Clearco co-founders: Andrew D’Souza (L) and Michele Romanow (R)

***

Here is a stylized framework for how a new business can raise funds:

- Debt: You borrow money from a lender but have to give a personal guarantee and lien on your assets. In the event your business fails and you can’t repay the loan, you declare bankruptcy. (Risk weighted to borrower)

- Equity: You sell a % of your business to an investor. If the business fails, you don’t “owe” the investor anymore money. But if the business succeeds, that equity can end up being very expensive. (Risk weighted to investor)

As a new founder, there are clear trade-offs between these funding options.

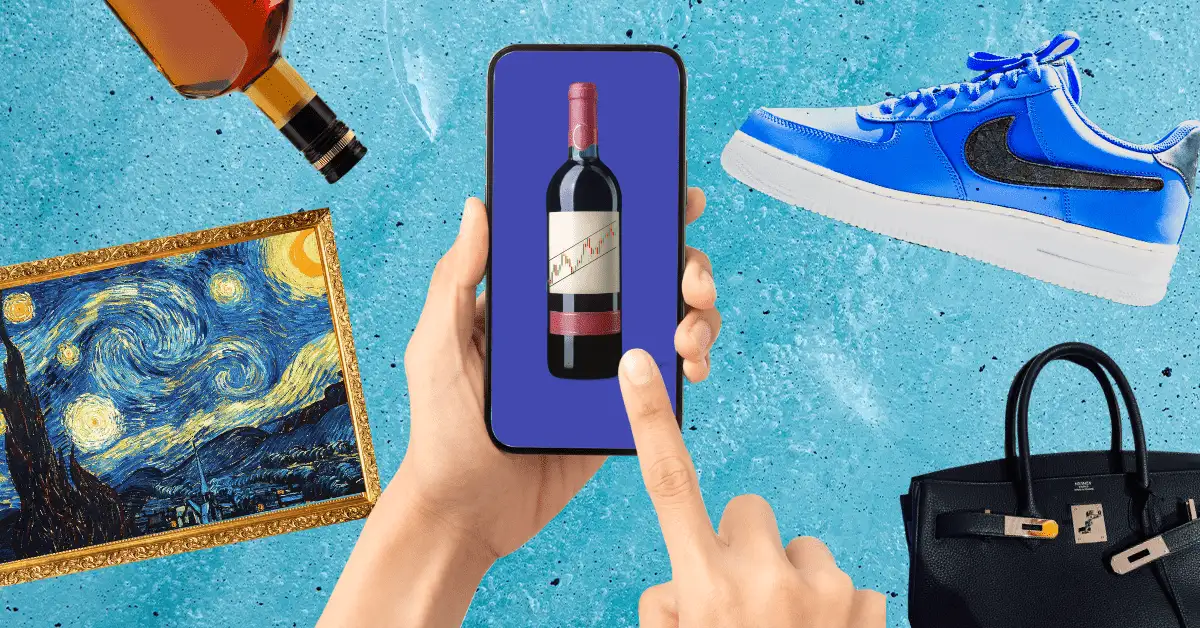

In 2015, Clearco — an Ontario-based startup previously named Clearbanc — created another funding model for the internet age. With an abundance of data and AI-powered analytics, the startup unveiled the revenue-share agreement (RSA).

Initially, Clearco targeted ecommerce businesses with the model.

Think of a direct-to-consumer (DTC) mattress startup. You acquire customers for $X using Facebook and Google ads and have an expected lifetime value of $Y.

Clearco will invest funds — from $10k to $10m — for you to spend on ads. In return, Clearco plugs into your payment system and takes a percentage of sales until it recoups the investment + 6% (however long that takes).

Unlike lengthy bank or VC negotiations, the Clearco application process takes 20 minutes and it doesn’t ask for a credit check, personal guarantee, board seat or fixed payment timeline.

Further, there is no risk of ruin (like with debt) and the funding is non-dilutive (like with equity).

To date, Clearco has used the RSA model to deploy $2B+ across 4.5k+ businesses.

There’s more to come: yesterday, Clearco officially rebranded from its previous name (Clearbanc) and also announced a $100m funding round (at a $2B valuation).

These changes come as Clearco pursues a number of new opportunities:

- ClearInventory Capital: Clearco will fund inventory and take a % of sales until it is paid back + 6%.

- ClearRunway for SaaS Founders: Clearco offers up to 24 months of funding for SAAS companies to cover operating expenses (“runway costs”).

- ClearValuation: A platform that provides a free valuation tool for founders and access to a network for potential M&A deals.

- ClearAngel: A program for early stage founders that have as little as $2k of monthly revenue.

The Hustle recently spoke with Clearco’s co-founders Andrew D’Souza and Michele Romanow to find out more:

***

Data-driven model funds more diverse founders

“When we started, we knew there were a lot of barriers to entry in the venture industry,” the Clearco team tells us. “There are so many incredible founders that don’t have the ‘right’ background or network to get funded.”

By creating a model that focuses on data (e.g., what are the unit economics of an ecommerce business), Clearco has deployed money across a more diverse set of founders than the traditional VC industry:

- It funds female-led startups at 8x the rate of the broader VC industry

- Black and LatinX founders make up 13% of funding (vs. 2.6% for VCs)

“We’ve deployed $2B+ since our founding,” the co-founders note. “Compare that to a traditional VC fund that might deploy $1B over 8 years.”

The rebrand reflects larger ambitions

As “Clearbanc”, the startup successfully built the revenue-share agreement model for ecommerce as well as mobile gaming and software-as-a-service (SAAS) firms.

Now, Clearco wants to use its data, AI tools and broader network to help companies it invests in.

Per D’Souza and Romanow, Clearco can leverage data to tell companies it funds where to spend ad dollars (e.g., Instagram vs. TikTok) or how much inventory they should take on (which Clearco can also finance).

The team is also launching ClearAngel, an early stage incubator dubbed “Y Combinator for the 99%.”

“Not every business is headed towards a multi-billion dollar venture exit,” says D’Souza. “ClearAngel is a way for us to transfer the startup building playbook for non-venture types of businesses and help them succeed.”

The program includes revenue share agreements, mentorship, access to Clearco’s network and more.

What type of companies is Clearco right for?

When asked if Clearco’s terms might be perceived as “expensive” for some businesses, D’Souza and Romanow note the trade-offs for all funding sources.

“There’s a continuum from equity to debt,” they say. “If you’re 100% sure your business will succeed, you should use debt and lever up. Uncertainty exists, though. And we are offering something in the middle, which is dependent on people’s risk appetite and how much ownership they want to give up.”

Clearbanc pioneered a new asset class and the team is happy for competition if it means more people get funded. Ultimately, they say, Clearco is in it to help founders (the startup’s motto is “By Founders, For Founders”).

“Our biggest concern isn’t competition,” D’Souza says. “Our biggest concern and risk is not having the right talent at our company. We are focused on keeping an entrepreneurial culture and supporting the founders we fund.”