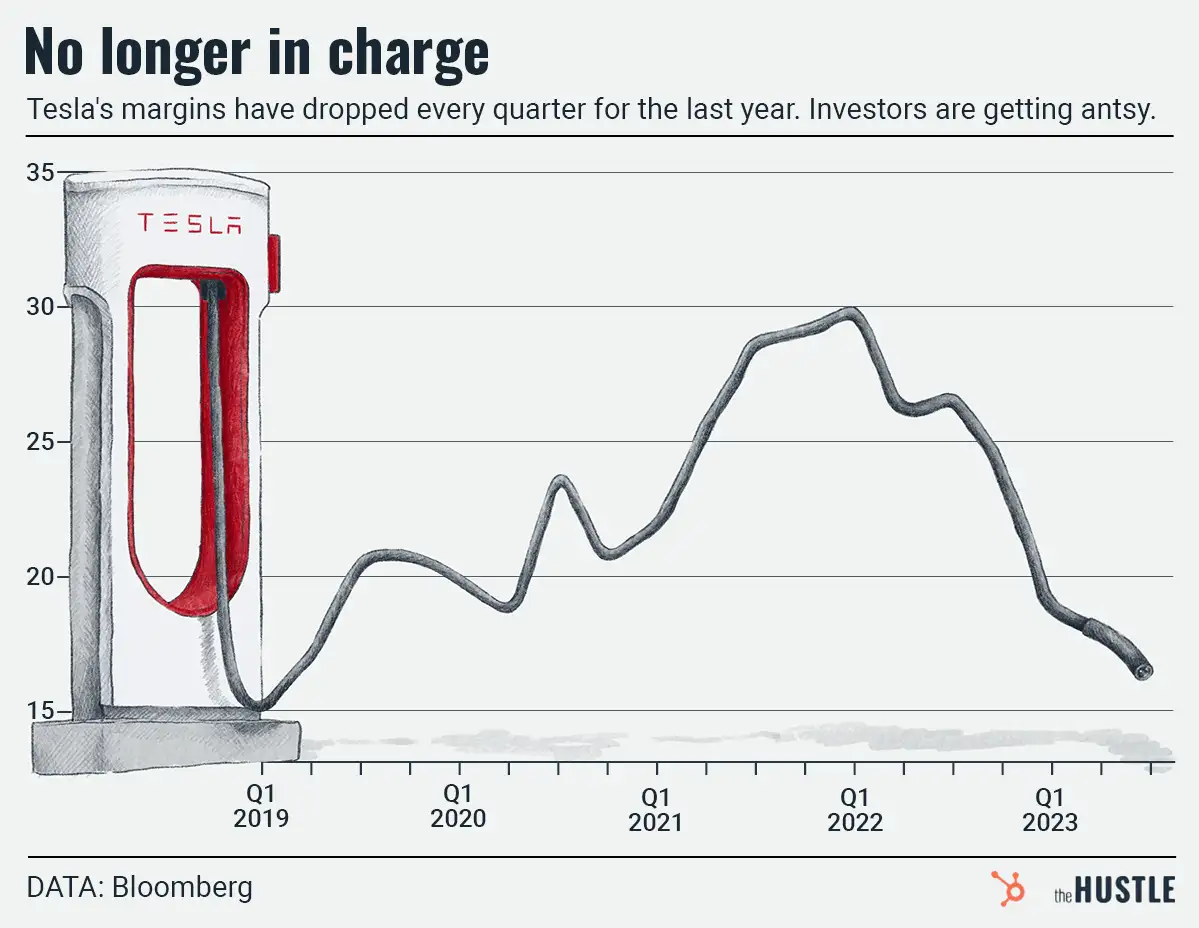

Tesla is struggling, and the outlook for improvement isn’t thrilling anyone either

