What’s behind California-to-Texas relocations? (It’s more than taxes)

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Return-to-work mandates are struggling

-

Does anyone know what ‘founder mode’ is?

-

Oh, no, another acronym: Disillusioned NEETs

-

Elon Musk vs. Delaware

-

‘How’d the economy fare in 2023?’… is a great question

-

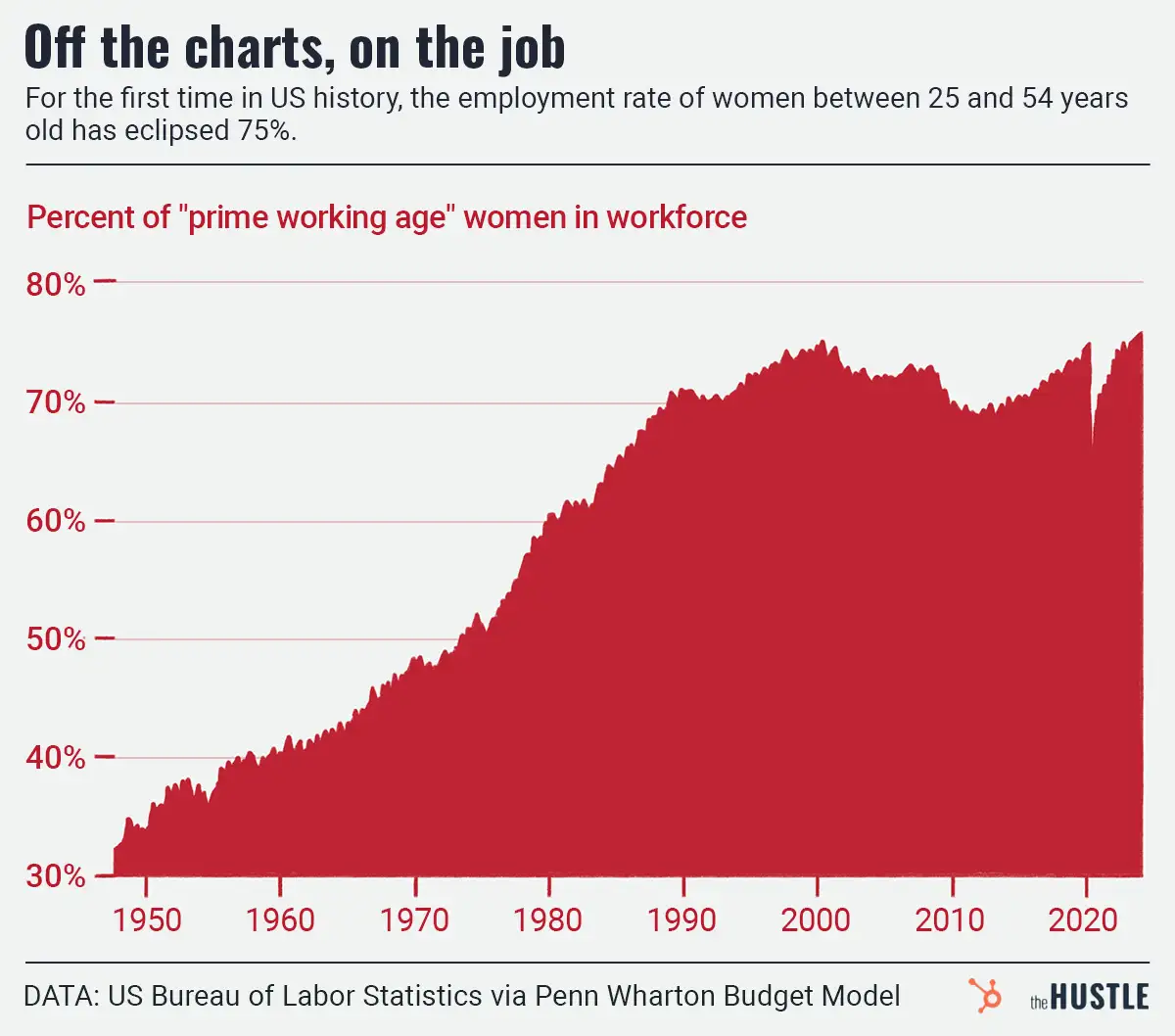

More college-educated moms are working than ever before

-

Please chill this long weekend, CEOs

-

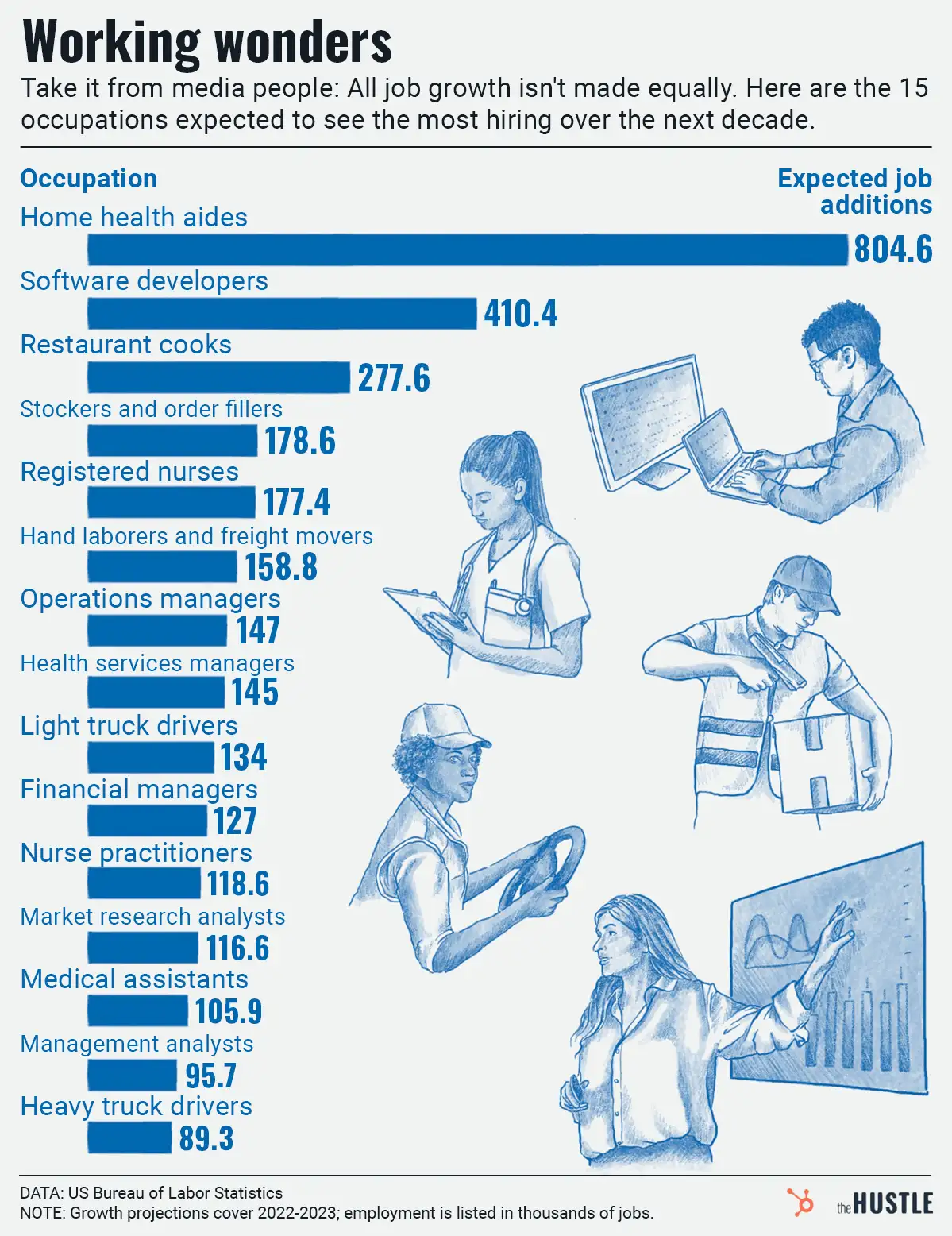

How do you feel about the job market? Probably pretty weird

-

The American economy is fine, but Americans aren’t