Other than “what’s trending on r/WallStreetBets,” one of the main ways investors value stocks is by looking at future expected cash flows.

If you want to see this process at work, look no further than Live Nation.

The live events company reported a YoY revenue drop of 95% in Q3, yet its current market value ($14B) is largely in line with fall 2019.

The market is pricing in a return to normality

In a recent report, The Economist bucketed in-person event companies into 3 categories (collectively worth $180B+):

- Exhibition, conventions, and trade shows (e.g., Informa)

- Event promotion (e.g., Live Nation)

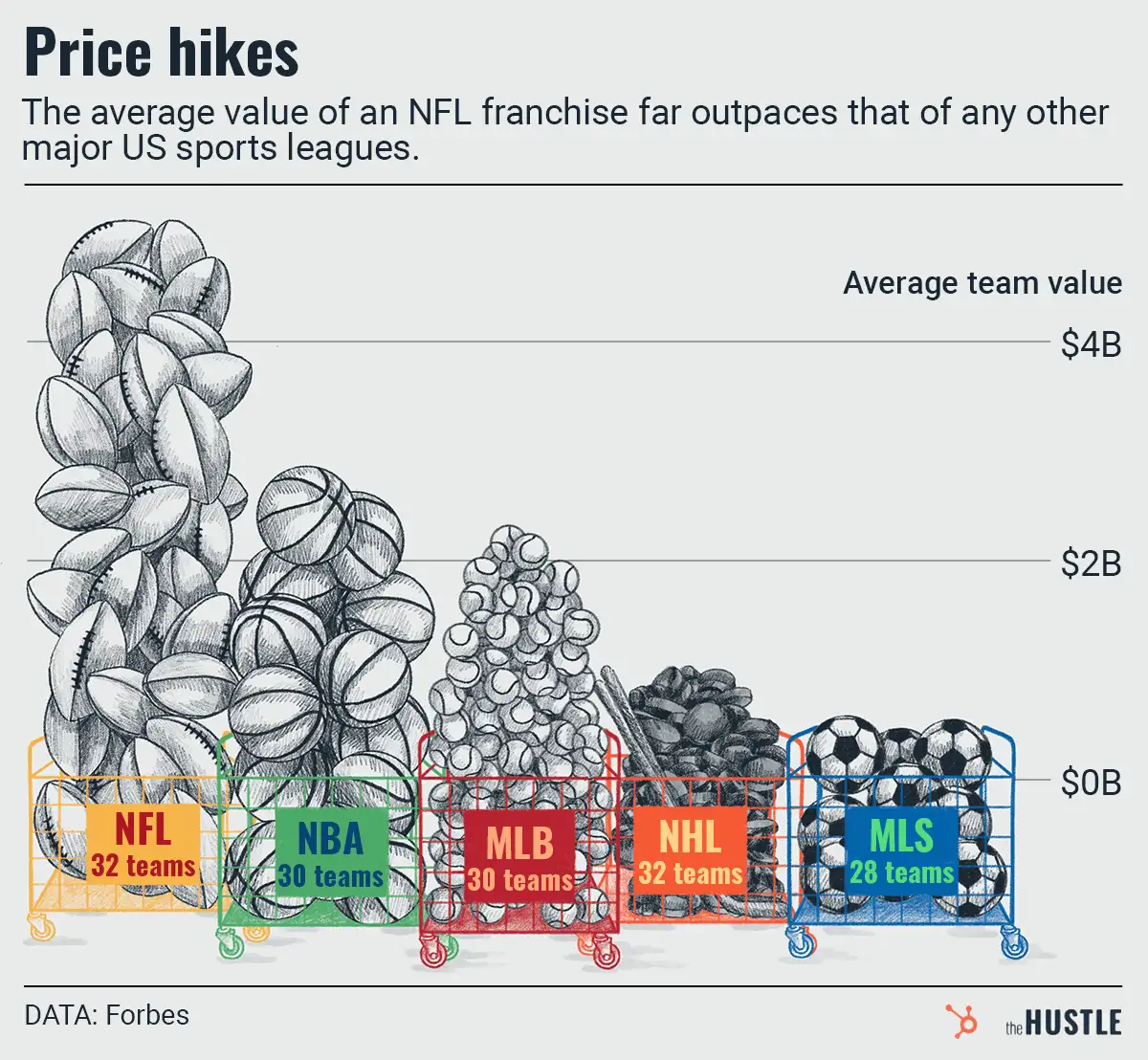

- Pro sports (e.g., NBA)

The article comes to an interesting conclusion: Companies unable to adapt during the pandemic are in a good position to do well moving forward (and vice versa).

There was little the exhibition industry could do this year

Its revenue is projected to decline by 67% to $9B, per The Economist.

Take the Hannover Messe — one of the world’s largest trade fairs — as an example. Typically hosted in April, the event is housed in a complex the size of ~69 American football fields and can accommodate 250k people.

This type of event can’t be replicated in Zoom.

Investors seem to agree: Informa, the largest player in the space, is up 15%+ since news of the vaccines first broke.

Most major sports leagues were able to keep going

However, the money does not flow evenly across all stakeholders.

Among American sports leagues, teams take home ticket and concession revenue (which have been crushed), but leagues take home broadcasting rights (still going).

More concerning than the revenue split is the way live sports is being consumed. Everyone going digital during the pandemic has 2 negative effects:

- Hastening the decline of the lucrative cable TV bundle.

- Rapidly changing viewing habits away from “whole game” consumption to snippets here and there.

Live events have seen some digital doubles

The South Korean super-boy-band BTS garnered ~1m viewers for a virtual concert. And Lil Nas X serenaded 33m watchers in Roblox.

However, like the exhibition industry, certain live event elements (e.g., mosh pits, rave sticks, Coachella wristbands, insane amounts of molly) can’t be duplicated online.

Touring accounts for the majority of a musician’s revenue — and they’ll want to get back to normal. Live Nation’s CEO Michael Rapino sure thinks it’ll happen, saying that he “expect[s] shows at scale” by next summer.