The Dow index got a makeover. What does it mean?

The Dow index had its biggest reshuffle in years. With Salesforce in and Exxon out, what does this all mean?

Published:

Updated:

Related Articles

-

-

A bunch of young Americans are living on their parents’ tab

-

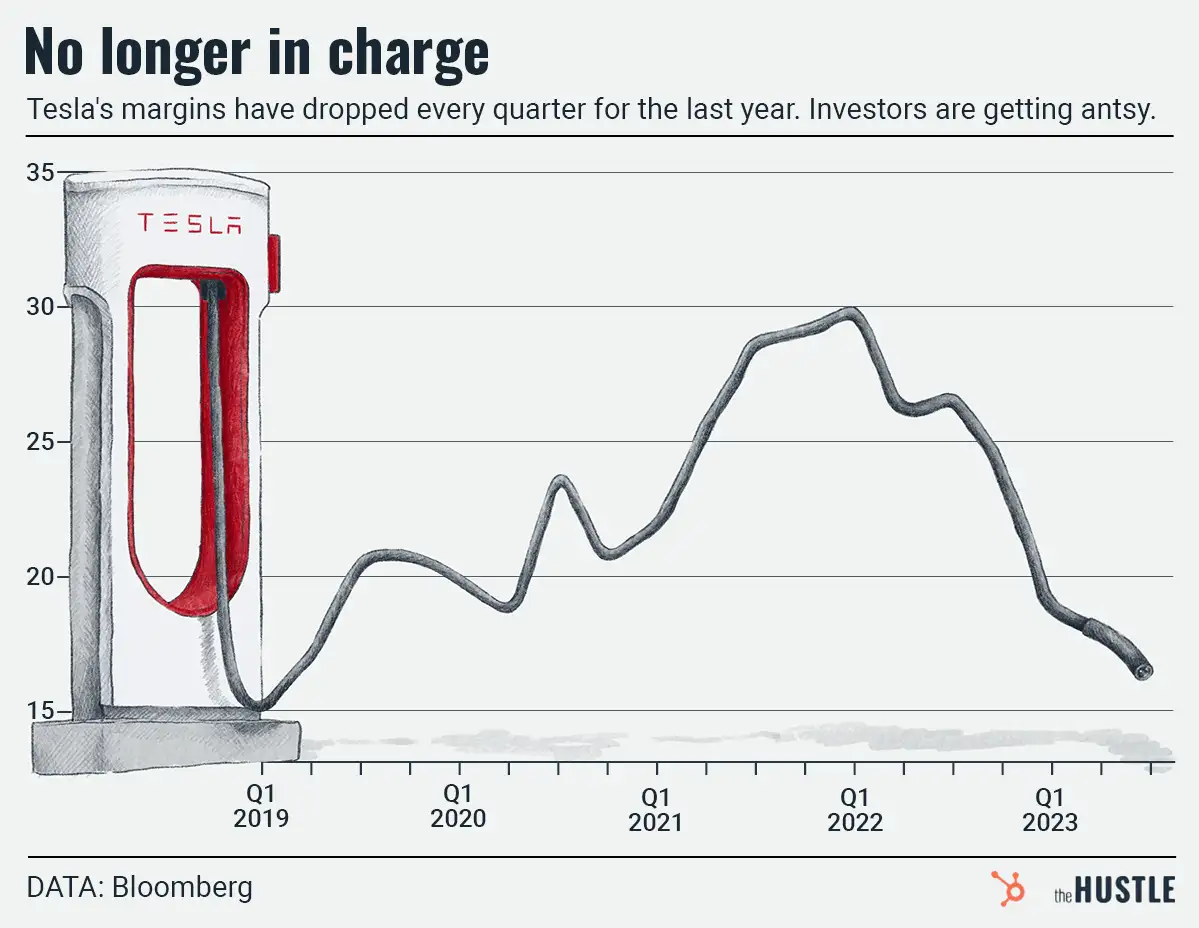

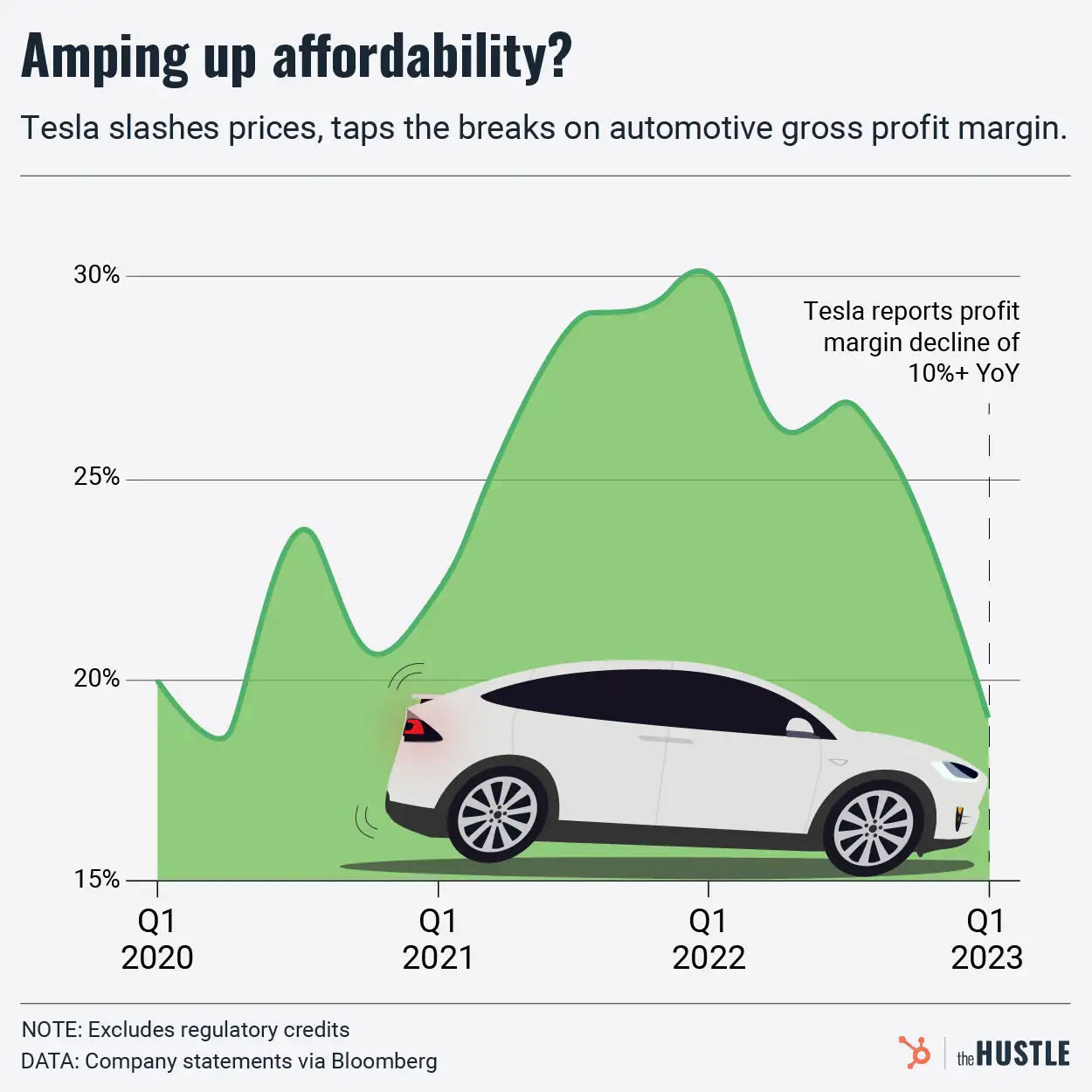

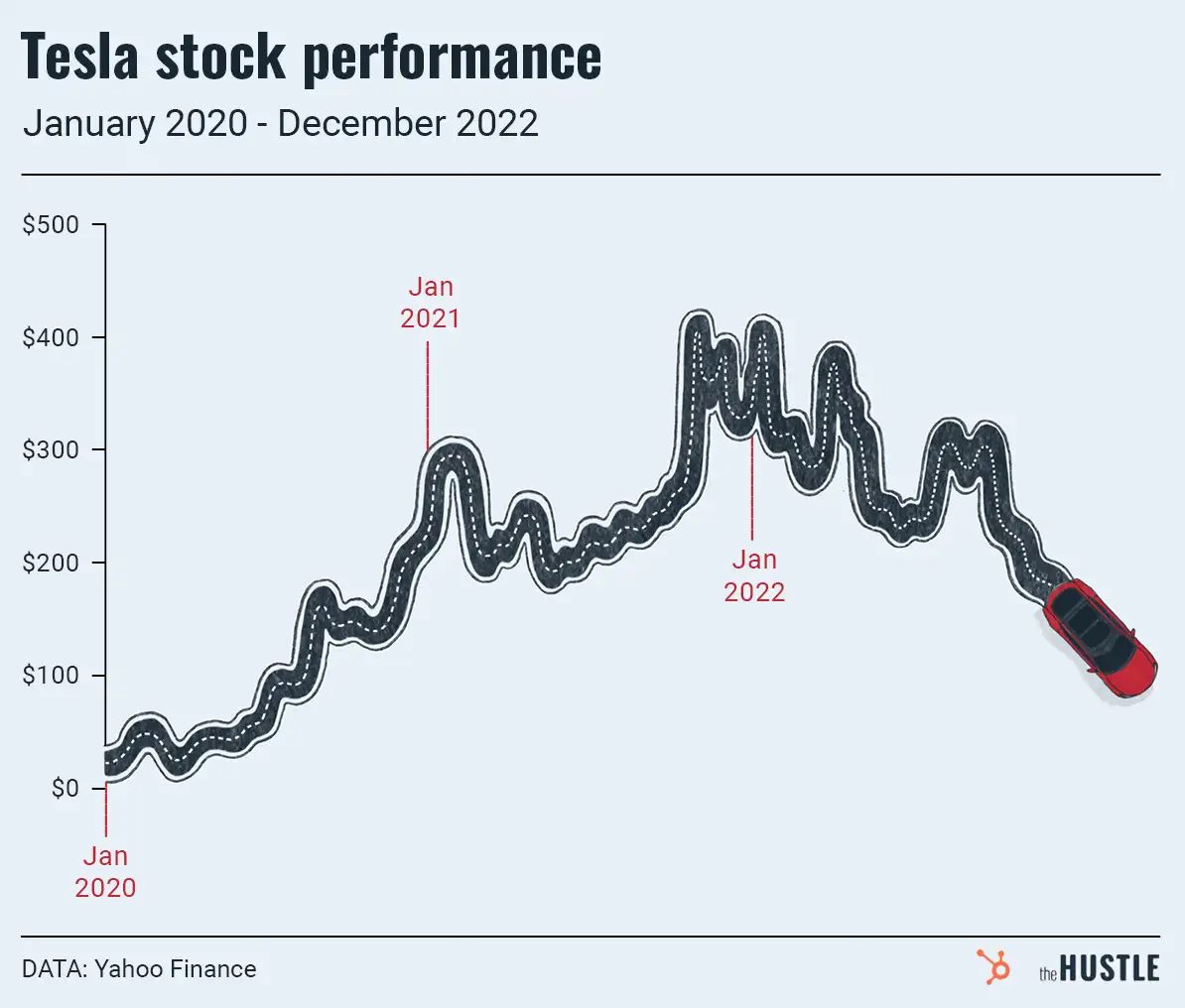

Tesla is struggling, and the outlook for improvement isn’t thrilling anyone either

-

Move over, stocks — alternative investing apps are here

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Tesla charges ahead with lower prices, sacrificing profits and shocking rivals

