Photo by Tomohiro Ohsumi/Getty Images

This time last year, Masayoshi Son was the laughingstock of the investing world.

The SoftBank CEO had bet a big part of his ~$99B super-VC Vision Fund on WeWork and — pardon our French — it ate sh*t.

The 63-year-old billionaire is not the type to dwell, though.

He lost $70B in 2000 when the dotcom bubble burst

But still had the intestinal fortitude to cut a $20m check to a little-known Chinese entrepreneur named Jack Ma. That investment in Alibaba is now worth $100B+, or a 5000x return. #FlexingOnEm

Post-WeWork, Son has shed a ton of assets to make room for more bets. He raised $80B+ in cash by selling stakes in SoftBank’s Japanese telecoms unit, T-Mobile, Alibaba, and the entirety of chip designer ARM.

Some of that money has gone into a massive Big Tech options bet (e.g., $AMZN, $GOOGL) dubbed the “NASDAQ Whale.”

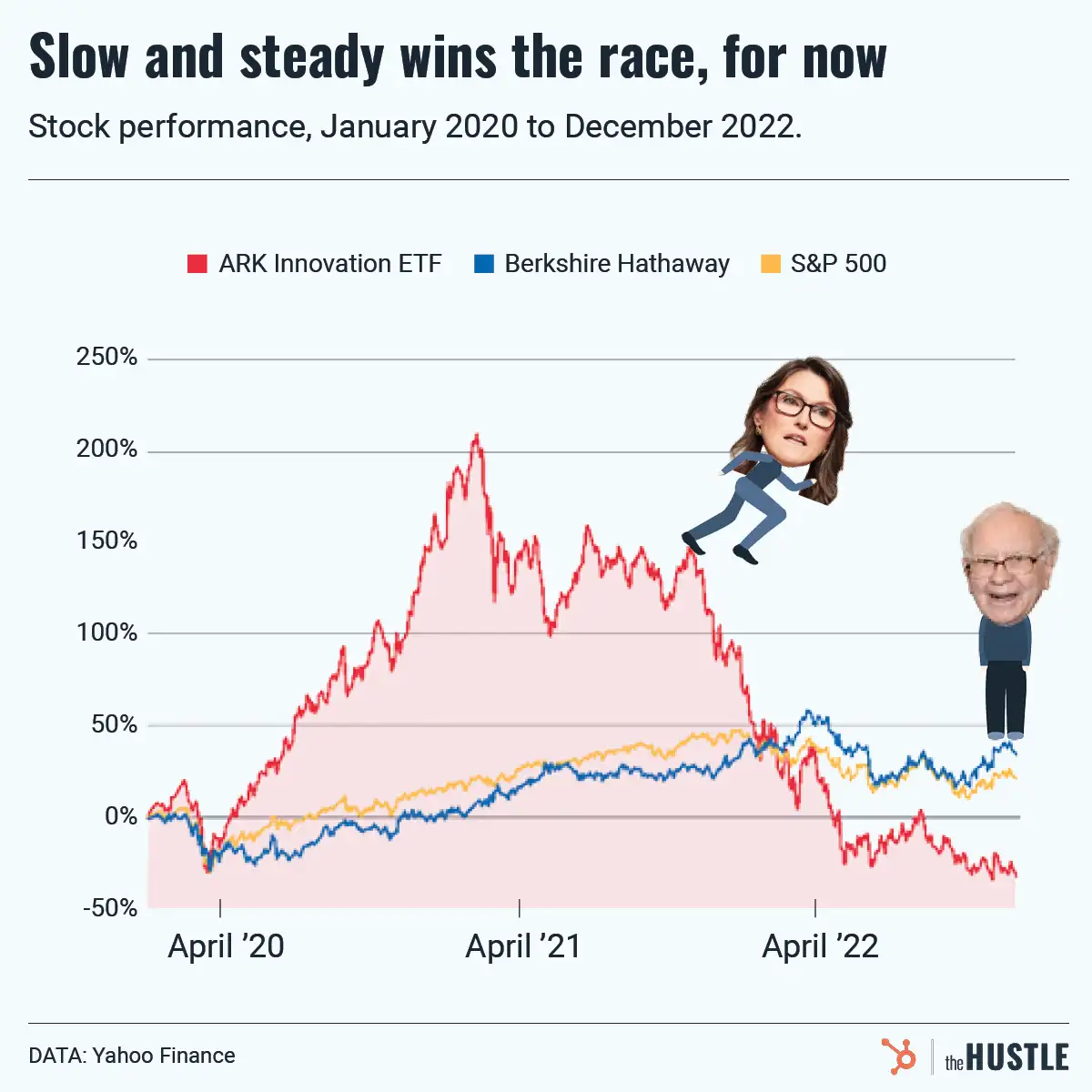

The Vision Fund was in the red but rallied

In the 3 years of its existence the fund is up ~10%, according to The Economist. While the NASDAQ has returned 10x this figure over the same period, some of Son’s bets that have gone public are doing nicely:

- 10X Genomics (an increase of ~11x on invested capital)

- Guardant Health (8.5x)

- Vir Biotech (3.6x)

- Slack and Uber (meh)

The Vision Fund still has stakes in hot startups that are benefiting massively from the post-pandemic digital reality: DoorDash, ByteDance (TikTok parent) and Coupang (South Korea’s Amazon).

SoftBank is raising a SPAC because… why not?

There’s concern that Son could use this popular financing vehicle to bring one of his dud startups to the markets (FYI: if Son SPACs WeWork, we’re shutting down The Hustle).

The Vision Fund has already placed $83B across 92 firms while a second (less famous) Vision Fund has done 13 deals, per The Economist.

In a (maybe) apocryphal fundraising story, Son told Saudi Arabia’s Crown Prince, “give me $100B and I’ll give you $1T.”

Well, Vision Fund 1 is a 12-year investment vehicle, meaning we have 9 years to go… so Masa may very well get the last laugh.