As it prepares for a Hong Kong IPO, crypto-mining company Bitmain revealed that its revenue grew from $278m in 2016 to $2.5B last year to $2.8B in just the first half of 2018.

The world’s largest crypto-mining company has been profitable since 2016, avoiding the volatility of cryptocurrency exchanges by capitalizing on the tools of the new trade and then diversifying beyond them.

In the gold rush, smart entrepreneurs sold shovels…

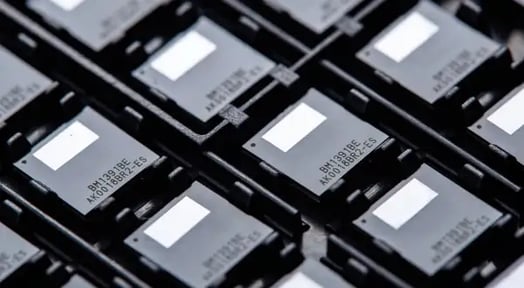

Now, Bitmain sells the tools that enable the crypto rush: mining equipment. Bitmain capitalized on the enormous growth of Bitcoin and other cryptocurrencies — which increased in value 15x last year — without becoming totally reliant upon it.

While crypto exchange markets suffered $600B in losses since January, Bitmain increased revenue 10x and profit 9x from its previous year. So, how did crypto’s ’Main biz beat the market?

Bitmain didn’t put all its Bits in one Main

After carving out 85% market share as a virtual Bitcoin-mining monopoly (completely contradicting crypto’s central tenet of decentralization), Bitmain reinvested its massive profits in new research projects.

Bitmain now offers blockchain services and AI chips to power cloud systems and object-recognition programs — and ⅓ of the company’s 2.6k work in R&D to develop new technology.

So for better or for worse, Bitmain now has enormous control over the supposedly decentralized crypto market as it prepares for its IPO: After filing its prospectus, the value of the top 20 cryptocurrencies rose 20%.