-

Fractional investing is making everyone a landlord… kinda

-

A tense situation at the happiest place on earth

-

Tesla’s not-as-epic-as-expected end to the year

-

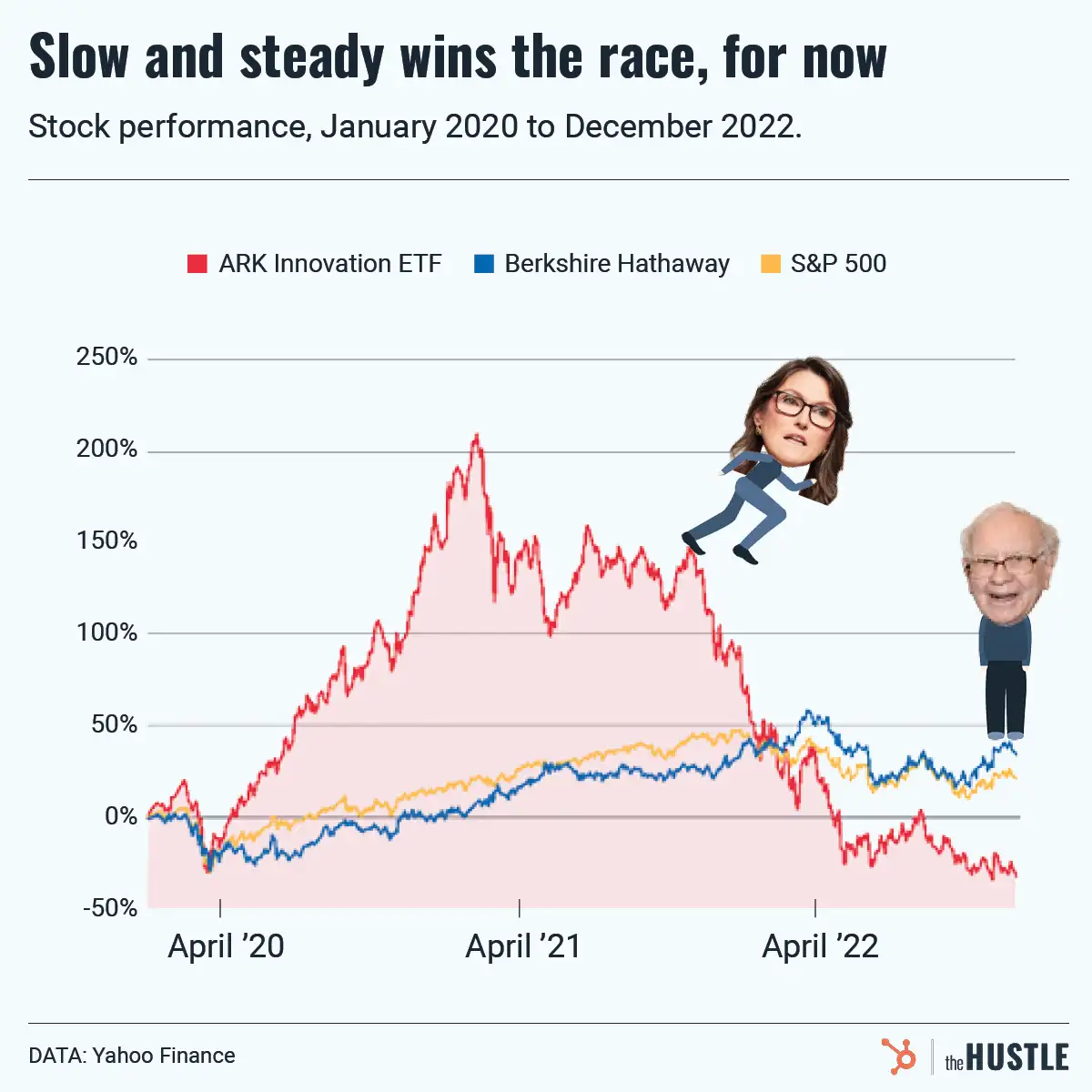

Cathie Wood’s bold bets have yet to pay off