How Rivian customers score on its IPO

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

The third-party apps Uber and Lyft are trying to kill

-

Is Uber’s new ‘bus’ doing more harm than good?

-

What will self-driving cars be like inside?

-

How did Waymos become the ethical tech trend?

-

The hum of a hundred helicopters

-

C’mon and ride the train

-

Meet the new Jag, nothing like the old Jag

-

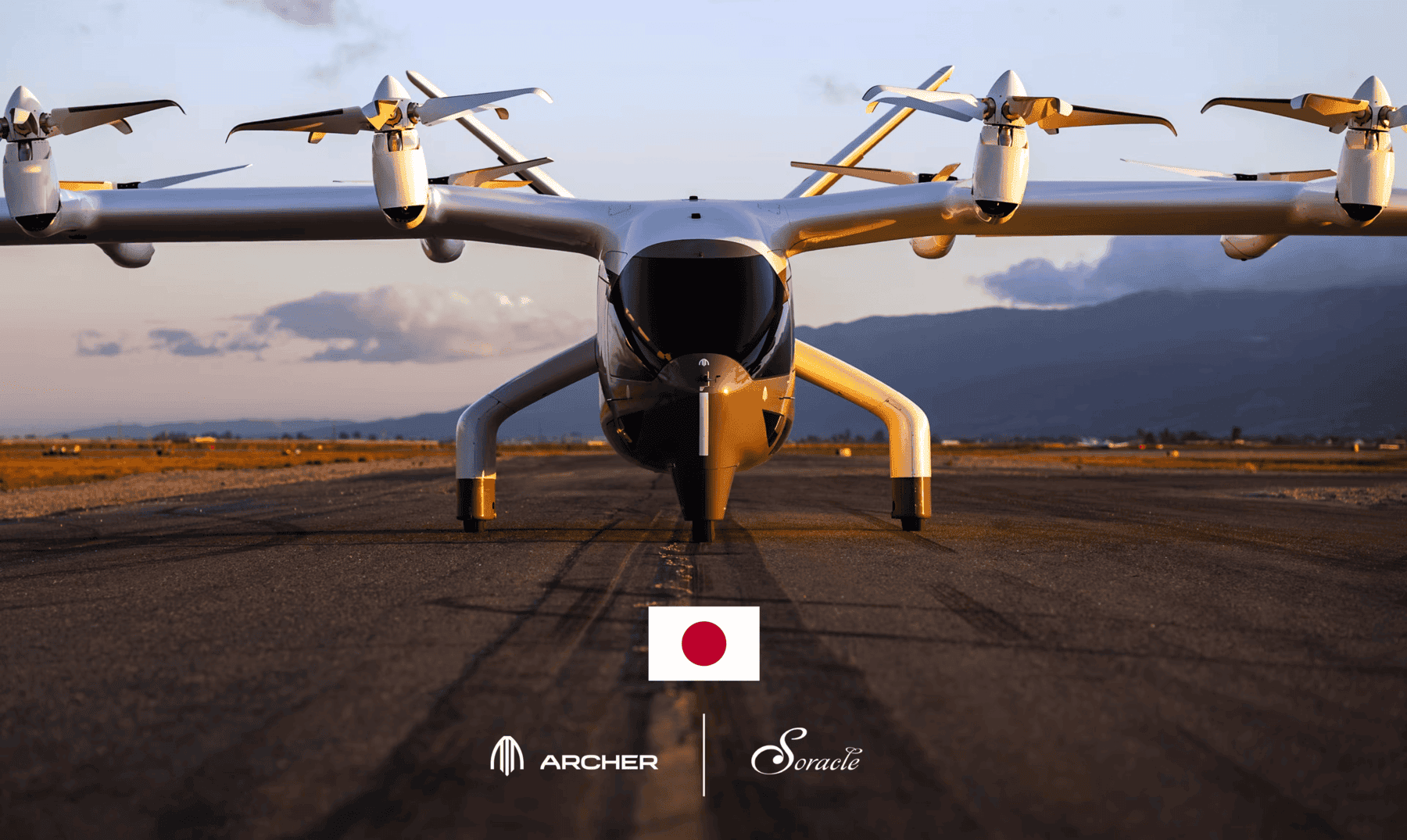

Should we walk or hail an air taxi?

-

Travelers would pay more for better, beautiful bus stops