This tax change would reshape the entire real estate industry

President Biden wants to eliminate 1031 exchanges, which allow real estate investors to defer gains on property deals.

Published:

Updated:

Related Articles

-

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Millions of Americans retired early. Now they want to work again

-

The Dow index got a makeover. What does it mean?

-

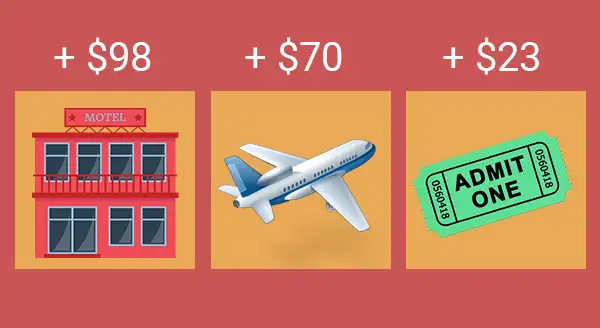

Junk fees, explained

-

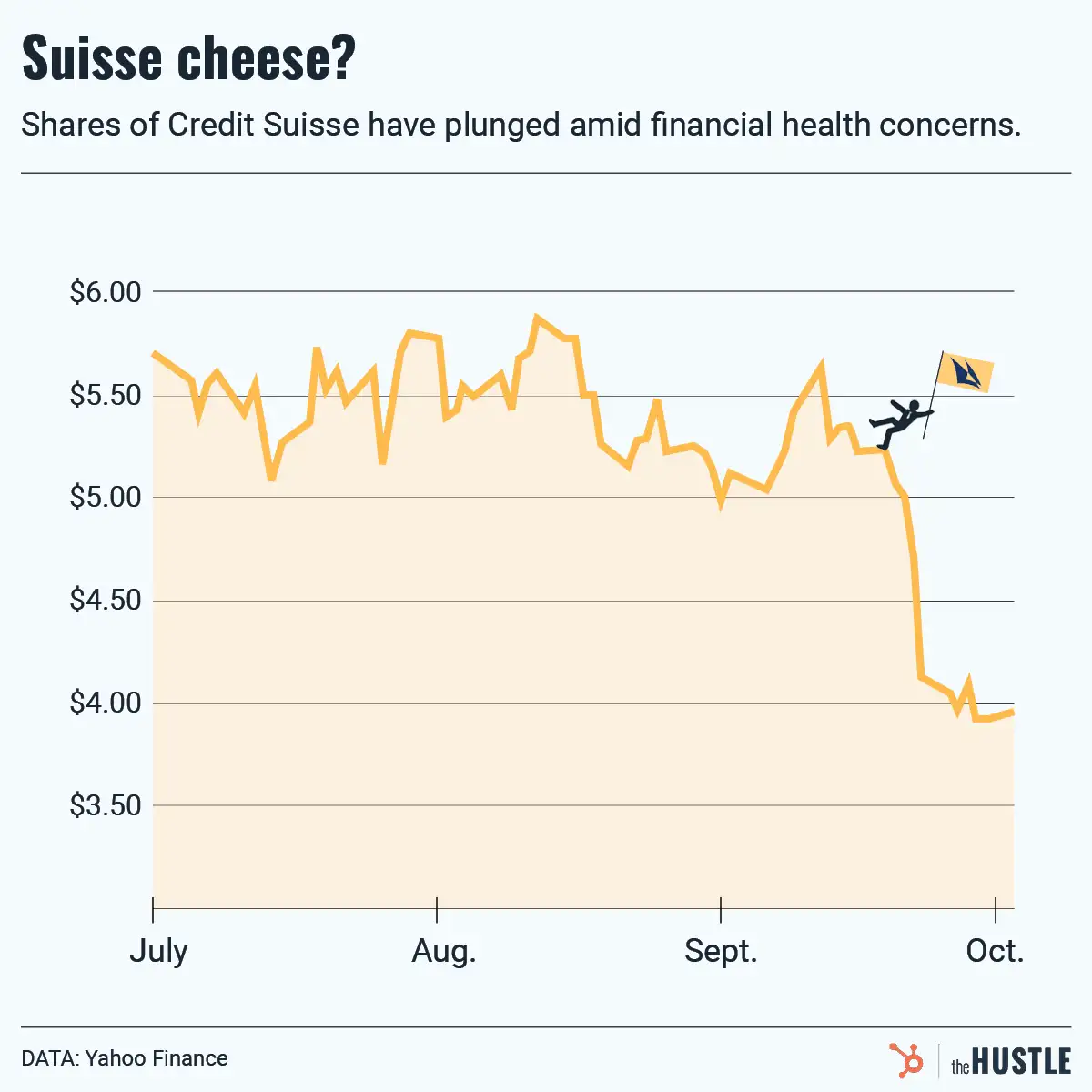

Not those credit default swaps again…

-

People are opening up about their finances… on the street

-

Interchange fees, explained

-

Are we caught in a ‘bear market trap’?

-

Digits: Crypto ads, Kilimanjaro, and more