What’s behind the crazy market rally? A billionaire investor explains

The Fed’s rate cuts are boosting stocks -- and the FAAMG crowd is exceptional.

Published:

Updated:

Related Articles

-

-

Elon Musk vs. Delaware

-

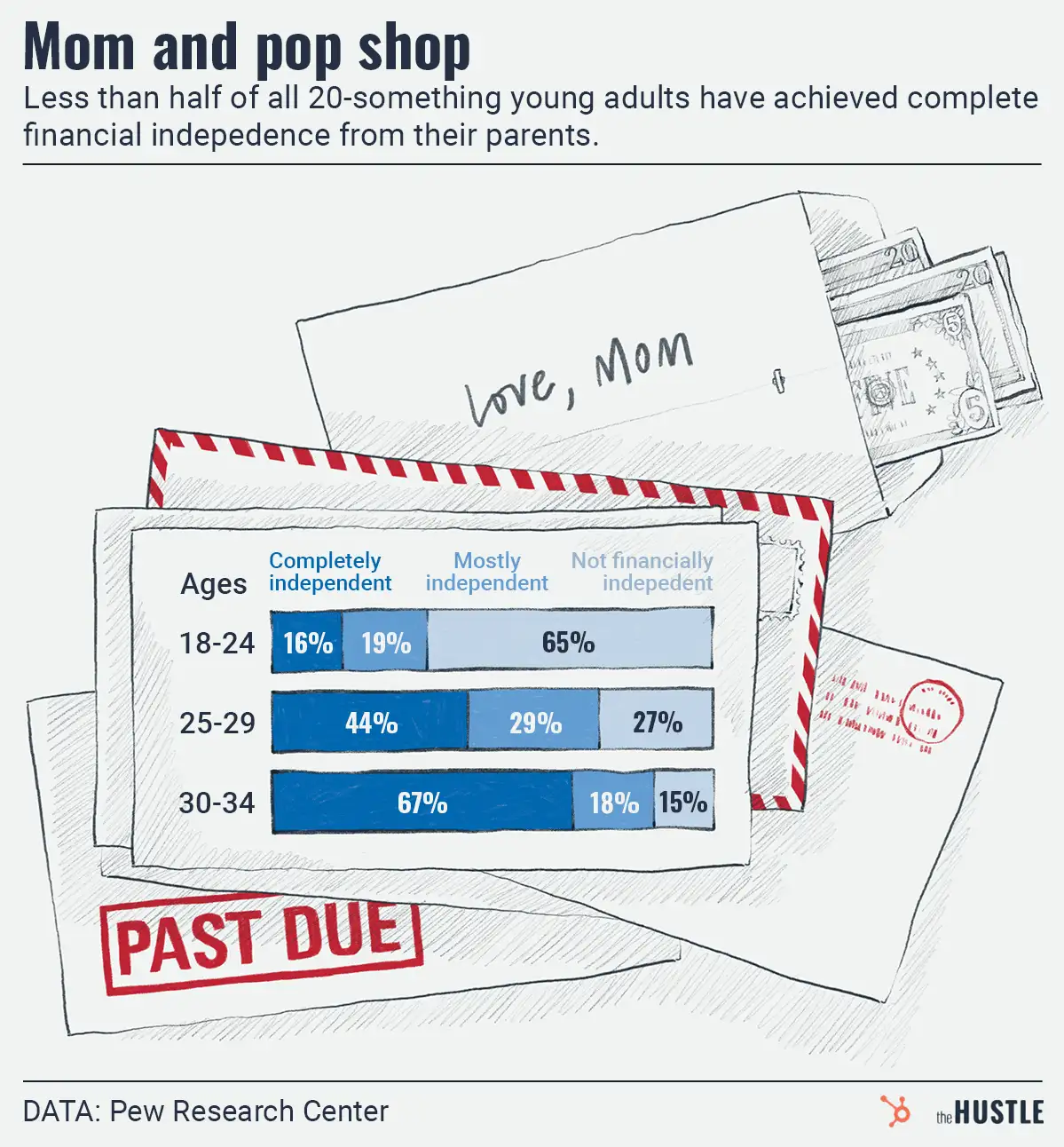

A bunch of young Americans are living on their parents’ tab

-

Please chill this long weekend, CEOs

-

Need help brushing up on the new dictionary?

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Where business is headed in 2023: Highlights from 3 reports

-

How a soda reseller built a multimillion-dollar empire

-

The Dow index got a makeover. What does it mean?

-

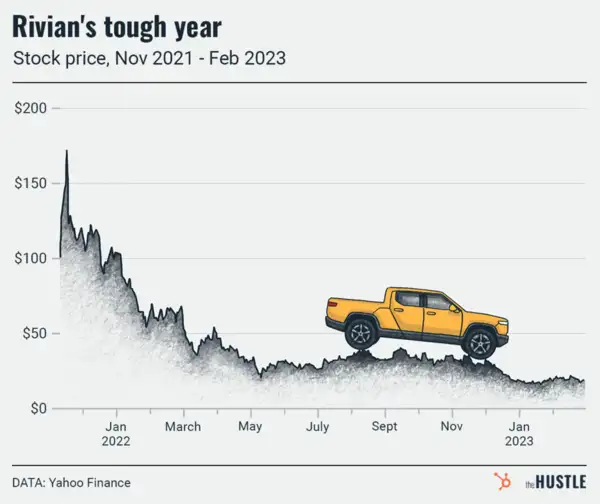

What’s up with Rivian?