-

If an auto industry exec tells you their job doesn’t suck, don’t believe them

-

Just because you can easily fly this new helicopter doesn’t mean you should

-

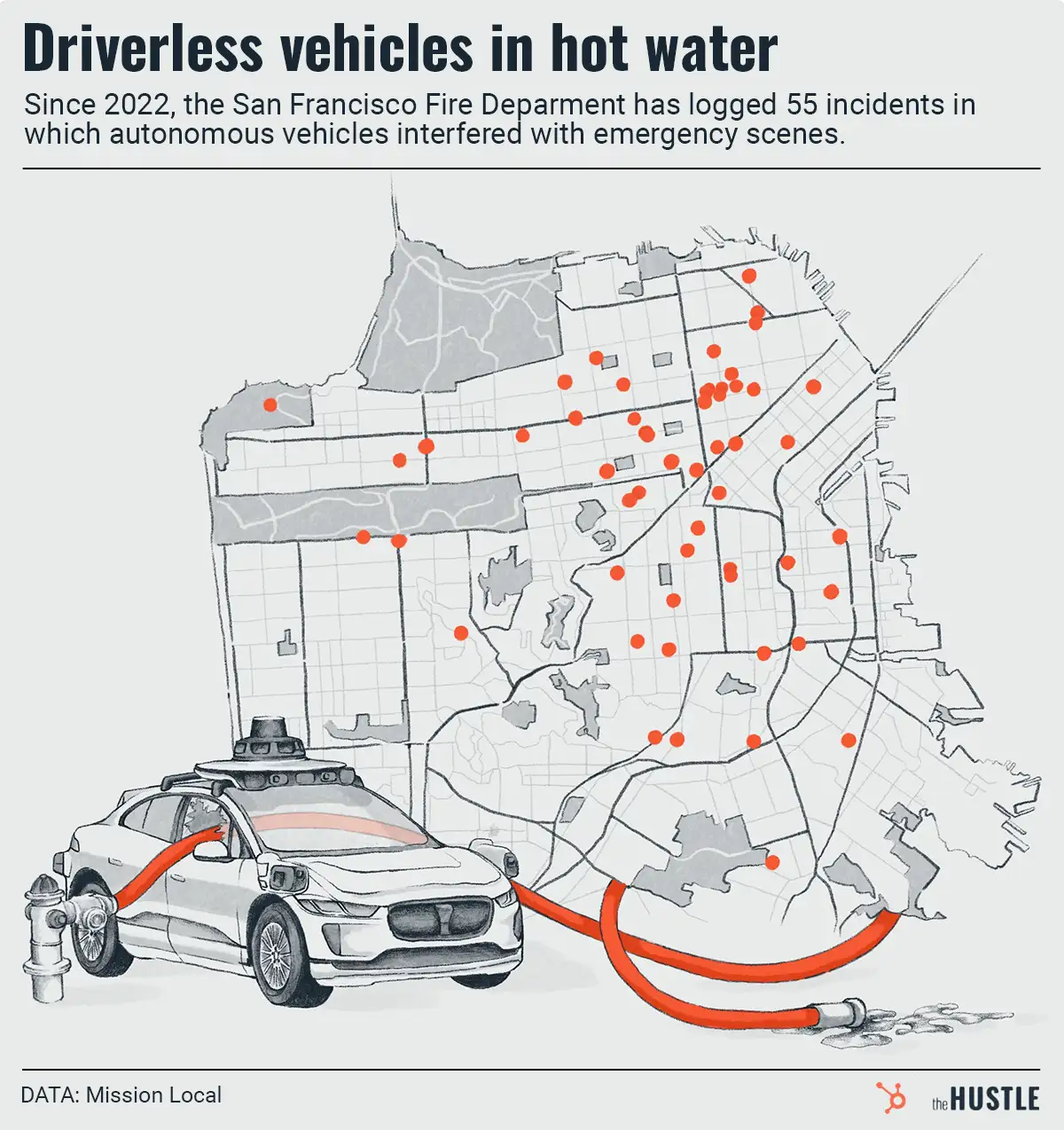

Where there’s smoke, there’s an autonomous vehicle blocking a fire

