There have been a number of high-profile public listings this fall: Asana, Palantir, Snowflake, Unity Software.

Delivery app DoorDash is joining the fray and there’s probably a 100% chance you’ve used this service more than all those other companies combined.

In honor of the 5x we ordered The Cheesecake Factory from DoorDash over the weekend, here are 5 things you need to know about the upcoming IPO (via Protocol):

1. The pandemic has (predictably) juiced business

Through the first 9 months of 2020, DoorDash’s 18m customers have spent $16B which translates to revenue of $1.9B, up 226% YoY.

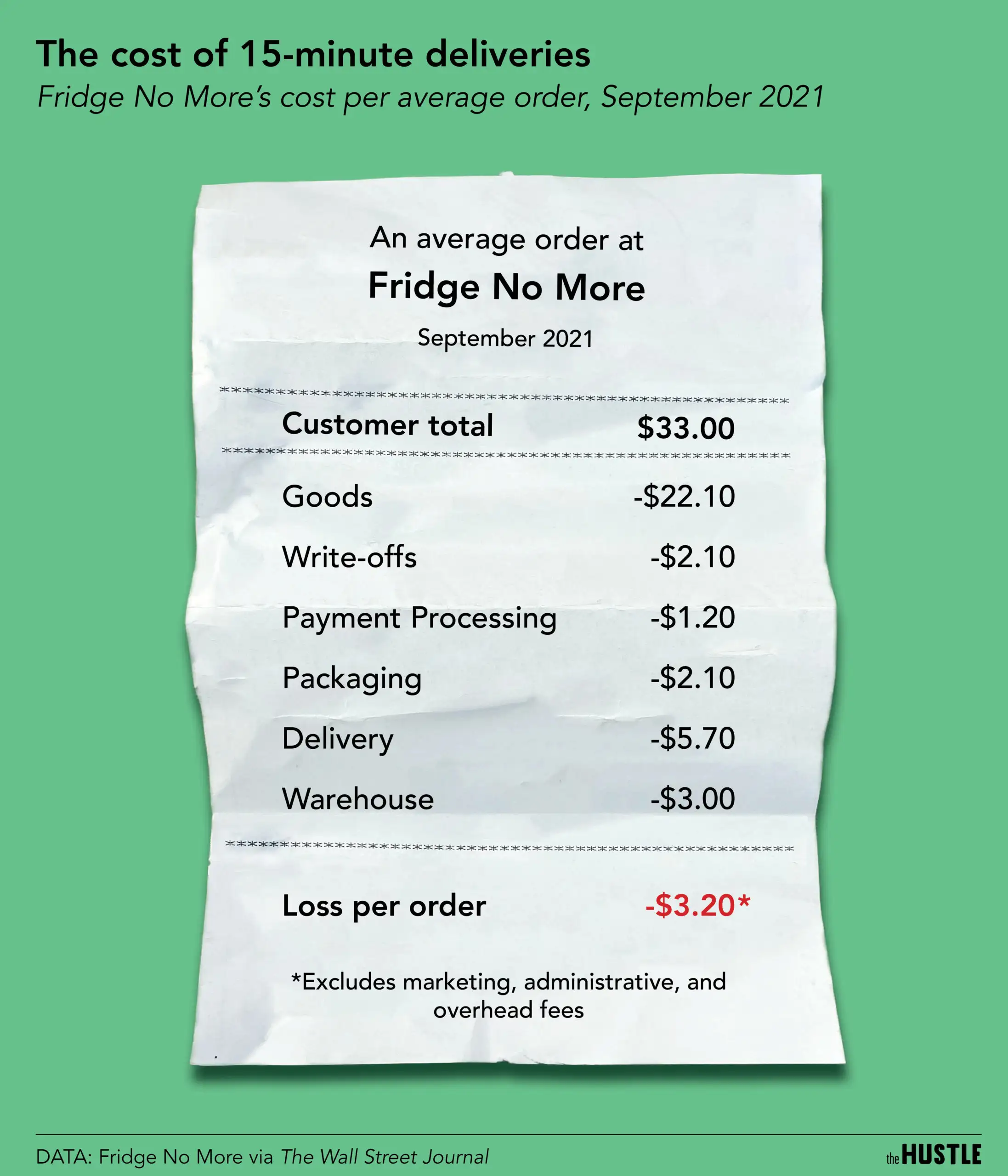

2. DoorDash is still losing money though… but it’s getting better

Because of heavy sales and marketing expenses, DoorDash lost $149m on the $1.9B of revenue… this is an improvement over the $534m it lost through the same period in 2019. (It even made a 3% profit in Q2 2020… a first).

3. The startup wants to do more than food

DoorDash wants to “grow and empower local economies” by providing a suite of services: marketing and analytics tools, and delivery subscription services.

Critics may balk at this vision, particularly after DoorDash joined Uber and Lyft to help pass Prop 22, which keeps gig workers on contractor status.

4. DoorDash has A LOT of risks

Its S1 filing has more than 50 pages covering risk factors; some of the most notable:

- Food delivery is insanely competitive (Uber Eats, GrubHub, Domino’s etc.) and there is no guarantee that the business can achieve long-term profitability.

- Labor is a challenge. Even with its Prop 22 win, a new wage floor puts pressure on DoorDash’s margins.

- The COVID-19 business bump is a one-and-done.

5. MASAYOSHI SON!!

Out of the WeWork wreckage, Japanese billionaire Masayoshi Son has made a comeback in 2020. At its present valuation of $16B, DoorDash would be a ~5x return for Son ($680m investment → $3.5B stake).

The co-founders’ combined stake — Stanford classmates Tony Xu (CEO), Andy Fang (CTO), and Stanley Tang (CPO) — is worth $2.3B. 🤯