iDebt: Apple partners with Goldman on new mobile credit card

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

What’s next for Apple Vision Pro?

-

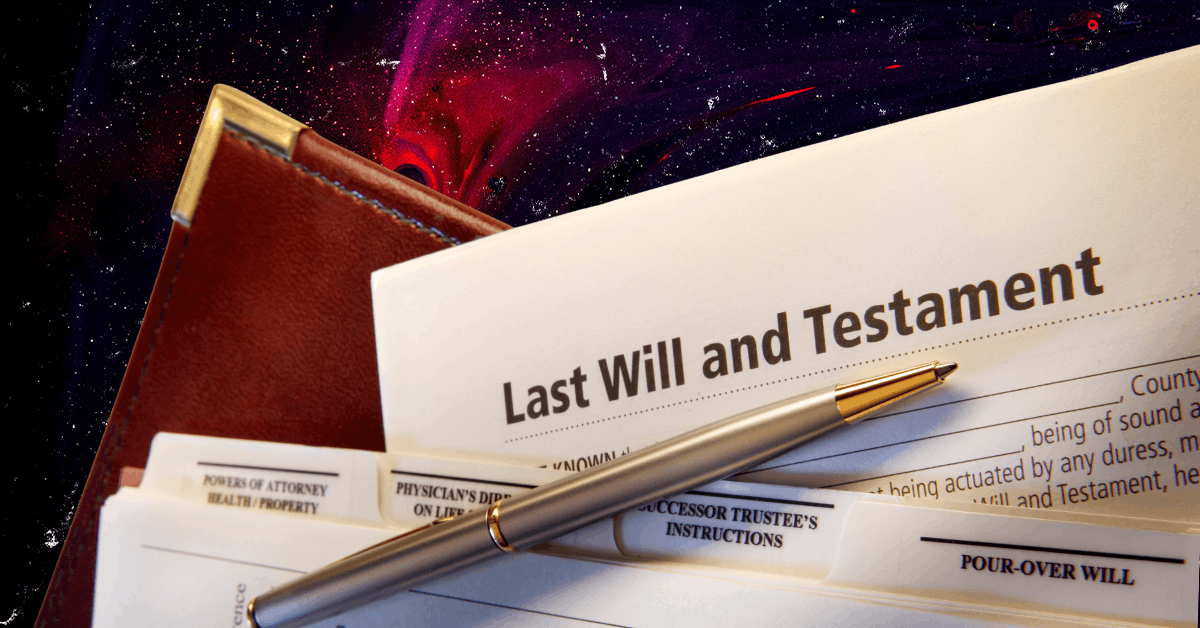

Move over, stocks — alternative investing apps are here

-

Apple vs. apples

-

Mac made a big change for gamers

