Monster US pharmacy chain CVS just made a $66B bid ($200 per share) to acquire the health insurance monster, Aetna. That’s too many monsters.

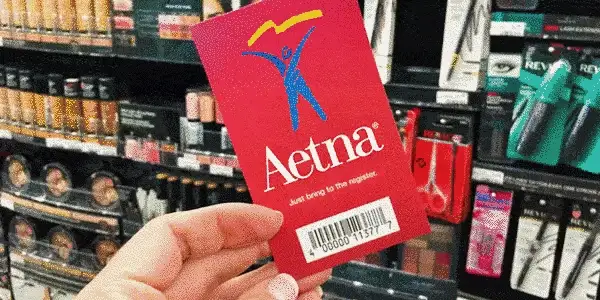

Were this to happen, it would definitely be one of the biggest deals of the year: joining the nation’s second largest pharmacy chain with the third-largest health-insurance company in the US, and launch CVS Health Corp. into a new world.

What’s their angle?

CVS is currently a pharmacy-benefit manager, meaning they can negotiate drug benefits for insurance plans, and owning the health insurance behemoth would essentially cut out the middleman.

This would give CVS a leg up when negotiating drug prices with pharmaceutical companies — an incredibly important advantage at a time when drug companies are under fire to cut costs for consumers.

And also, of course… they’re scared of Amazon

Truly — the monster retail brand has recently expressed interest in branching into the online pharmacy game, opening up a can of panicked worms in yet another industry.

Sources say CVS made the offer earlier this month but has been in discussions about a possible health deal for several months. According to Quartz, the deal is said to still be in the early stages, but if Aetna decides they want to sell, it’s expected to come to fruition in the coming weeks.

This could mean a lot for the state of health insurance

Now with the president looking to repeal the Affordable Care Act, the insured, as well as insurers, have been left in limbo regarding the future state of healthcare coverage in the US.

If the deal goes through, CVS and Aetna could be the godfathers of a new trend in corporate responsibility, offering another avenue for Americans to get covered.