Sitting in the basement of a historic courthouse in Lincoln — a wind-swept town in north central Kansas — Bradley Roberts laughs while comparing his current situation to his previous life in San Francisco.

Roberts was like many people in the Bay Area: Savvy, successful, and drowning in housing expenses. When he bought a house ~15 years ago, he and his partner went $300k over their budget. Rent at his last place in San Francisco was nearly $4k a month.

“It was awful,” Roberts, 50, told The Hustle.

Roberts, whose grandparents were from Lincoln, bought a converted barn home in the middle of town last year for $22k. His annual housing costs in Lincoln are about the same as what his monthly housing costs were in San Francisco.

“When I moved to Kansas,” Roberts said, “I was like, ‘holy shit, they’re giving stuff away.’”

Bradley Roberts started a handyman business and says he “fell in love with Lincoln, again.” (The Hustle)

Roberts is exaggerating, but only slightly.

In Kansas small towns, the houses are cheap, with quality homes going for $100k and fixer-uppers costing far less. Land, a commodity over which NIMBY battles rage throughout the country, can actually be obtained for free in several counties.

The downside to living in rural Kansas, of course, has always been economic opportunity. High-paying jobs don’t grow as easily as the milo.

But price-conscious urban dwellers have been drawn to places they never thought they could live. After a year of soaring real estate prices in every city and suburb, long-depressed and depopulated Kansas is going through a lower-key real estate boom of its own.

“It always used to be the case that we said there’s a big difference between what’s going on in the larger cities and the rural areas,” said Stanley Longhofer, a professor and founding director of the Wichita State University Center for Real Estate. “And the answer now is not as much. It really is kind of across the board.”

Are the Great Plains the greatest option left for an affordable lifestyle? And can small towns reverse the market forces that have long made them financially risky and undesirable?

The boom and bust of the Great Plains

In the mid-1800s, after breaking treaties and forcing the removal of Native Americans, the United States had thousands of miles of land in the middle of the country — and almost no Western settlers wanted to live there.

Then, in 1862, Abraham Lincoln pulled the ultimate Manifest Destiny power move with the Homestead Act.

The government granted individuals 160 acres of free land as long as they lived on and farmed the land for 5 years, enticing Americans to claim 270m acres in states like Kansas, Nebraska, and North Dakota. Free territory was also distributed to railroad companies, which sold their surplus land to new residents at dirt-cheap rates.

Buoyed by the free and inexpensive land, small towns sprung up overnight, often just a few miles from each other. These hyperlocal economies thrived with farming at the center of life.

But in the 1920s, the mechanization of agriculture reduced the need for farm work, and population loss followed. The outflow accelerated in the coming decades as commercial farming operations consolidated family farms and interstate highways took away visitors.

Once-bustling Main Streets are now pockmarked with shuttered buildings, and elder care facilities are often small towns’ top employers.

Vacant storefronts in Lincoln (The Hustle)

Kansas embodies the ups and downs of the Homestead Act as much as anywhere.

- The state boomed from ~100k residents in 1860 to 1.4m in 1890, making it larger than New Jersey.

- But the vast majority of Kansas counties experienced peak population before 1950.

- Farms in the state have declined from 167k in 1920 to 58.3k today, while growing in size from an average of 272 acres to 784 acres.

My own family deserted the Great Plains. My great-grandmother’s parents farmed in Osborne in the early 20th century, but her daughter moved to larger, less-agrarian McPherson, and her daughter, my mother, moved to the Kansas City area.

With dwindling populations, the large number of small towns has turned into a logistical and financial headache. Many of Kansas’s sparsely populated 104 counties and 627 incorporated municipalities (compare that to 58 counties and 482 municipalities in 13x larger California) struggle to pay for government services, recruit civic leaders, and hold onto businesses, health care, and schools.

Towns can’t survive without enough people, and people are hard to recruit when the local economies are in shambles. So to attract newcomers, towns have attempted a dizzying array of stunts and initiatives.

One of the most influential was a modern remix of the Homestead Act by Marquette. To save its school and stanch its population loss in 2003, Marquette’s leaders offered ~60 free lots for anyone willing to move in and build a house.

A Hutchinson News story picked up by the Associated Press led to a national media sensation, culminating in a visit from “CBS Evening News.”