-

Why Apple is betting big on Vision Pro: Because it can

-

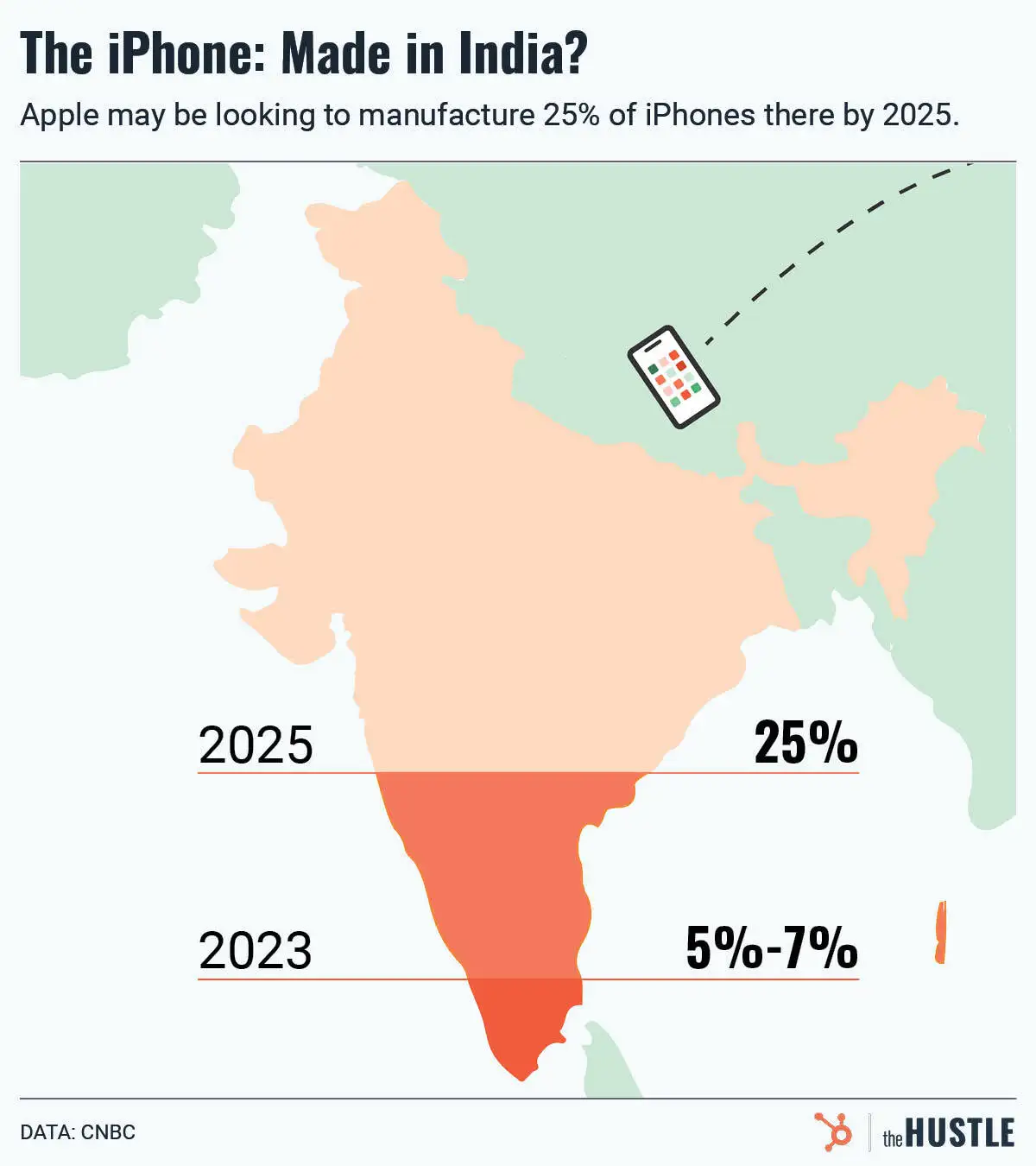

Is India Apple’s next frontier?

-

Apple’s big changes, courtesy of the EU

-

Why Apple store workers are unionizing

-

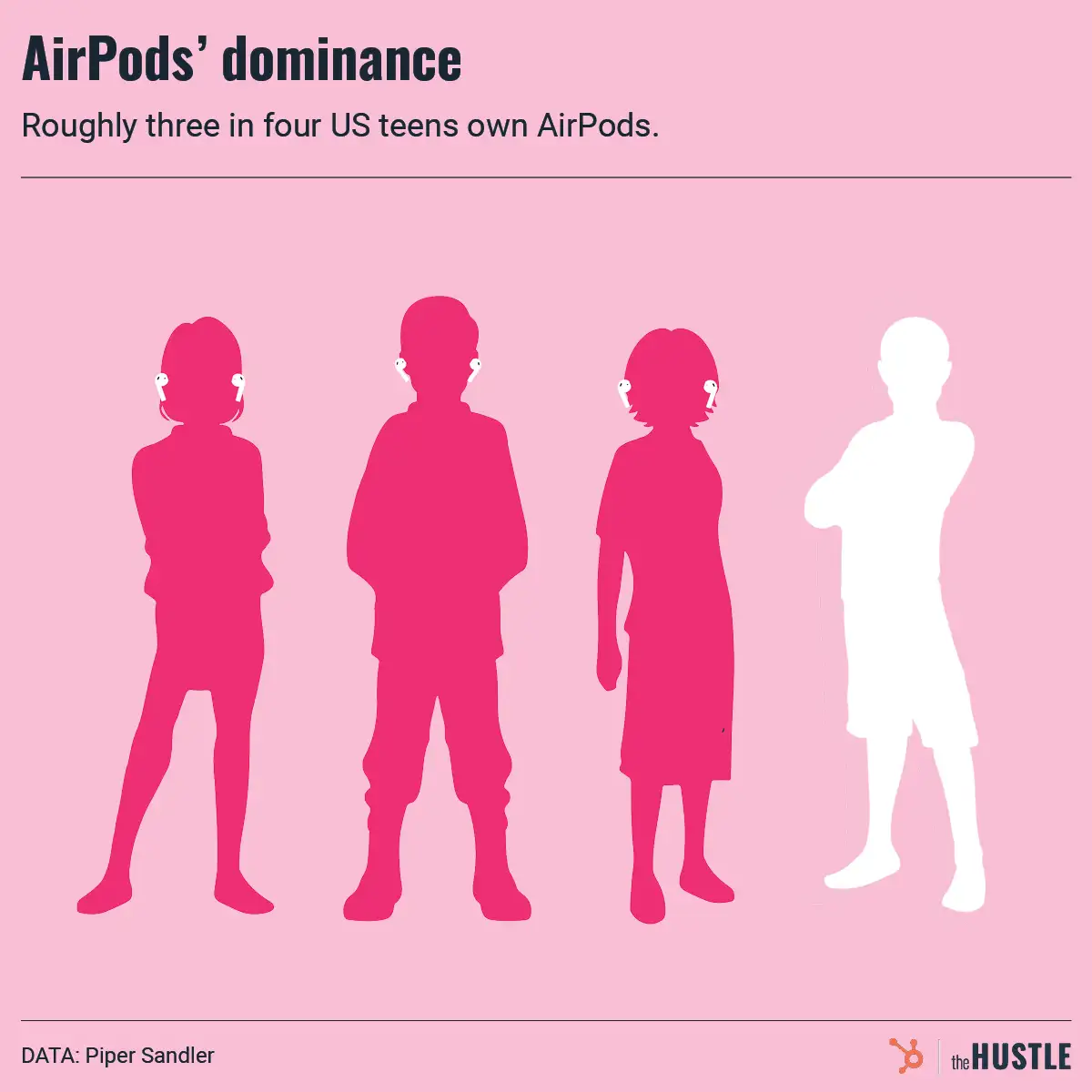

What AirPods say about the future of Apple