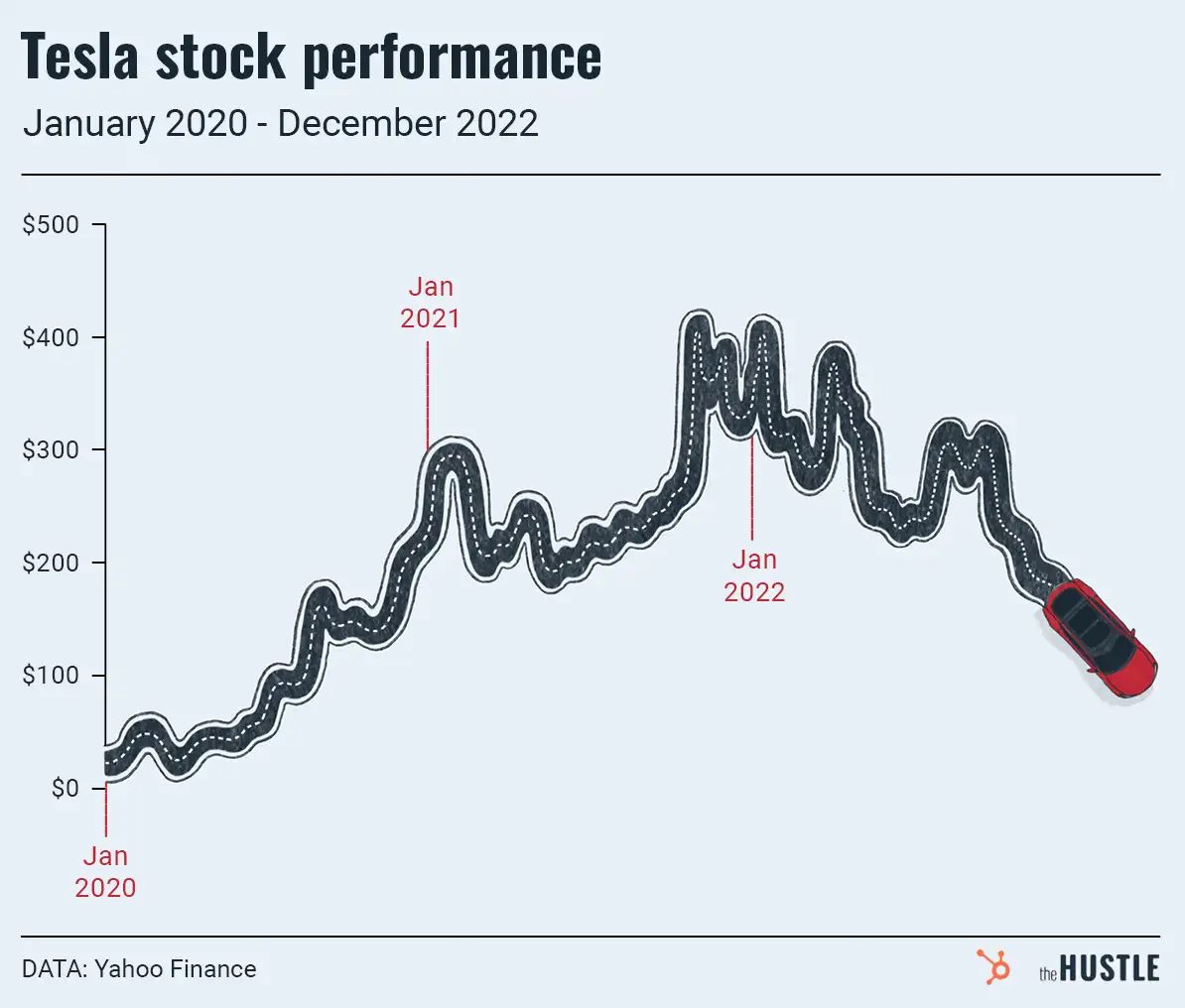

Over a year ago, Cathie Wood — founder of asset manager ARK Invest — said that Tesla could be a $1.4T company, including an autonomous Tesla taxi fleet worth $1T on its own.

According to Forbes, this wild prediction brought on ridicule from seasoned Wall Street voices. (TBH, it sounded a bit cray.)

At the time, $TSLA’s market cap was hovering around $40B. Well, Musk Daddy’s EV maker is currently worth $386B — and Wood is laughing at the haters.

Betting big on innovation

Ark Invest’s key product is its thematic ETF offerings.

According to ETF Database, Ark has the top 5 performing ETFs over the past 12 months, including:

- ARK Genomic Revolution (ARKG), which includes Invitae (genetic testing) and CRISPR Therapeutics (gene editing)… up +101% this year

- ARK Next Gen Internet (ARKW), which includes Tesla (a meme factory disguised as a car company) and Roku (streaming)… up +95%

- ARK Fintech (ARKF), which includes Square (payments) and Mercadolibre (Latin America ecommerce)… up +71%

“Coronavirus has catapulted our innovative platforms into high gear,” Wood tells Forbes.

ARK Invest is not like other Wall Street firms

It makes all of its research available on its website and keeps a real-time log of its trades.

The firm’s hiring practices are also atypical.

While the Goldmans of the world hire MBAs, ARK targets talent with specific industry expertise (e.g., molecular engineering) and empowers them to identify the next hot trends.

The firm’s growth has been explosive

Since the end of 2016, ARK has seen a nearly 100x increase in its assets under management (AUM) — from $307m to $29B.

Forbes estimates that — based on management fees — Wood’s personal wealth from ARK totals $250m, an impressive feat considering that, in the early years, she had to dig into her savings to keep things afloat.

What’s next?

More cowbell innovation.

Analysis from Hardfork shows ARK has recently increased its portfolio weightings in Slack, Teladoc, Taiwan Semiconductors, and — drumroll — Tesla!

***

Disclosure: The author has taken a long position in an ARK ETF ($ARKF) after the publication of this article.