-

$750m reasons we’re getting ever closer to flying cars becoming a reality

-

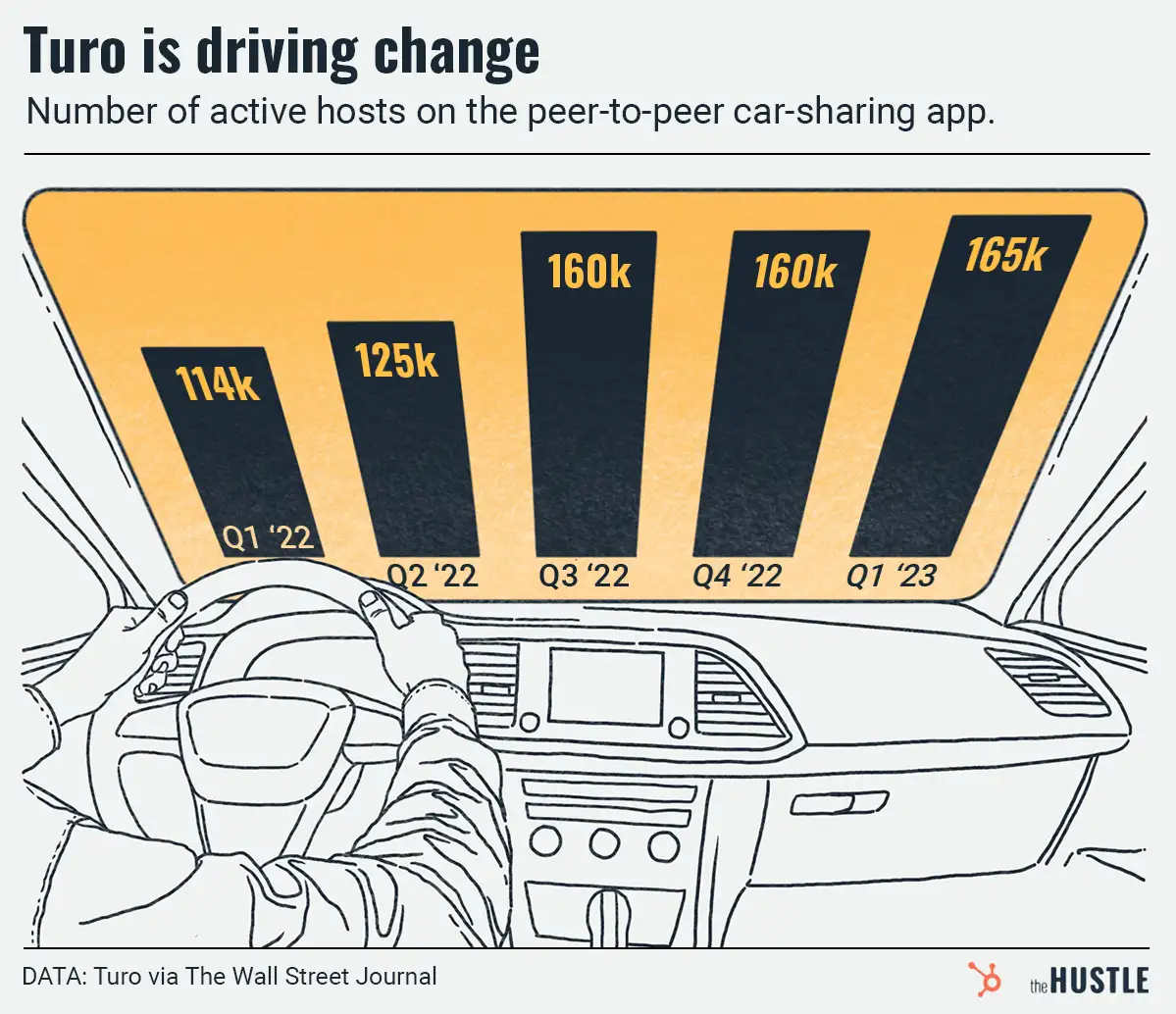

Can’t Airbnb the house? How ’bout the car, its roof, its headrest, your parking spot…