Netflix announced another $2B in debt financing, the 6th time in 4 years the company is taking out more than $1B in debt.

The company is on track to add 27.4m subscribers this year (a feat that took HBO 40 years) — but to do it, Netflix expects to hit $3B in negative cash flow.

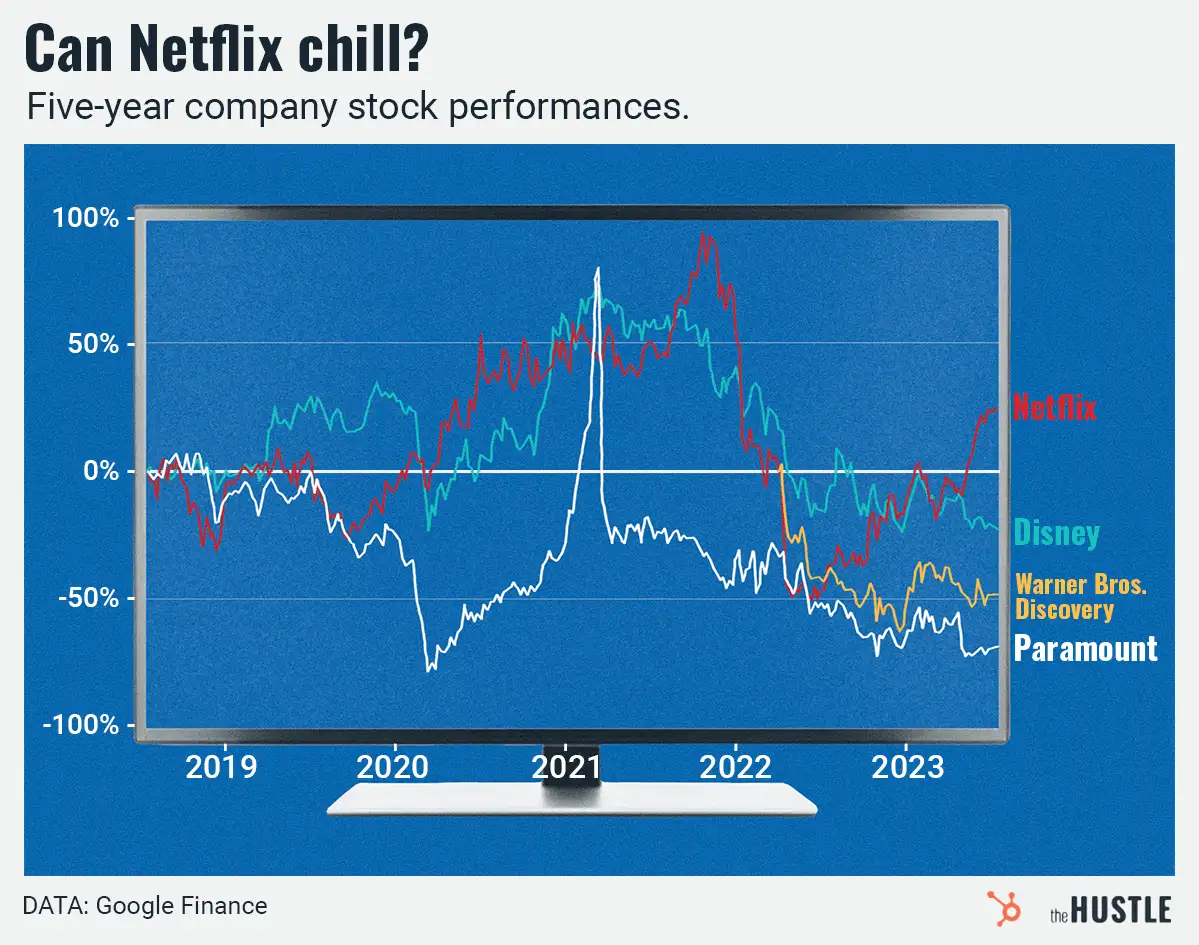

The Barons of Binge

Netflix is the most popular TV platform for 39.7% of TV watchers, twice as many as YouTube (17%), and 3x as many as cable (12.6%).

How’d they do it? By building a business out of binge-watching, attracting viewers through convenient distribution, and keeping them there with original content. But now, competitors from both sides of the stream (WarnerMedia, Disney/Fox, Apple, and Amazon to name a few) are starting to paddle upriver to catch Netflix.

Big growth requires big debt

Netflix plans to spend $8B on content this year to stay ahead of the competition, which explains why it needs to keep so much cash around.

This content spending has left Netflix with $18.6B in financial obligations — but also enabled it to stay on top after Disney left to start its own streaming platform and took its content with it.

Now, Netflix is focused on maintaining growth: Analysts think it can expand from 137m subscribers to 200m by 2020 — if it taps the global market. Hopefully, Netflix’s 80 foreign-language productions this year will do the trick.