Meet Agora, the company powering Clubhouse

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Know a lot of people? Turn it into a side hustle

-

Eyewear innovations are coming into focus

-

The third space that isn’t a place

-

Looking for Gen Z? Check the group chat

-

An AI experiment made a surprisingly pleasant Twitter

-

Can Discord clean up the internet’s criminal justice system?

-

Threads’ golden opportunity is here — Meta doesn’t seem too interested in taking it

-

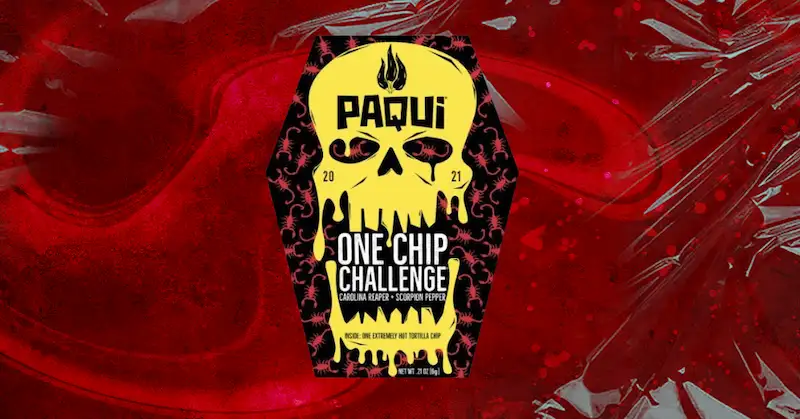

One chip, several problems

-

Avocado guy goes viral again and other weird takes from the extremely wealthy