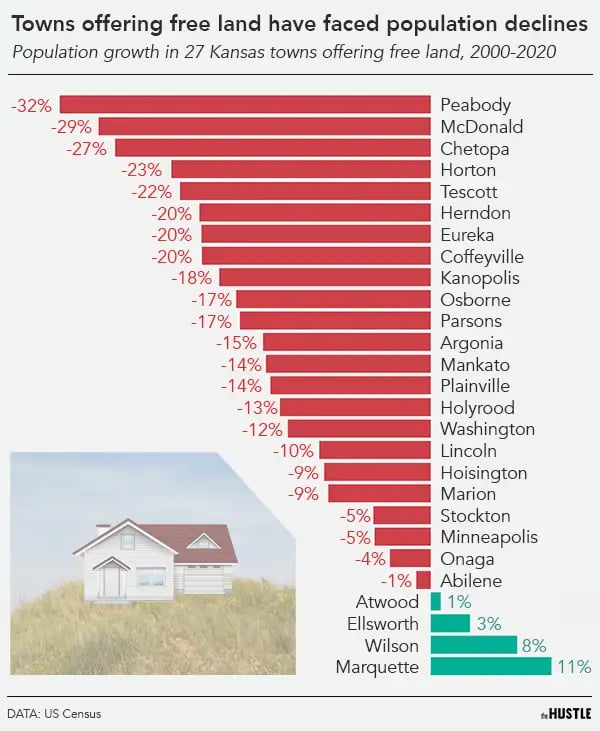

At least 27 Kansas towns have enacted free land programs since the late 1990s. Only a few have had success.

The Hustle

Even in Marquette the population rose for about 10 years before falling again, and its elementary school was only temporarily saved, closing in 2014. Roughly 20 lots are still available.

Why can’t Kansas give away land?

It’s because the rural areas’ biggest strength — cheap real estate — has also been a weakness.

Free but flawed

On a cold day last November, Lincoln County Economic Development Foundation director Kelly Gourley drove me to the east side of the town, where an asphalt cul de sac backed into a sea of yellowing grass.

Lincoln (pop. 1.2k) is not overly small for rural Kansas. It has a theater, a high school that ranks among the top 25% in the state, and even a luxurious Airbnb in a downtown loft. But the population has fallen by 25% since 1980, and numerous storefronts are boarded up on the main drag. A coffee shop below the Airbnb closed just a few weeks before my trip.

The grass on the east side is another sign of frustration. It was supposed to be covered by homes, symbolizing a Lincoln repopulated by the free land program. But only 2 of 21 lots have been developed, one by a former mayor and another that functioned as a spec home.

Gourley, who started her job after the program was enacted, explains why a free giveaway can still be a questionable deal.

- A new house would cost ~$100k-$200k to build but is likely to sell for less, given the low real estate prices.

- Buyers also struggle to get homes appraised at the cost of construction and sometimes need to cover the difference out of pocket.

Kelly Gourley stands near the lots Lincoln can’t give away. It doesn’t help that a nearby creek means some are in a floodplain (The Hustle)

Lincoln has shifted to prioritize its inexpensive existing housing stock, a strategy that has its own drawbacks. Similar to many Kansas towns, ~30% of Lincoln’s houses require significant repair or outright demolition.

Given how this shortage of good homes and economic risk for new construction scares off people who would even want to move to rural Kansas, it’s easy to see why towns have sunk in a downward spiral.

But the insane real estate prices that have challenged the rest of the country have led to a spark in interest.

Building up supply

Priscilla Frankenstein loved the views in Whitehall, Montana, pop. 1k. On clear days, she could see peaks and snow in almost every direction.

But after moving in 2019 from California and opening a restaurant, Frankie’s, with her husband, Charles, prices got too high as the rapid growth in nearby Bozeman spread to smaller towns. Their landlord hiked their rent, and they were asked to pay $320k to buy the building where Frankie’s was located.

Seeking an affordable alternative, they moved to Lincoln in January and found a much cheaper building for a restaurant. They also bought a house that’s big enough for their family of 5 for $70k.

In Lincoln, houses that used to sit on the market for a year were selling within weeks in 2021, Gourley said. She can’t recall ever having fewer houses available after more than 30 were sold each year in Lincoln County in 2019, 2020, and 2021, up from 14 in 2018, per Lincoln County statistics.

Other rural Kansas counties experienced the same rush. MLS data of 15 small counties across the state showed 2021 housing sales up 11% from 2019, and median time on the market last summer was ~33% lower than in 2019.

Downtown Lincoln, Kansas (Wikimedia)

“We’ve seen a lot of people coming back to rural communities because the cost of living is lower and because there’s a quieter, calmer lifestyle here,” said Betsy Wearing, coordinator of programs at the Kansas-based Dane G. Hansen Foundation.

The momentum has led to a new challenge: preparing the housing market to meet the demand.

Economic development corporations are scouring for grants to pay for demolition and rehabilitation costs, as well as payments that bridge the difference between the cost of new housing and the amount a bank will cover for a mortgage.

In Lincoln, Gourley secured $150k in grant money late last year to help prospective buyers rehab 5 chronically vacant houses.

Residents have also gotten involved in renovations. Vicki Hook, a native of nearby Beverly, moved back to Kansas from Florida and bought a 2nd home as an investment. She paid $7.5k, put in ~$60k in repairs, and hopes to sell it for $85k+.

Vicki Hook, left, returned to Lincoln after decades away. Pam Morgan moved to Lincoln from Kansas City not long after a chance side trip in central Kansas. (The Hustle)

In crowded housing markets in large cities, house flipping is often viewed as a driver of inequality.

That’s not a major concern yet in Lincoln, given the sheer quantity of neglected homes and the lack of outside speculators. But the lower incomes in Kansas small towns mean greater sensitivity to increasing costs, even for prices that look cheap to people on the coasts.

While Charles Frankenstein doesn’t want Lincoln prices escalating as high as in Whitehall, he expects property values to increase.

“We look at Lincoln as a place we’re moving to and investing into,” he said, “and we want to watch it grow and be on the ground floor of it as it grows.”

Making a living on the Plains

Eric and Emily Wolgamot had all but given up on homeownership before they found Lincoln.

In the last few years, they moved out of California, where Emily Wolgamot struggled to pay $1.2k in monthly rent on a telemarketer’s salary in San Diego, to Seligman, a tourist town outside Flagstaff.

The cost was manageable — $400 a month for a plot in a trailer park — but they needed a larger space for them and their 3 kids, and yet taking the next step seemed impossible.

They saw off-grid 3-bedroom houses listed at $150k. Houses with basic necessities, like plumbing, were going as high as $500k.

“And I kind of wanted to turn on a faucet,” Wolgamot said.

She and Eric started searching online for houses across the country. Lincoln had the best deal: 2 vacant houses for a combined $5.5k. They paid cash and now only owe taxes, which run ~$150 a month.

Since moving in spring 2020, Eric has rehabbed their homes while starting his own tree trimming and junk removal business. The work is far different from the service-industry jobs they had in California and Arizona, but they say it has been enough to provide for their family, given the low cost of housing.

Eric and Emily Wolgamot bought two vacant homes in Lincoln for $5.5k (The Hustle)

Entrepreneurship is encouraged for newcomers to Lincoln.

A website advertising the town lists new or transitioning opportunities for restaurateurs, contractors, accountants, attorneys, and veterinarians. Gourley has plans to open a gym. Roberts, the San Francisco transplant, started a handiwork business.

Life isn’t the same as in the Bay Area, where he owned a flower business and drove a Mercedes. But last fall, while visiting a friend in Palm Springs who was barely scraping enough money to afford a mortgage, Roberts realized the advantages of rural Kansas.

“I feel fortunate to be here because now I’m back to where I feel comfortable,” he said.

That isn’t to say Lincoln doesn’t have its drawbacks. The diminished, aging population makes it hard to grow business. This is one reason why Gourley wants to recruit remote workers, who can increase the need for services while not being dependent on the local economy for their earnings.

Reliance on the local economic base is still a significant risk.

Dil Darjee, a Bhutanese refugee, moved with his family from St. George, Utah, and opened the Post Rock Motel & Restaurant in 2020. Lincoln was one of the few places he found a business opportunity he could afford.

The motel has drawn rave reviews online for cleanliness and professionalism, and his restaurant serves a range of Himalayan and American cuisine. But that’s not enough to guarantee success. Although his revenues had picked up during hunting season in November, he said he struggled to cover his expenses in the summer months.

“I’m hoping for better days,” he said.

The narrowing gap between urban and rural

After my conversation with Darjee, I drove back to the Kansas City area.

The next day I enjoyed the various things people enjoy in bigger cities: going to a coffee shop, watching live jazz at a bar. I’m fortunate to have enough stability to afford increasingly expensive urban life, and I prefer hustle and bustle over calm and quiet.

Somewhere between Marquette and Lincoln (The Hustle)

Besides an urban area’s multitude of options and luxuries, there are more pressing needs rural Kansas does not meet. Anybody who doesn’t drive would have extreme difficulty getting around, and people who want racial and cultural diversity will not find it (small towns in north central and northwest Kansas are usually 90%+ white). Child care is also hard to come by, although nonprofits have begun incentivizing it.

This lack of amenities, coupled with the shortage of quality housing, are why Longhofer, the Wichita State professor, does not expect rural Kansas towns to find lasting salvation from recent real estate trends.

“These have been issues that are not new with the pandemic. They’ve been long term,” Longhofer said. “And so often we want to come up with this magic amulet that’s going to fix all the problems, and it’s just a challenge for small-town America.”

Yet people who need to move may find life in the city and life on the Plains is more similar than ever. The Wi-Fi is still fast in towns like Lincoln, the same shows are still on Netflix, and Amazon packages still come to your door. The communities are small, but friendly.

And it’s so, so much cheaper.

During my visit, Gourley showed me the ultimate real estate bargain: an olive-green Dutch Colonial house with, an ad states, “enough woodwork to cause anyone to swoon.” It’s a fixer-upper but not beyond repair.

The free fixer-upper in Lincoln (The Hustle)

The price tag: $0.00.

The only catch is the house must be moved. But the free lots are just down the street. A buyer could put the free house on a free lot.

There’s more: One of the grants Gourley secured can be used on the house, meaning income-eligible buyers could get $30k to spend on renovations.

As of last week, the house was still available. It could be yours, if you’re willing to have someone pay you to take it.

Update (2/1/22): The Hustle added some language to more clearly explain that the events surrounding the Homestead Act included the displacement of Native Americans who had inhabited Midwestern land for centuries.